1040x Form 2014

What is the 1040x Form

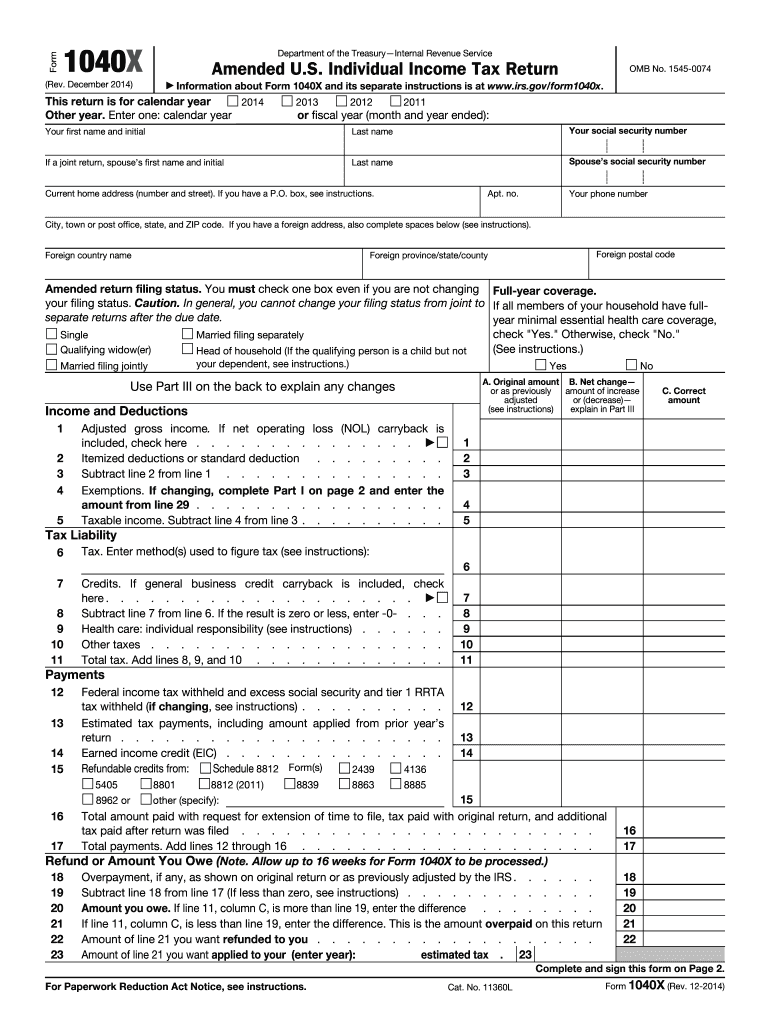

The 1040x Form is an amended U.S. federal tax return form used by taxpayers to correct errors or make changes to a previously filed Form 1040, 1040A, or 1040EZ. This form allows individuals to adjust their income, deductions, or credits, ensuring that their tax filings accurately reflect their financial situation. It is essential for taxpayers who discover discrepancies after submitting their original returns, as it helps maintain compliance with IRS regulations.

How to use the 1040x Form

To effectively use the 1040x Form, start by gathering all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Carefully fill out the form, providing explanations for each amendment in the designated sections. It is crucial to include the correct tax year and ensure that all calculations are accurate. Once completed, submit the form to the IRS, following the specific mailing instructions provided for your state.

Steps to complete the 1040x Form

Completing the 1040x Form involves several key steps:

- Obtain the correct version of the 1040x Form for the tax year you are amending.

- Fill out your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide a clear explanation of the changes you are making.

- Adjust the relevant figures in the sections provided, ensuring that you calculate any additional tax owed or refund due.

- Review the form for accuracy and completeness before signing and dating it.

Legal use of the 1040x Form

The 1040x Form is legally recognized as a valid means for taxpayers to amend their tax returns. It must be completed accurately and submitted within the appropriate time frame, typically within three years of the original filing date. When using the form, it is essential to comply with IRS guidelines to ensure that the amendments are accepted and processed without issues. Failure to adhere to legal requirements may result in penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x Form are crucial for taxpayers to keep in mind. Generally, you must file the amended return within three years from the original due date of the return or within two years from the date you paid the tax, whichever is later. It is important to stay informed about any changes to IRS deadlines, especially during tax season, to ensure timely submission and avoid penalties.

Form Submission Methods

The 1040x Form can be submitted to the IRS through various methods. Taxpayers can mail the completed form to the appropriate address based on their state of residence. Additionally, some taxpayers may have the option to file electronically using approved tax software that supports the 1040x Form. It is important to verify the submission method that best suits your needs and ensures compliance with IRS regulations.

Quick guide on how to complete 1040x 2014 form

Complete 1040x Form seamlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle 1040x Form on any device via airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign 1040x Form effortlessly

- Find 1040x Form and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your alterations.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040x Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040x 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 1040x 2014 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the 1040x Form and why do I need it?

The 1040x Form is an amended U.S. tax return that allows taxpayers to correct errors or make changes to their previously filed Form 1040. If you've made mistakes on your original return or need to claim additional deductions, filing the 1040x Form is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

-

How can airSlate SignNow help me with the 1040x Form?

airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign your 1040x Form online. With our digital signature solution, you can streamline the amendment process, ensuring that your corrections are submitted promptly and securely.

-

Is there a cost associated with using airSlate SignNow for the 1040x Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, ensuring that you can find an affordable option for managing your 1040x Form. Our plans are designed to provide cost-effective solutions without compromising on features, such as document templates and eSigning capabilities.

-

What features does airSlate SignNow offer for 1040x Form users?

Our platform includes features specifically designed for 1040x Form users, such as customizable templates, bulk sending options, and real-time tracking of document status. Additionally, you can easily integrate the 1040x Form with other applications to enhance your workflow and ensure a seamless experience.

-

Can I integrate airSlate SignNow with other software for 1040x Form processing?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to connect your 1040x Form processes with tools like CRMs, accounting software, and cloud storage platforms. This integration capability enhances productivity and ensures that all your documents are easily accessible.

-

How secure is airSlate SignNow when handling the 1040x Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance protocols to protect your sensitive information while processing the 1040x Form. You can trust that your documents are handled securely throughout the signing and filing process.

-

Can I track the status of my 1040x Form once sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including the 1040x Form. You will receive notifications and updates on the status of your form, ensuring you are informed every step of the way until it is completed and filed.

Get more for 1040x Form

- American dental association dental claim form

- Medical leave return to work form dch health system

- Holistic health intake form

- Statement of good health template form

- New psychosocial assessment childrendoc crawfordconsulting form

- Altus dental enrollment form

- Order form cpap

- Therapeutic phlebotomy order form 21960769

Find out other 1040x Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online