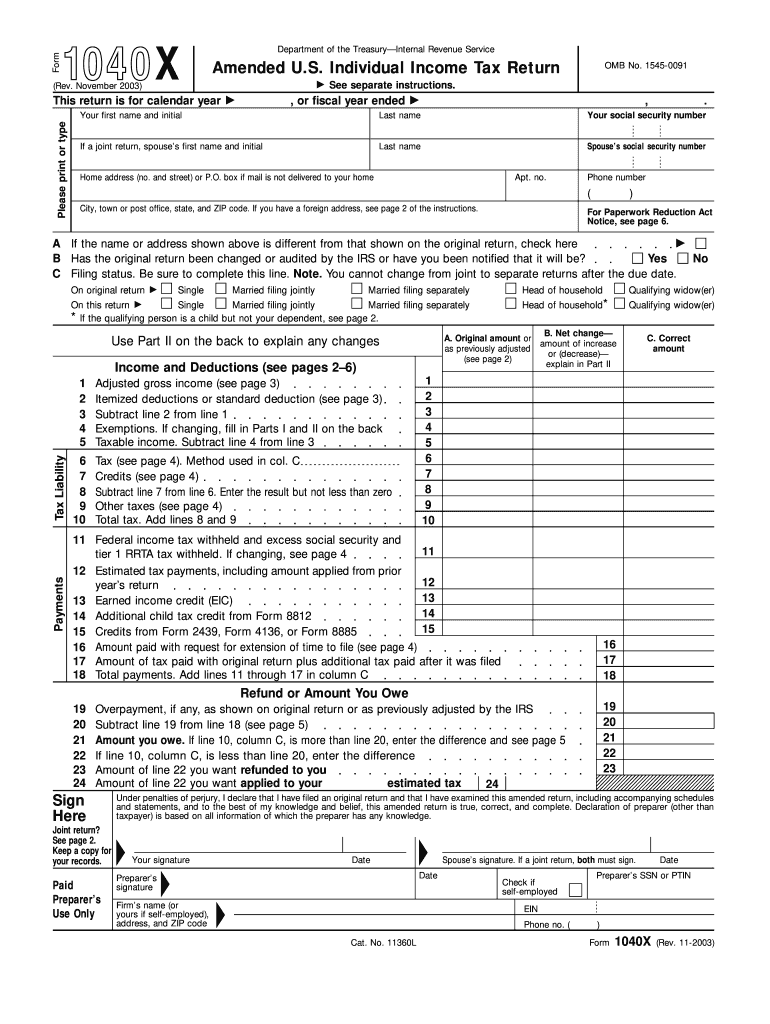

1040x Form 2003

What is the 1040x Form

The 1040x Form is an amended U.S. federal tax return form used by taxpayers to correct errors or make changes to a previously filed Form 1040, 1040A, or 1040EZ. This form allows individuals to adjust their income, deductions, credits, and filing status. It is crucial for ensuring that your tax records are accurate and up-to-date, which can help prevent issues with the Internal Revenue Service (IRS) in the future.

How to use the 1040x Form

Using the 1040x Form involves several steps. First, you need to gather your original tax return and any supporting documents related to the changes you wish to make. Next, fill out the 1040x Form by providing the necessary information in the designated sections, including your personal details, the tax year, and the specific changes being made. After completing the form, review it for accuracy, and then submit it to the IRS either by mail or electronically, depending on your circumstances.

Steps to complete the 1040x Form

Completing the 1040x Form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the 1040x Form for the tax year you are amending.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending at the top of the form.

- Complete the sections that reflect the changes you are making, including adjustments to income, deductions, and credits.

- Provide explanations for each change in the space provided.

- Sign and date the form before submitting it.

IRS Guidelines

The IRS has specific guidelines for filing the 1040x Form. It is essential to ensure that you are amending your tax return within the allowed time frame, typically within three years from the original filing date or within two years from the date you paid the tax owed. The IRS recommends that you do not submit a 1040x Form until you have received your refund from your original return, as this may delay processing. Additionally, be aware of any state-specific requirements that may apply.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x Form are critical to avoid penalties. Generally, the form must be filed within three years of the original return's due date or within two years of paying any tax owed. It is advisable to keep track of these dates to ensure compliance and to prevent any issues with the IRS. For example, if you filed your 2020 tax return on April 15, 2021, you would have until April 15, 2024, to submit your 1040x Form for that year.

Form Submission Methods (Online / Mail / In-Person)

The 1040x Form can be submitted through various methods. While e-filing is not available for the 1040x Form, you can mail it to the appropriate IRS address based on your state of residence. It is important to check the IRS website for the correct mailing address, as it may vary. Additionally, you can choose to submit the form in person at your local IRS office if you prefer. Always ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete 1040x 2003 form

Effortlessly Complete 1040x Form on Any Device

Digital document management has gained increased popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to design, alter, and electronically sign your documents swiftly without delays. Manage 1040x Form on any device utilizing the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign 1040x Form without hassle

- Locate 1040x Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the instruments that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form navigation, and mistakes that require printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device you prefer. Edit and electronically sign 1040x Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040x 2003 form

Create this form in 5 minutes!

How to create an eSignature for the 1040x 2003 form

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 1040x Form?

The 1040x Form is an amended U.S. tax return form that allows taxpayers to make corrections to their previously filed 1040 forms. Whether you've realized a mistake, need to add additional deductions, or change your filing status, the 1040x Form provides a way to rectify those issues. It’s important to ensure that any amendments are filed accurately to avoid potential penalties.

-

How can airSlate SignNow help with the 1040x Form?

airSlate SignNow signNowly simplifies the process of completing and filing your 1040x Form. Our electronic signature platform allows you to easily fill out your 1040x Form online, add necessary signatures, and securely share documents with tax professionals or the IRS. This ensures that your amended return is processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the 1040x Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is considered cost-effective compared to the benefits it offers. We provide several pricing plans to meet the needs of individuals and businesses looking to streamline their document management, including those needing the 1040x Form. With our service, you can save time and reduce costly filing mistakes.

-

What features does airSlate SignNow offer for the 1040x Form?

airSlate SignNow offers features such as customizable templates, electronic signatures, and secure document sharing that are perfect for the 1040x Form. You can easily manage and track the status of your documents, and utilize our user-friendly interface to navigate through the entire filing process. These features help ensure that your amendments are submitted properly and efficiently.

-

Can I integrate airSlate SignNow with other applications for managing the 1040x Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications including accounting software and cloud storage services. This allows users to manage their 1040x Form alongside other essential documents and workflows in one place. Our integrations enhance productivity and provide a more comprehensive solution for tax management.

-

What are the benefits of using eSignature for the 1040x Form?

Using eSignature for the 1040x Form maximizes efficiency by reducing the time required for signatures and document transfers. It also enhances security, ensuring that your sensitive tax information is safely transmitted. Moreover, eSigning allows for faster amendments to your tax filings, leading to quicker resolutions and refunds.

-

How do I start using airSlate SignNow for my 1040x Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you’ll have access to our intuitive platform where you can create, edit, and manage your 1040x Form and other documents. Our support team is also available to guide you through any questions you may have during the setup process.

Get more for 1040x Form

- Instructions for form nyc 210 claim for new york city school tax credit year 2020

- City of ny tax commission 1 centre st new york ny city form

- Instructions for form it 213 claim for empire state child credit tax year 2020

- Instructions for form it 204 ip new york partners schedule k 1 tax year 2020

- Form ct 3 a general business corporation combined franchise tax return tax year 2020

- Every california stock agricultural cooperative and registered foreign corporation must file a statement of information with

- Section i see instruction sheet for filing fees and form

- 2019 schedule nj dop amp schedule nj wwc 2019 schedule nj dop amp schedule nj wwc form

Find out other 1040x Form

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online