Amended Tax Form 2016

What is the Amended Tax Form

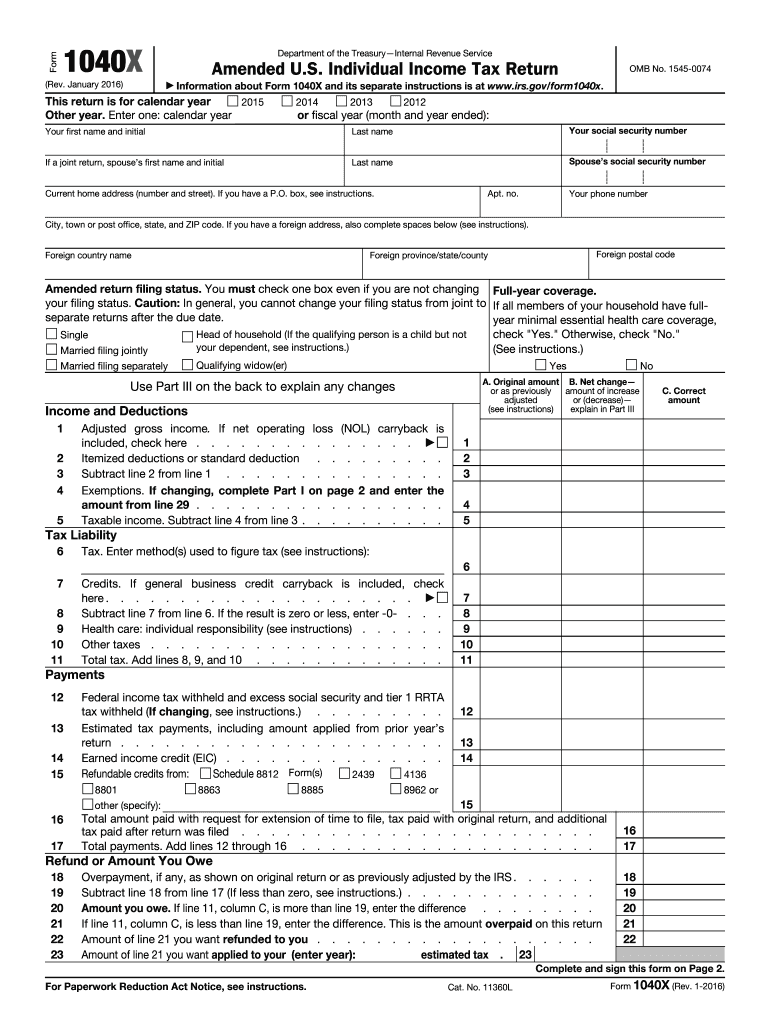

The Amended Tax Form is a document used by taxpayers in the United States to make corrections to a previously filed tax return. This form allows individuals to report changes in income, deductions, or credits that may affect their tax liability. The most commonly used form for this purpose is the IRS Form 1040-X, which is specifically designed for amending individual income tax returns. By filing this form, taxpayers can ensure that their tax records are accurate and up to date, potentially leading to refunds or adjustments in tax owed.

How to use the Amended Tax Form

Using the Amended Tax Form involves several steps to ensure proper completion and submission. First, gather all relevant documents, including the original tax return and any supporting documentation for the changes being made. Next, fill out the Form 1040-X, clearly indicating the changes and providing explanations where necessary. It is important to follow the instructions carefully, as errors can lead to delays or rejections. After completing the form, review it for accuracy before submitting it to the IRS, either by mail or electronically, depending on the options available.

Steps to complete the Amended Tax Form

Completing the Amended Tax Form requires careful attention to detail. Here are the essential steps:

- Obtain the Form 1040-X from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- Clearly outline the changes you are making in the appropriate sections, including the reason for the amendment.

- Calculate any additional tax owed or refund due based on the amended figures.

- Sign and date the form before submitting it.

Legal use of the Amended Tax Form

The Amended Tax Form is legally binding when completed and submitted in accordance with IRS guidelines. To ensure its legal validity, taxpayers must provide accurate information and adhere to the deadlines set by the IRS. The form must be signed by the taxpayer or their authorized representative. Additionally, the use of electronic signatures is permitted, provided that the eSignature complies with the relevant laws, such as the ESIGN Act and UETA. This legal framework ensures that amended tax returns are treated with the same validity as traditional paper submissions.

Filing Deadlines / Important Dates

Timely filing of the Amended Tax Form is crucial to avoid penalties or interest on any additional tax owed. Generally, taxpayers have up to three years from the original filing deadline to submit an amendment. For example, if you filed your 2020 tax return on April 15, 2021, you would have until April 15, 2024, to file an amended return for that year. It is essential to keep track of these dates, especially if you are expecting a refund or if the changes could impact your tax situation significantly.

Form Submission Methods (Online / Mail / In-Person)

The Amended Tax Form can be submitted in various ways, depending on individual preferences and circumstances. Taxpayers can file the form electronically through approved tax software that supports Form 1040-X. Alternatively, the form can be printed and mailed to the appropriate IRS address based on the taxpayer's state of residence. In-person submissions are generally not available for amended returns, as the IRS encourages electronic or mail submissions for efficiency. It is important to retain a copy of the submitted form for personal records.

Quick guide on how to complete 2016 amended tax form

Effortlessly prepare Amended Tax Form on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Amended Tax Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Amended Tax Form with ease

- Obtain Amended Tax Form and then click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review all the information and click the Done button to save your alterations.

- Choose your preferred method for delivering your form, whether via email, SMS, invite link, or download to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Amended Tax Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 amended tax form

Create this form in 5 minutes!

How to create an eSignature for the 2016 amended tax form

How to create an eSignature for your 2016 Amended Tax Form online

How to create an eSignature for your 2016 Amended Tax Form in Google Chrome

How to generate an electronic signature for putting it on the 2016 Amended Tax Form in Gmail

How to create an eSignature for the 2016 Amended Tax Form from your smartphone

How to make an eSignature for the 2016 Amended Tax Form on iOS devices

How to make an electronic signature for the 2016 Amended Tax Form on Android OS

People also ask

-

What is an Amended Tax Form and why might I need it?

An Amended Tax Form is used to correct errors or make changes to your previously filed tax returns. You might need it if you discover mistakes in your income, deductions, or tax credits after submission. Using airSlate SignNow, you can easily eSign and send your Amended Tax Form securely and efficiently.

-

How can airSlate SignNow help me with my Amended Tax Form?

airSlate SignNow allows you to electronically sign and send your Amended Tax Form with ease. The platform streamlines the workflow, reduces the chances of errors, and ensures that your document is secure and compliant. This makes it ideal for both individuals and businesses needing to manage their tax documents.

-

Is there a cost associated with using airSlate SignNow for my Amended Tax Form?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to fit various budgets and usage needs. By utilizing the service for your Amended Tax Form, you not only save on postal costs but also time, as the platform simplifies the signing and submission process.

-

What features does airSlate SignNow offer for managing Amended Tax Forms?

airSlate SignNow provides features such as customizable templates, in-app eSigning, secure document storage, and collaboration tools. These features help ensure your Amended Tax Form is accurately completed and securely stored, allowing easy access whenever needed.

-

Can I integrate airSlate SignNow with other tools for managing my Amended Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as Google Drive, Dropbox, and popular accounting software. This integration allows you to pull in data and manage your Amended Tax Form more effectively within your existing workflows.

-

How secure is my data when using airSlate SignNow for an Amended Tax Form?

Data security is a top priority at airSlate SignNow. All documents, including your Amended Tax Form, are protected with bank-level encryption and comply with industry standards. You can trust that your sensitive tax information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for electronic signatures on Amended Tax Forms?

Using airSlate SignNow for your Amended Tax Form offers numerous benefits, including faster turnaround times and enhanced convenience. You’ll be able to sign documents from anywhere, anytime, without the hassle of printing or mailing. This not only improves efficiency but also reduces your carbon footprint.

Get more for Amended Tax Form

Find out other Amended Tax Form

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed