Form 920 Withholding Certificate for Pension or Annuity 2020

What is the Form W-4P?

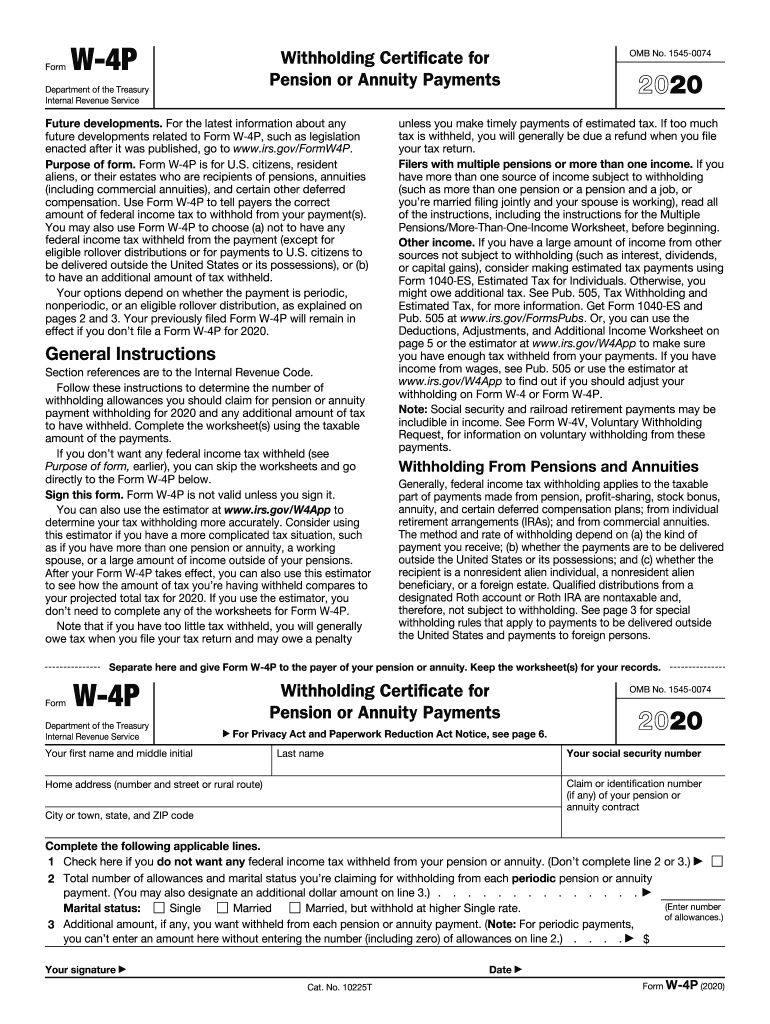

The Form W-4P, also known as the Withholding Certificate for Pension or Annuity Payments, is a crucial document used by individuals to instruct payers on how much federal income tax to withhold from their pension or annuity payments. This form is particularly important for retirees or individuals receiving annuity payments, as it helps ensure that the correct amount of taxes is withheld, preventing underpayment or overpayment of taxes throughout the year. The W-4P allows taxpayers to specify their withholding allowances, which can affect their overall tax liability.

How to Use the Form W-4P

To effectively use the Form W-4P, individuals should first gather relevant financial information, including their total expected pension or annuity income and any other sources of income. The form requires taxpayers to provide personal details such as their name, address, Social Security number, and filing status. After filling out the necessary sections, individuals can submit the completed form to their pension or annuity payer, who will then adjust the withholding accordingly. It is advisable to review and update the form whenever there are significant changes in income or tax status.

Steps to Complete the Form W-4P

Completing the Form W-4P involves several key steps:

- Obtain the latest version of the Form W-4P from the IRS website or your pension provider.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the number of allowances you wish to claim, based on your tax situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your pension or annuity payer.

Legal Use of the Form W-4P

The Form W-4P is legally binding once it is signed and submitted to the appropriate pension or annuity payer. It complies with IRS regulations regarding withholding for pension and annuity payments. Proper completion and submission of this form ensure that the withholding aligns with the taxpayer's financial situation and helps avoid potential penalties for under-withholding. It is essential to keep a copy of the submitted form for personal records and future reference.

IRS Guidelines for Form W-4P

The IRS provides specific guidelines on how to fill out the Form W-4P, including instructions on determining the number of allowances to claim. Taxpayers should refer to the IRS publication that accompanies the form for detailed explanations of each section. Additionally, the IRS recommends that individuals review their withholding status annually or whenever there are significant life changes, such as marriage, divorce, or retirement, to ensure accurate tax withholding.

Filing Deadlines for Form W-4P

There are no specific deadlines for submitting the Form W-4P; however, it is advisable to complete and submit the form before the start of the tax year to ensure that the correct amount of withholding is applied to pension or annuity payments. If changes are made to the form during the year, they should be submitted as soon as possible to adjust withholding for the remainder of the tax year. Keeping track of any changes in income or tax status is essential for maintaining accurate withholding.

Quick guide on how to complete form 920 withholding certificate for pension or annuity

Complete Form 920 Withholding Certificate For Pension Or Annuity effortlessly on any platform

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Form 920 Withholding Certificate For Pension Or Annuity on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Form 920 Withholding Certificate For Pension Or Annuity with ease

- Locate Form 920 Withholding Certificate For Pension Or Annuity and click Get Form to begin.

- Employ the available tools to fill out your form.

- Mark essential portions of your documents or conceal sensitive data using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your edits.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 920 Withholding Certificate For Pension Or Annuity and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 920 withholding certificate for pension or annuity

Create this form in 5 minutes!

How to create an eSignature for the form 920 withholding certificate for pension or annuity

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the form w 4p, and how can it benefit my employees?

The form w 4p is a tax form used by employees to indicate the amount of state income tax withholding they want from their paychecks. Using this form can help employees manage their tax liabilities more effectively by adjusting their withholding preferences based on their financial situation.

-

How do I fill out the form w 4p using airSlate SignNow?

Filling out the form w 4p with airSlate SignNow is simple. You can easily create a fillable template of the form w 4p, share it with your employees, and they can complete it electronically. The platform allows for safe digital signatures, ensuring compliance and security.

-

Is airSlate SignNow affordable for small businesses needing the form w 4p?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. With flexible subscription options, you can efficiently manage the form w 4p alongside other document signing needs without stretching your budget.

-

What features does airSlate SignNow offer for managing the form w 4p?

airSlate SignNow provides various features for managing the form w 4p, including customizable templates, automated workflows, and secure electronic signatures. These tools streamline the process of tax form collection and help maintain compliance.

-

Can I integrate airSlate SignNow with other software for handling form w 4p?

Absolutely! airSlate SignNow integrates seamlessly with many popular software applications, allowing you to manage the form w 4p alongside your HR or payroll systems. This integration ensures a smooth workflow and easy access to all your employee documents.

-

What are the advantages of using airSlate SignNow for the form w 4p over traditional paper forms?

Using airSlate SignNow for the form w 4p offers several advantages, including faster processing times, reduced paperwork, and enhanced security. Digital signatures provide a level of authenticity that paper forms may lack, and electronic storage makes retrieval effortless.

-

How secure is airSlate SignNow when handling sensitive forms like the form w 4p?

airSlate SignNow employs industry-standard encryption and security protocols to protect sensitive documents, including the form w 4p. With features like audit trails and strict user authentication, your employees' information remains secure throughout the signing process.

Get more for Form 920 Withholding Certificate For Pension Or Annuity

- Order approving guardian washington form

- Wa initial form

- Approving plan form

- Periodic personal care form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497430024 form

- Washington annual 497430025 form

- Notices resolutions simple stock ledger and certificate washington form

- Minutes for organizational meeting washington washington form

Find out other Form 920 Withholding Certificate For Pension Or Annuity

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form