W 4p Form 2016

What is the W-4P Form

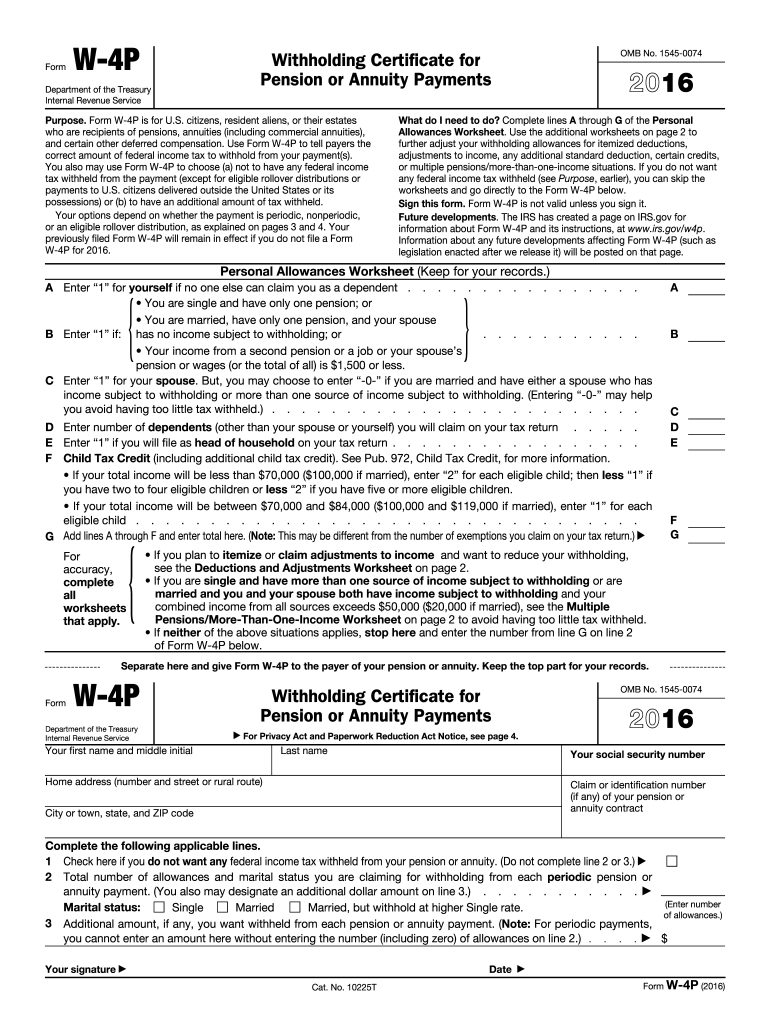

The W-4P Form, officially known as the Withholding Certificate for Pension or Annuity Payments, is a tax form used in the United States. It is primarily utilized by individuals who receive pension or annuity payments and wish to have federal income tax withheld from these payments. This form allows recipients to specify the amount of tax to be withheld based on their tax situation, ensuring that they do not face a significant tax liability when filing their annual tax returns.

How to Obtain the W-4P Form

The W-4P Form can be easily obtained from several sources. Individuals can download it directly from the IRS website, where it is available in PDF format for printing. Additionally, many financial institutions and pension plan administrators provide this form to their clients, ensuring that it is readily accessible. It is important to ensure that you are using the most current version of the form to comply with IRS regulations.

Steps to Complete the W-4P Form

Completing the W-4P Form involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Withholding Amount: Indicate the amount you wish to have withheld from your pension or annuity payments. You can choose a specific dollar amount or a percentage of the payment.

- Exemptions: If applicable, you can claim exemption from withholding by completing the relevant section.

- Signature: Sign and date the form to validate it.

Once completed, the form should be submitted to the payer of your pension or annuity payments, not the IRS.

Legal Use of the W-4P Form

The W-4P Form is legally recognized as a valid document for specifying tax withholding on pension and annuity payments. It is essential to complete this form accurately to ensure compliance with IRS regulations. Failure to provide a W-4P Form may result in the payer withholding taxes at the highest rate, which could lead to over-withholding and potential complications during tax filing. Keeping a copy of the submitted form for personal records is advisable.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-4P Form. It is important to review these guidelines to understand how withholding works and what options are available for adjusting your withholding amounts. The IRS recommends that individuals regularly review their withholding, especially if there are changes in income, marital status, or dependents, to avoid underpayment or overpayment of taxes.

Form Submission Methods

The W-4P Form can be submitted through various methods, depending on the payer's requirements. Common submission methods include:

- Online Submission: Some pension plans allow for electronic submission of the W-4P Form through their secure portals.

- Mail: You can print the completed form and mail it directly to the payer's address.

- In-Person: If preferred, you may deliver the form in person to the payer's office.

It is important to confirm the preferred submission method with your pension or annuity provider to ensure timely processing.

Quick guide on how to complete w 4p 2016 form

Complete W 4p Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without hassle. Handle W 4p Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to edit and eSign W 4p Form without any difficulty

- Locate W 4p Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign W 4p Form and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4p 2016 form

Create this form in 5 minutes!

How to create an eSignature for the w 4p 2016 form

How to create an electronic signature for your W 4p 2016 Form in the online mode

How to make an electronic signature for the W 4p 2016 Form in Google Chrome

How to make an electronic signature for signing the W 4p 2016 Form in Gmail

How to generate an eSignature for the W 4p 2016 Form straight from your smart phone

How to generate an electronic signature for the W 4p 2016 Form on iOS devices

How to generate an electronic signature for the W 4p 2016 Form on Android devices

People also ask

-

What is the W 4p Form and how is it used?

The W 4p Form is a tax form used by pensioners to indicate how much federal income tax should be withheld from their pension payments. By filling out this form, recipients can ensure the correct amount is deducted based on their personal tax situation, helping them avoid underpayment penalties during tax season.

-

How can I electronically sign the W 4p Form using airSlate SignNow?

With airSlate SignNow, you can easily eSign the W 4p Form by uploading it to our platform and using our intuitive eSignature tools. This streamlines the signing process, allowing you to complete the form quickly and securely, ensuring it is ready to be submitted without any hassle.

-

What are the benefits of using airSlate SignNow for the W 4p Form?

Using airSlate SignNow for the W 4p Form offers numerous benefits, including enhanced security, ease of use, and the ability to track the status of your documents. Our platform simplifies the signing process, making it cost-effective and efficient for both individuals and businesses.

-

Is there a cost associated with using airSlate SignNow for the W 4p Form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different user needs. You can choose from a free trial or select a subscription plan that fits your budget, providing you access to all features needed for managing the W 4p Form and other documents.

-

Can I integrate airSlate SignNow with other applications for managing the W 4p Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and more. This allows you to manage your W 4p Form and other documents more efficiently by keeping everything in one place.

-

What security measures does airSlate SignNow implement for the W 4p Form?

Security is a top priority at airSlate SignNow. We use industry-standard encryption to protect your W 4p Form and other sensitive documents during transmission and storage, ensuring that your personal information remains confidential and secure.

-

How do I access my completed W 4p Form on airSlate SignNow?

Once you complete and eSign your W 4p Form on airSlate SignNow, you can easily access it through your account dashboard. The platform allows you to download, share, or store your completed forms securely for future reference.

Get more for W 4p Form

- Form ct 1120 ext 2011

- Supplemental application physician assistant touro college www1 touro form

- Patagonia repair form

- Dining dollars credit request form bama dining bamadining ua

- Mid america transaction routing form 2009

- Whats a routing slip used for in the usps form

- Pdpm calculation worksheet for snfs cms form

- Assumed name application for certificate of ownership form

Find out other W 4p Form

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement