Form W 4P Department of Retirement Systems 2021

What is the Form W-4P?

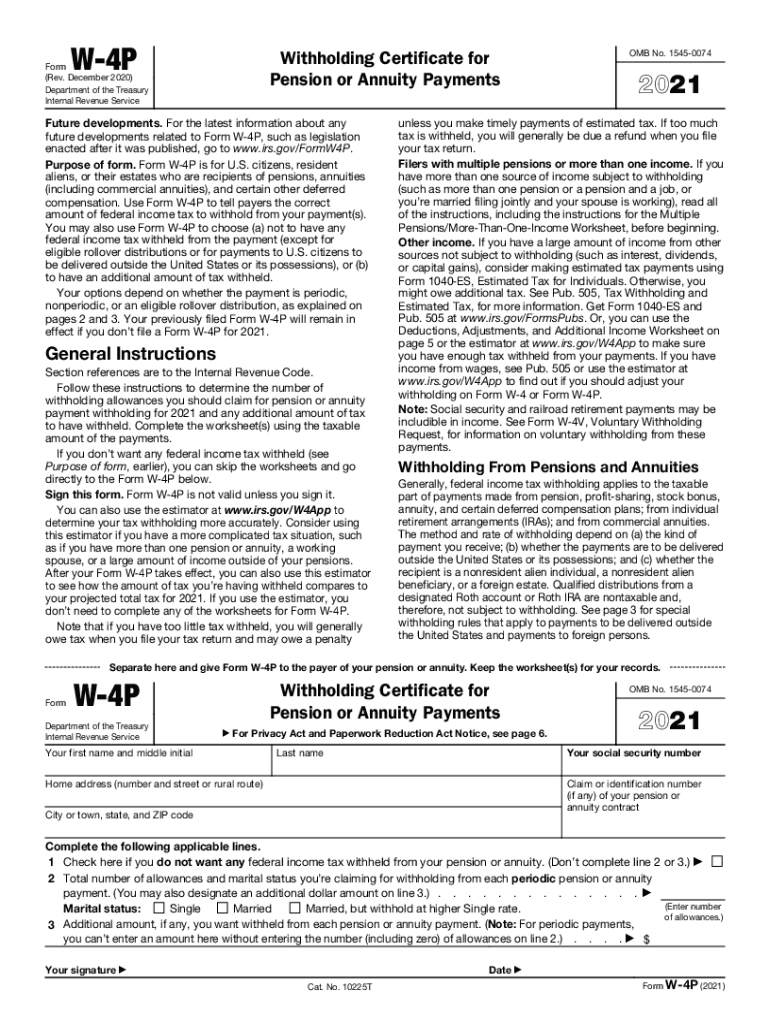

The Form W-4P, also known as the Withholding Certificate for Pension or Annuity Payments, is a document used by individuals to instruct payers on how much federal income tax to withhold from their pension or annuity payments. This form is essential for retirees or individuals receiving periodic payments from retirement plans, ensuring that the correct amount of tax is withheld based on their financial situation. The form helps to avoid underpayment penalties and ensures compliance with IRS regulations.

Steps to Complete the Form W-4P

Completing the Form W-4P involves several straightforward steps:

- Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Withholding Allowances: Specify the number of allowances you are claiming. This can affect the amount withheld.

- Additional Withholding: If you want to have an additional amount withheld from your payments, specify that amount in the designated section.

- Signature and Date: Sign and date the form to validate your instructions.

Once completed, the form should be submitted to the payer of your pension or annuity payments.

Legal Use of the Form W-4P

The Form W-4P is legally binding when filled out correctly and submitted to the appropriate payer. It complies with IRS regulations, ensuring that the withholding amounts are accurate and reflect the individual's tax obligations. To maintain legal validity, it is crucial to provide truthful information and update the form whenever there are changes in your financial situation or tax status.

How to Obtain the Form W-4P

The Form W-4P can be obtained directly from the IRS website or through your pension plan administrator. It is available in printable format, allowing you to fill it out by hand or electronically. For convenience, many tax preparation software programs also include the form, making it easy to complete as part of your overall tax planning.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form W-4P, it is advisable to complete and submit it before the start of your pension or annuity payments. This ensures that the correct withholding amount is applied from the beginning. Additionally, if there are any changes in your tax situation, it is best to update the form promptly to avoid any tax issues at year-end.

Examples of Using the Form W-4P

Consider a retiree receiving monthly pension payments who expects to have a lower income in retirement. They may choose to claim more allowances on their Form W-4P to reduce withholding and increase their monthly cash flow. Conversely, an individual who anticipates additional income from investments may opt to withhold more tax by claiming fewer allowances. These examples illustrate how the form can be tailored to fit individual financial circumstances.

Quick guide on how to complete 2021 form w 4p department of retirement systems

Complete Form W 4P Department Of Retirement Systems with ease on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and without interruptions. Handle Form W 4P Department Of Retirement Systems on any device using airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to modify and electronically sign Form W 4P Department Of Retirement Systems effortlessly

- Find Form W 4P Department Of Retirement Systems and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Update and electronically sign Form W 4P Department Of Retirement Systems and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form w 4p department of retirement systems

Create this form in 5 minutes!

How to create an eSignature for the 2021 form w 4p department of retirement systems

The best way to generate an e-signature for a PDF file online

The best way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is the w 4p form and how does airSlate SignNow help?

The w 4p form is a key document for employees to communicate their tax withholding preferences to employers. With airSlate SignNow, you can easily prepare, send, and eSign your w 4p form, ensuring that all your tax information is accurate and securely stored.

-

How can I access the w 4p template in airSlate SignNow?

AirSlate SignNow provides a user-friendly interface where you can access a variety of document templates, including the w 4p form. Simply log in, search for the w 4p template in our library, and customize it according to your needs before sending it for signatures.

-

What are the pricing options for using airSlate SignNow for w 4p documents?

AirSlate SignNow offers several pricing plans that are cost-effective, allowing businesses of all sizes to manage their document signing needs, including the w 4p. You can choose a plan based on your usage, and we provide a free trial period for you to explore the features.

-

Is it secure to eSign a w 4p form using airSlate SignNow?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication methods, ensuring that your w 4p form is signed safely. You can have peace of mind knowing that your sensitive tax information is protected throughout the entire signing process.

-

What features does airSlate SignNow offer for managing w 4p forms?

AirSlate SignNow includes features such as customizable templates, automated reminders, and status tracking for your w 4p forms. These tools streamline the signing process and enhance productivity by allowing you to manage documents efficiently.

-

Can I integrate airSlate SignNow with other applications for w 4p processing?

Absolutely! AirSlate SignNow offers integrations with various applications, such as CRM systems and cloud storage services, to simplify the workflow for processing w 4p forms. This connectivity allows you to seamlessly manage your documents in one unified platform.

-

What are the benefits of using airSlate SignNow for w 4p eSigning?

Using airSlate SignNow for w 4p eSigning provides numerous benefits, including reduced paperwork and faster processing times. The platform’s ease of use encourages quick turnarounds, making it effortless to keep your tax documents compliant and up-to-date.

Get more for Form W 4P Department Of Retirement Systems

- 30 day notice to terminate month to month lease residential from landlord to tenant district of columbia form

- 30 day notice 497301597 form

- Dc notice 497301598 form

- Dc month to month form

- Dc 30 day form

- 30 day notice to terminate tenancy at will for residential from tenant to landlord district of columbia form

- 7 day notice to pay rent or lease terminates for residential property district of columbia form

- Assignment of deed of trust by individual mortgage holder district of columbia form

Find out other Form W 4P Department Of Retirement Systems

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors