Form 1040x 2013

What is the Form 1040x

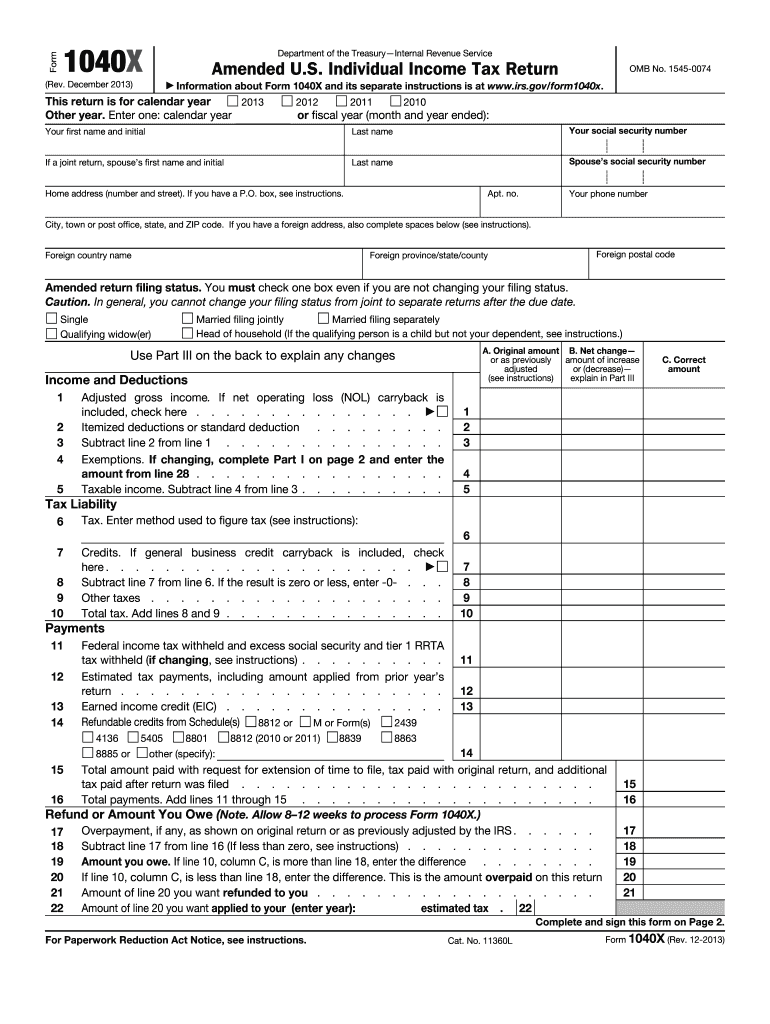

The Form 1040x is the official document used by taxpayers in the United States to amend their previously filed federal income tax returns. This form allows individuals to correct errors, update filing statuses, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that your tax records are accurate and up-to-date, which can ultimately affect your tax liability and potential refunds.

How to use the Form 1040x

Using the Form 1040x involves several steps to ensure that your amendments are processed correctly. First, you need to obtain the form, which can be downloaded from the IRS website or filled out electronically using compatible software. After completing the form, you should clearly indicate the changes made in each section. It is crucial to provide an explanation for each amendment in the designated area. Finally, submit the form to the appropriate IRS address based on your state of residence.

Steps to complete the Form 1040x

Completing the Form 1040x requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form, including your name, address, and Social Security number.

- Fill out the section for the tax year you are amending.

- Provide the corrected amounts for income, deductions, and credits in the appropriate columns.

- Explain the reasons for your amendments in the designated section.

- Sign and date the form before submission.

Legal use of the Form 1040x

The Form 1040x holds legal significance as it is recognized by the IRS as an official method for taxpayers to amend their tax returns. To ensure its legal validity, the form must be completed accurately and submitted within the designated timeframe. It is important to comply with IRS regulations regarding amendments to avoid potential penalties or issues with your tax records.

Filing Deadlines / Important Dates

When filing the Form 1040x, it is important to be aware of the deadlines. Generally, you must file the amended return within three years from the original filing date or within two years from the date you paid the tax, whichever is later. Missing these deadlines can result in the inability to claim refunds or make necessary corrections.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040x can be submitted through various methods. While e-filing is available for certain tax years using compatible tax software, many taxpayers still opt to mail their amended returns. If you choose to mail the form, ensure that you send it to the correct IRS address based on your state of residence. In-person submission is not typically available for this form, as it is primarily processed through mail or electronic filing.

Quick guide on how to complete 2013 form 1040x

Complete Form 1040x effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals. It offers a superb environmentally-friendly substitute for traditional printed and signed documentation, allowing you to acquire the necessary form and securely maintain it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Form 1040x on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to adjust and eSign Form 1040x with ease

- Find Form 1040x and click on Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically available from airSlate SignNow.

- Craft your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Recheck all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 1040x and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 1040x

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 1040x

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 1040x and why is it important?

Form 1040x is a crucial IRS form used to amend a previously filed tax return. It's important because it allows taxpayers to correct errors, claim additional deductions, or address any discrepancies. Understanding how to properly fill out Form 1040x can signNowly help in maximizing your tax refund or reducing liabilities.

-

How can airSlate SignNow assist with handling Form 1040x?

airSlate SignNow streamlines the process of submitting Form 1040x by providing an easy-to-use platform for eSigning and sending necessary documents securely. By using our solution, you can ensure your amended return is filed accurately and on time, eliminating the risk of delays associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for Form 1040x?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage key tax documents like Form 1040x without breaking the bank. You can choose a plan that best suits your requirements for eSigning and document management.

-

What features does airSlate SignNow offer for Form 1040x filing?

airSlate SignNow provides a range of features including customizable templates, secure eSigning, and document tracking that simplify the filing of Form 1040x. These tools help ensure that you complete your amendments swiftly and accurately, giving you peace of mind throughout the process.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1040x?

Absolutely! airSlate SignNow offers seamless integration with popular accounting software, making it easy to manage your Form 1040x directly from your financial systems. This integration helps enhance your workflow by allowing you to synchronize your data without additional manual entry.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 1040x?

Using airSlate SignNow for documents like Form 1040x offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. By choosing our platform, you can ensure that your amendments are processed quickly, securely, and with minimal hassle.

-

How does airSlate SignNow ensure the security of my Form 1040x and personal information?

airSlate SignNow prioritizes your security by implementing advanced encryption protocols and strict access controls. This means that your Form 1040x and any sensitive personal information are protected against unauthorized access, ensuring your data remains confidential.

Get more for Form 1040x

Find out other Form 1040x

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors