1040x Form 2010

What is the 1040x Form

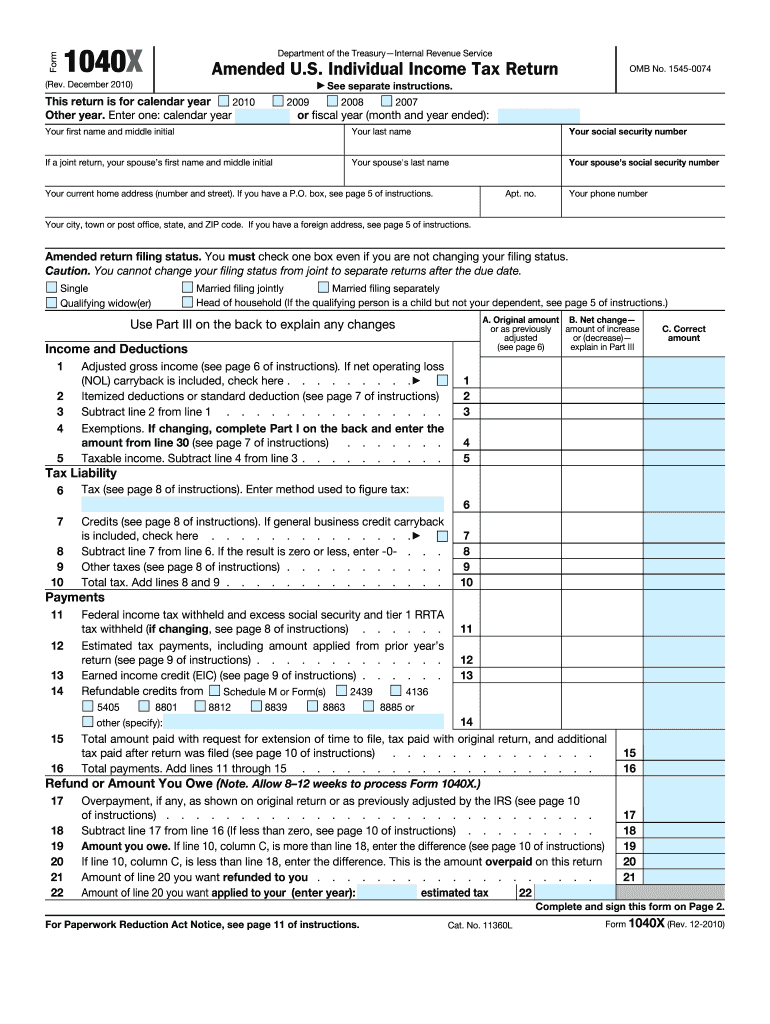

The 1040x Form is an amended U.S. federal tax return used by taxpayers to correct errors or make changes to a previously filed Form 1040, 1040A, or 1040EZ. This form allows individuals to adjust their income, deductions, or credits, ensuring that their tax return accurately reflects their financial situation. It is essential for taxpayers who discover mistakes after submitting their original return, as it provides a legal means to rectify those errors with the Internal Revenue Service (IRS).

How to use the 1040x Form

Using the 1040x Form involves several steps. First, you need to gather all relevant documents related to your original tax return and the changes you wish to make. Next, fill out the 1040x Form, clearly indicating the changes and providing explanations where necessary. Ensure that you include any additional schedules or forms that may be affected by the amendments. Finally, submit the completed form to the IRS, either by mail or electronically, depending on your situation and the options available for your tax year.

Steps to complete the 1040x Form

Completing the 1040x Form requires careful attention to detail. Follow these steps:

- Obtain a copy of your original tax return for reference.

- Download the 1040x Form from the IRS website or use tax software that supports this form.

- Fill in your personal information, including your name, address, and Social Security number.

- In Part I, indicate the year of the return you are amending.

- In Part II, explain the changes you are making and why.

- In Part III, provide the corrected amounts for your income, deductions, and credits.

- Review the form for accuracy and completeness.

Legal use of the 1040x Form

The 1040x Form is legally recognized as a valid means to amend a tax return. To ensure its legal standing, it must be completed accurately and submitted within the appropriate timeframe. This form must include all necessary signatures and dates, as well as any supporting documentation that justifies the changes. By adhering to IRS guidelines, taxpayers can ensure that their amendments are processed correctly and legally.

Filing Deadlines / Important Dates

Timely filing of the 1040x Form is crucial. Generally, you must submit the amended return within three years from the original filing date or within two years from the date you paid the tax, whichever is later. Be aware of specific deadlines, as missing them may result in the inability to claim a refund or make necessary adjustments. It is advisable to check the IRS website for the most current information regarding deadlines.

Form Submission Methods (Online / Mail / In-Person)

The 1040x Form can be submitted in various ways. Currently, the IRS allows electronic filing for certain tax years through approved tax software. For other years or situations, you may need to print the form and mail it to the appropriate IRS address based on your state of residence. In-person submissions are generally not an option for amended returns. Always verify the submission method applicable to your specific circumstances to ensure proper processing.

Quick guide on how to complete 2010 1040x form

Complete 1040x Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 1040x Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1040x Form seamlessly

- Find 1040x Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1040x Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1040x form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1040x form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a 1040x Form?

The 1040x Form is an amendment form for individuals who need to correct or change their federal tax return, specifically the IRS Form 1040. It allows taxpayers to adjust their filing by adding or modifying information, ensuring that they are compliant with U.S. tax laws. Utilizing the 1040x Form can help in filing accurate returns and claiming potential refunds.

-

How can airSlate SignNow help with the 1040x Form?

airSlate SignNow simplifies the process of managing the 1040x Form by allowing users to easily send and eSign the document. Our platform streamlines the amendment filing process by ensuring that all necessary signatures are collected securely and efficiently. With features designed for productivity, airSlate SignNow empowers users to handle their tax documents effortlessly.

-

Is there a cost associated with using airSlate SignNow for the 1040x Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals alike. Our pricing plans are competitive and provide various features that streamline document management, including service for the 1040x Form. You can choose a plan that fits your needs and budget, ensuring you get great value for accessing our services.

-

What features does airSlate SignNow offer for handling the 1040x Form?

airSlate SignNow offers features such as electronic signatures, document tracking, and templates that can be applied to the 1040x Form. These capabilities enhance efficiency and ensure that users can complete their tax amendments in a timely manner. Additionally, our user-friendly interface makes it simple for anyone to navigate through the process of eSigning and managing the document.

-

Is airSlate SignNow secure for signing the 1040x Form?

Absolutely! airSlate SignNow takes security seriously, employing advanced encryption methods to protect all documents, including the 1040x Form. We ensure that all electronic signatures are legally binding and that sensitive information remains confidential throughout the process. Your peace of mind is a top priority for us when handling your documents.

-

Can I integrate airSlate SignNow with other applications while working on the 1040x Form?

Yes, airSlate SignNow offers robust integration options with various applications, making it easy to manage your workflow while dealing with the 1040x Form. You can connect with popular platforms like Google Drive, Dropbox, and CRM systems to streamline document management. This flexibility allows for a seamless experience across all of your business tools.

-

What are the benefits of using airSlate SignNow for the 1040x Form?

Using airSlate SignNow for your 1040x Form provides numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. With our digital solution, you can prepare and amend your tax return quicker than traditional methods. Moreover, the ability to track document status ensures that you never lose sight of your 1040x Form during the process.

Get more for 1040x Form

- 2020 instructions for form 1120 h internal revenue service

- Schedule g supplemental information regarding form 990 or

- Form w 12 rev october 2020 irs paid preparer tax identification number ptin application and renewal

- 1041 form 1041 t allocation of estimated tax payments to

- 2020 form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

- Form 4852 rev september 2020 substitute for form w 2 wage and tax statement or form 1099 r distributions from pensions

- Fillable online 2017 form 1120s us income tax return

- 2020 form 1040 v payment voucher

Find out other 1040x Form

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA