Additional Amount of Tax Withheld 2012

What is the Additional Amount Of Tax Withheld

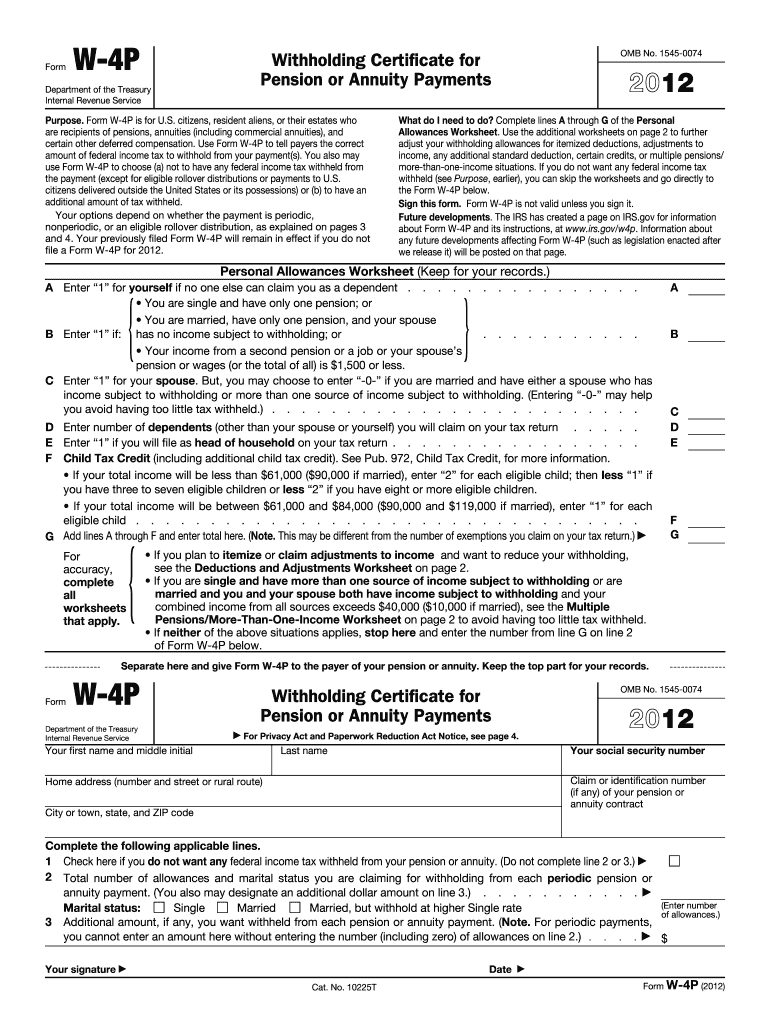

The Additional Amount Of Tax Withheld refers to the extra amount of federal income tax that an employee can request to be withheld from their paycheck. This option is available on the W-4 form, allowing individuals to adjust their withholding based on their financial situation, such as additional income, tax credits, or changes in family status. By specifying this amount, taxpayers can better manage their tax liability and potentially avoid owing taxes at the end of the year.

Steps to complete the Additional Amount Of Tax Withheld

Completing the Additional Amount Of Tax Withheld involves a few straightforward steps:

- Obtain a W-4 form from your employer or download it from the IRS website.

- Fill out your personal information, including your name, address, and Social Security number.

- In the section regarding additional withholding, specify the extra amount you wish to have withheld from each paycheck.

- Review your completed form for accuracy.

- Submit the form to your employer's payroll department.

IRS Guidelines

The IRS provides specific guidelines regarding the Additional Amount Of Tax Withheld. Taxpayers should ensure they are compliant with IRS regulations when adjusting their withholding. The IRS recommends using the Tax Withholding Estimator tool available on their website to determine the appropriate amount to withhold based on your financial situation. This tool can help you avoid under-withholding and potential penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines related to the Additional Amount Of Tax Withheld is crucial for compliance. Employees can submit their updated W-4 forms at any time, but it is advisable to do so before the start of a new tax year or when there are significant changes in income or family status. Employers typically implement changes in withholding in the next pay period after receiving the updated form.

Penalties for Non-Compliance

Failing to comply with the IRS guidelines regarding the Additional Amount Of Tax Withheld can lead to penalties. If too little tax is withheld, taxpayers may face underpayment penalties when filing their annual tax return. It is important to regularly review and adjust withholding amounts to ensure compliance and avoid unexpected tax liabilities.

Eligibility Criteria

Any employee receiving wages can request the Additional Amount Of Tax Withheld on their W-4 form. There are no specific eligibility criteria beyond being an employee subject to federal income tax withholding. However, individuals should consider their overall tax situation, including other income sources, deductions, and credits, to determine if additional withholding is necessary.

Quick guide on how to complete additional amount of tax withheld

Effortlessly Prepare Additional Amount Of Tax Withheld on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It serves as an outstanding environmentally-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Additional Amount Of Tax Withheld on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to alter and electronically sign Additional Amount Of Tax Withheld with ease

- Obtain Additional Amount Of Tax Withheld and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes leading to new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Additional Amount Of Tax Withheld and ensure clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct additional amount of tax withheld

Create this form in 5 minutes!

How to create an eSignature for the additional amount of tax withheld

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Additional Amount Of Tax Withheld in my paycheck?

The Additional Amount Of Tax Withheld refers to the extra federal income tax that you can opt to withhold from your paycheck. This allows you to manage your tax liabilities more effectively, particularly if you expect to owe additional taxes at the end of the year. Adjusting this amount can aid in avoiding a tax bill during tax season.

-

How does adjusting the Additional Amount Of Tax Withheld affect my take-home pay?

When you adjust the Additional Amount Of Tax Withheld, it directly impacts your take-home pay. Increasing the additional amount will reduce your take-home pay since more funds are withheld for taxes, while decreasing it will increase your take-home pay. It’s crucial to balance your withholding to match your expected tax liabilities.

-

Can I calculate my Additional Amount Of Tax Withheld using airSlate SignNow?

While airSlate SignNow primarily offers document management and electronic signature services, it can integrate with accounting tools that help you calculate the Additional Amount Of Tax Withheld. Utilizing these integrations, you can analyze your financial situation more effectively and make informed decisions regarding your tax withholding.

-

What features of airSlate SignNow help with tax documentation?

airSlate SignNow provides robust features for managing tax-related documentation, including eSigning and secure storage of tax forms. You can easily send and receive forms that involve the Additional Amount Of Tax Withheld, ensuring that all parties have access to the necessary documents promptly and securely.

-

Is there a cost associated with managing the Additional Amount Of Tax Withheld through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. The pricing plans are structured to provide value as you manage documents, including those related to the Additional Amount Of Tax Withheld. You can choose a plan that fits your business needs.

-

How do I ensure compliance when adjusting the Additional Amount Of Tax Withheld?

To ensure compliance when adjusting the Additional Amount Of Tax Withheld, it’s important to stay informed about IRS guidelines and regulations. Using airSlate SignNow can help streamline the documentation process, ensuring that all necessary forms are completed accurately and submitted on time.

-

Can airSlate SignNow assist with the filing process after adjusting the Additional Amount Of Tax Withheld?

Yes, airSlate SignNow can assist with the filing process by providing a secure platform for managing all relevant tax documents. Once you've decided on the Additional Amount Of Tax Withheld and completed your forms, you can easily share and eSign documents with your accountant or tax advisor through our platform.

Get more for Additional Amount Of Tax Withheld

- Georgia violation form

- Letter from tenant to landlord about insufficient notice of rent increase georgia form

- Notice rent increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase georgia form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant georgia form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase georgia form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services georgia form

- Temporary lease agreement to prospective buyer of residence prior to closing georgia form

Find out other Additional Amount Of Tax Withheld

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now