W4p Form 2017

What is the W4p Form

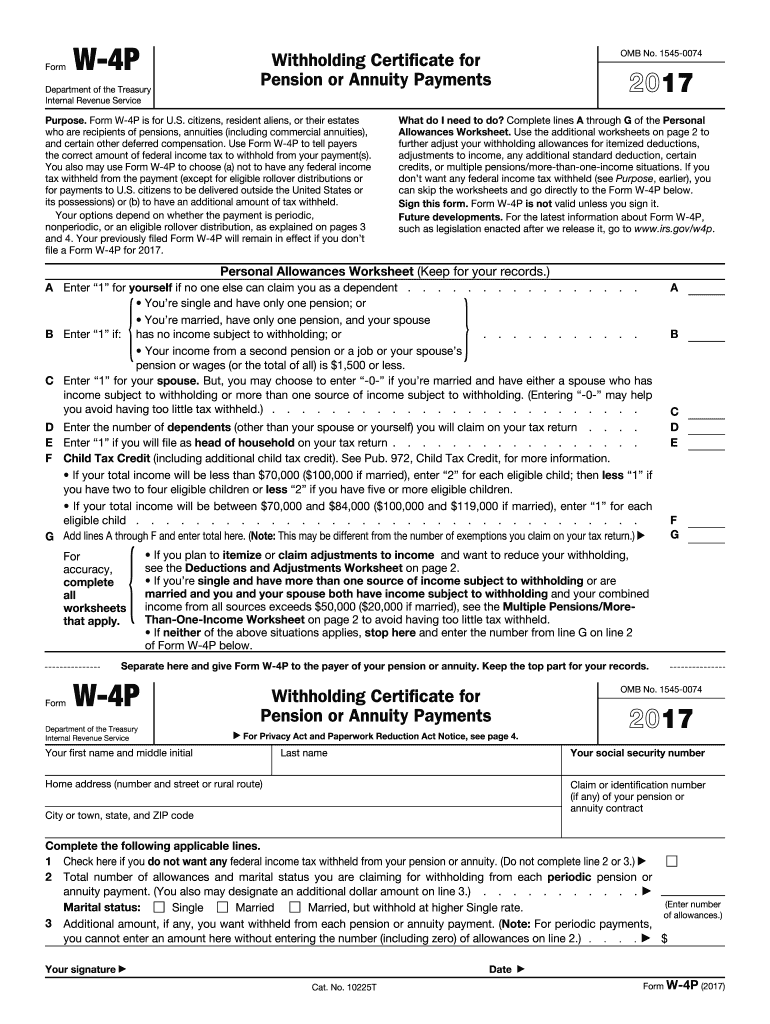

The W4p Form, also known as the Withholding Certificate for Pension or Annuity Payments, is a tax document used by retirees and pensioners in the United States. This form allows individuals to specify the amount of federal income tax to be withheld from their pension or annuity payments. By accurately completing the W4p Form, recipients can ensure that the correct amount of tax is deducted, helping to avoid underpayment penalties or large tax bills during tax season.

How to use the W4p Form

To use the W4p Form effectively, individuals must first obtain the form from the appropriate source, such as the IRS website or their pension plan administrator. Once in possession of the form, taxpayers should fill it out with accurate personal information, including their name, address, and Social Security number. It is essential to indicate the desired withholding amount based on personal tax circumstances. After completing the form, it should be submitted to the pension plan administrator or payroll department to ensure proper processing.

Steps to complete the W4p Form

Completing the W4p Form involves several straightforward steps:

- Obtain the W4p Form from the IRS website or your pension provider.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the amount of federal income tax you want withheld from your payments.

- Review the form for accuracy to prevent any errors.

- Submit the completed form to your pension plan administrator.

Legal use of the W4p Form

The W4p Form is legally binding when completed and submitted correctly. It adheres to IRS regulations, ensuring that the withholding amounts align with federal tax laws. It is important for recipients to understand that submitting an inaccurate form can lead to incorrect withholding, which may result in penalties or additional taxes owed. Therefore, ensuring compliance with IRS guidelines is crucial for the legal use of the W4p Form.

Key elements of the W4p Form

Several key elements are essential to the W4p Form:

- Personal Information: This includes your name, address, and Social Security number.

- Withholding Amount: The form allows you to specify how much tax you want withheld.

- Signature: Your signature certifies that the information provided is accurate.

- Date: The date of completion is necessary for processing the form.

Filing Deadlines / Important Dates

Filing deadlines for the W4p Form are typically aligned with the start of pension payments or when there is a change in tax circumstances. It is advisable to submit the form as soon as you begin receiving pension or annuity payments to ensure proper withholding from the outset. Additionally, if there are any changes in your financial situation, such as marital status or additional income, submitting a new W4p Form is recommended to adjust your withholding accordingly.

Quick guide on how to complete w4p 2017 form

Effortlessly Prepare W4p Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage W4p Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

How to Modify and Electronically Sign W4p Form with Ease

- Locate W4p Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and electronically sign W4p Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w4p 2017 form

Create this form in 5 minutes!

How to create an eSignature for the w4p 2017 form

How to generate an eSignature for the W4p 2017 Form in the online mode

How to create an eSignature for your W4p 2017 Form in Google Chrome

How to create an eSignature for putting it on the W4p 2017 Form in Gmail

How to create an eSignature for the W4p 2017 Form from your smartphone

How to create an electronic signature for the W4p 2017 Form on iOS devices

How to make an eSignature for the W4p 2017 Form on Android devices

People also ask

-

What is a W4p Form and why do I need it?

The W4p Form is an essential document used for tax withholding purposes by employees in the United States. It enables businesses to determine the correct amount of federal income tax to withhold from an employee's paycheck. By using the W4p Form, you can ensure compliance with tax regulations and avoid under-withholding or over-withholding.

-

How can airSlate SignNow help me manage my W4p Forms?

airSlate SignNow simplifies the management of your W4p Forms by providing an intuitive platform for electronic signing and document sharing. With our solution, you can easily send, sign, and store W4p Forms securely. This streamlines your workflow and reduces the time spent on manual paperwork.

-

Is there a cost associated with using airSlate SignNow for W4p Forms?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, including those specifically for managing W4p Forms. Our cost-effective solution allows you to choose a plan that best fits your budget while providing robust features for document management. Visit our pricing page to find the plan that suits you best.

-

What features does airSlate SignNow offer for W4p Forms?

airSlate SignNow provides a range of features for W4p Forms, including customizable templates, electronic signatures, and secure cloud storage. Additionally, you can track the status of your documents in real-time and automate reminders for signers, ensuring a smooth and efficient process.

-

Can I integrate airSlate SignNow with other software to manage W4p Forms?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including CRM systems and HR platforms. This allows you to efficiently manage your W4p Forms within your existing workflows, enhancing productivity and reducing the need for duplicate data entry.

-

How secure is my data when using airSlate SignNow for W4p Forms?

Security is a top priority at airSlate SignNow. When you use our platform to manage W4p Forms, your data is protected with advanced encryption methods and secure cloud storage. We also comply with industry standards to ensure that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for W4p Forms over traditional methods?

Using airSlate SignNow for W4p Forms offers numerous benefits over traditional paper methods, including increased efficiency, cost savings, and enhanced security. With our electronic signing solution, you can eliminate the hassles of printing, scanning, and mailing documents, allowing you to focus more on your core business activities.

Get more for W4p Form

- Lic8 filing representative application form

- Film agreement online apply form

- Online term change uwm form

- Form 15 certification and notice of termination of registration under section 12g or suspension of duty to file reports under

- City of redlands rebate form

- 504 plan fillable forms

- Trec fillable lease agreement form

- Notice of abandonment form az

Find out other W4p Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament