Form 1040 X Rev February 2024-2026

What is the Form 1040-X?

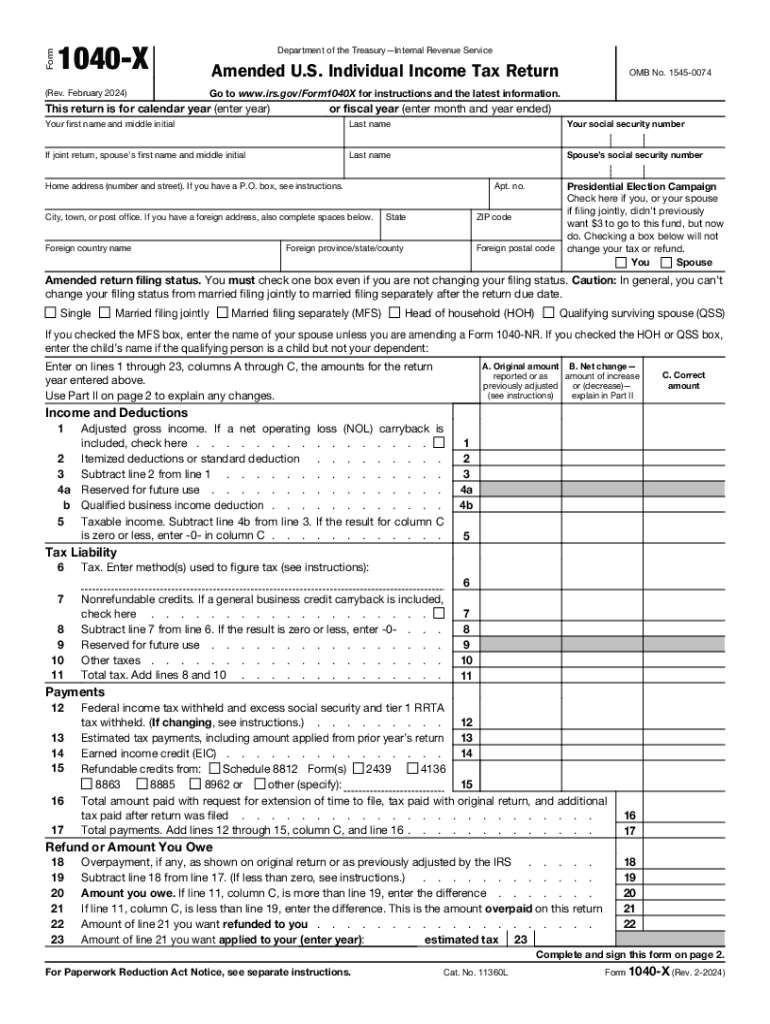

The Form 1040-X is the official IRS document used to amend a previously filed tax return. Specifically designed for taxpayers who need to correct errors or make changes to their original Form 1040, this form allows individuals to report changes in income, deductions, credits, or filing status. It is essential for ensuring that your tax records are accurate and reflect your true financial situation.

How to Use the Form 1040-X

Using Form 1040-X involves several steps to ensure accuracy and compliance with IRS regulations. First, you should obtain a copy of your original tax return, as you will need to reference it while completing the amendment. Next, fill out the 1040-X, providing the corrected information in the appropriate sections. The form includes three columns: the first shows the original amounts, the second shows the corrected amounts, and the third calculates the difference. Finally, submit the completed form to the IRS, either by mail or electronically, depending on your situation.

Steps to Complete the Form 1040-X

Completing Form 1040-X requires careful attention to detail. Begin by entering your personal information at the top of the form, including your name, address, and Social Security number. Then, in the first column, list the figures from your original return. In the second column, provide the corrected amounts. Use the third column to show the differences. Be sure to explain the reasons for the changes in the designated section. After verifying all information for accuracy, sign and date the form before submission.

Filing Deadlines / Important Dates

When amending a tax return, it is crucial to be aware of the filing deadlines. Generally, you can file Form 1040-X within three years from the original filing date or within two years from the date you paid the tax, whichever is later. For example, if you are amending a 2021 tax return, ensure you submit your amendment by the applicable deadline to avoid penalties and ensure you receive any potential refunds.

Required Documents

To successfully file an amended return using Form 1040-X, you will need several documents. Gather your original tax return, any supporting documentation for the changes you are making, such as W-2s or 1099s, and any relevant schedules. If you are claiming additional deductions or credits, include documentation that supports these claims. Having all necessary documents will help streamline the amendment process.

IRS Guidelines

The IRS provides specific guidelines for filing Form 1040-X. It is important to read and understand these guidelines to ensure compliance. The IRS advises that you do not submit Form 1040-X electronically for all tax years, so check the current rules for your specific situation. Additionally, if you are amending multiple years, you must file a separate Form 1040-X for each tax year being amended. Following these guidelines will help avoid delays in processing your amendment.

Form Submission Methods

Form 1040-X can be submitted to the IRS through various methods. While the IRS allows electronic filing for certain tax years, many taxpayers still submit their amended returns by mail. If you choose to mail your Form 1040-X, ensure you send it to the correct address based on your state of residence. Always consider using certified mail or another trackable service to confirm delivery. If you are filing electronically, follow the software instructions for submission.

Quick guide on how to complete form 1040 x rev february

Accomplish Form 1040 X Rev February effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Form 1040 X Rev February on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 1040 X Rev February without hassle

- Obtain Form 1040 X Rev February and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to the issues of lost or misplaced documents, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1040 X Rev February and ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 x rev february

Create this form in 5 minutes!

How to create an eSignature for the form 1040 x rev february

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to amend tax return 2021 using airSlate SignNow?

To amend your tax return 2021 with airSlate SignNow, simply upload your original tax documents, make the necessary changes, and eSign the amended return. Our platform streamlines the process, ensuring that you can easily manage your documents and submit them to the IRS without hassle.

-

How much does it cost to amend tax return 2021 with airSlate SignNow?

airSlate SignNow offers a cost-effective solution for amending your tax return 2021. Our pricing plans are designed to fit various budgets, and you can choose a plan that best suits your needs, ensuring you get the best value for your document management.

-

What features does airSlate SignNow offer for amending tax return 2021?

Our platform provides features such as document templates, eSigning, and secure cloud storage, all of which are essential for amending tax return 2021. These features help you efficiently manage your documents and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for amending tax return 2021?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to amend tax return 2021. This integration allows you to import and export documents effortlessly, enhancing your overall workflow.

-

Is it safe to use airSlate SignNow for amending tax return 2021?

Absolutely! airSlate SignNow prioritizes your security and privacy, employing advanced encryption and security protocols to protect your data while you amend tax return 2021. You can trust our platform to keep your sensitive information safe.

-

What are the benefits of using airSlate SignNow to amend tax return 2021?

Using airSlate SignNow to amend tax return 2021 offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly interface simplifies the amendment process, allowing you to focus on what matters most.

-

How can I get support while amending tax return 2021 with airSlate SignNow?

airSlate SignNow provides excellent customer support to assist you while amending tax return 2021. You can signNow out to our support team via chat, email, or phone for any questions or concerns you may have during the process.

Get more for Form 1040 X Rev February

Find out other Form 1040 X Rev February

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors