Tva Fraud Dispute Form

What is the TVA Fraud Dispute?

The TVA fraud dispute refers to a formal process through which individuals or businesses contest alleged fraudulent activities related to the Tennessee Valley Authority (TVA). This can involve discrepancies in billing, unauthorized charges, or misrepresentation of services. Understanding the nature of the dispute is crucial for effectively addressing the issues at hand and ensuring compliance with relevant regulations.

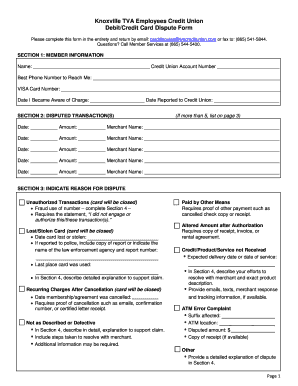

Steps to Complete the TVA Fraud Dispute

Completing the TVA fraud dispute involves several key steps to ensure that your concerns are adequately addressed. First, gather all relevant documentation, including bills, correspondence, and any evidence supporting your claim. Next, clearly outline the nature of the dispute, specifying the fraudulent activities you are contesting. After preparing your documentation, submit the dispute through the appropriate channels, either online or via mail, depending on the specific requirements set by the TVA.

Legal Use of the TVA Fraud Dispute

The legal use of the TVA fraud dispute process is grounded in consumer protection laws. Individuals have the right to contest charges they believe to be fraudulent. It is essential to follow the established procedures to ensure that your dispute is recognized and processed legally. This may involve adhering to specific timelines and providing accurate information to support your claim.

Required Documents for the TVA Fraud Dispute

When filing a TVA fraud dispute, certain documents are typically required to substantiate your claim. These may include copies of bills or statements, previous correspondence with TVA representatives, and any other evidence that supports your assertion of fraud. Ensuring that all documentation is complete and accurate can significantly enhance the chances of a favorable resolution.

Form Submission Methods

Submitting the TVA fraud dispute can be done through various methods. Typically, individuals can choose to submit their disputes online, which may offer a quicker response time. Alternatively, disputes can be sent via mail or delivered in person to a designated TVA office. It is important to follow the specific submission guidelines provided by TVA to ensure proper processing of your dispute.

Examples of Using the TVA Fraud Dispute

Examples of situations that may warrant a TVA fraud dispute include receiving a bill that contains charges for services not rendered, discrepancies in meter readings, or unauthorized account changes. Each of these scenarios represents a potential violation of consumer rights, and filing a dispute can help rectify the situation and recover any unjust charges.

Filing Deadlines / Important Dates

Filing deadlines for the TVA fraud dispute are critical to ensure that your claim is processed in a timely manner. Typically, there are specific timeframes within which disputes must be filed following the discovery of fraudulent activity. It is advisable to check the TVA's official guidelines for the most accurate and up-to-date information regarding these deadlines to avoid missing the opportunity to contest any charges.

Quick guide on how to complete tva fraud dispute

Complete Tva Fraud Dispute effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Handle Tva Fraud Dispute on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign Tva Fraud Dispute with ease

- Obtain Tva Fraud Dispute and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tva Fraud Dispute and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tva fraud dispute

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tva fraud dispute and how can airSlate SignNow help?

A tva fraud dispute refers to challenges in handling fraudulent activities related to tax value added (TVA). airSlate SignNow provides a secure platform for businesses to manage and document their transactions, ensuring that all signatures are verified. This helps reduce the risk of fraud and streamline the dispute resolution process.

-

Is airSlate SignNow cost-effective for managing tva fraud disputes?

Yes, airSlate SignNow offers cost-effective pricing plans that accommodate businesses of all sizes. By utilizing our solution, organizations can save time and resources, especially when dealing with tva fraud disputes, leading to overall enhanced operational efficiency.

-

What features does airSlate SignNow offer for tva fraud disputes?

airSlate SignNow offers features such as secure electronic signatures, document templates, and audit trails that are essential for managing tva fraud disputes. These enable businesses to create verified records, track document statuses, and provide evidence during disputes.

-

How can airSlate SignNow improve the workflow for tva fraud disputes?

By simplifying the document signing process, airSlate SignNow enhances workflow for managing tva fraud disputes. This allows teams to quickly share documents, obtain signatures, and keep track of every step, minimizing delays and ensuring prompt actions against fraudulent claims.

-

Can airSlate SignNow be integrated with other software for tva fraud dispute management?

Absolutely! airSlate SignNow can be integrated with various business applications, enhancing your ability to manage tva fraud disputes effectively. This connectivity allows for streamlined data sharing and processing, ensuring that all related tasks are handled promptly.

-

What are the benefits of using airSlate SignNow in tva fraud disputes?

Using airSlate SignNow in tva fraud disputes offers numerous benefits, including increased security, reduced costs, and improved compliance. The platform’s electronic signature feature ensures that all documents are legally binding, providing an added layer of protection against fraudulent claims.

-

How secure is airSlate SignNow in dealing with tva fraud disputes?

airSlate SignNow prioritizes security, utilizing encryption and secure storage to protect sensitive data related to tva fraud disputes. This ensures that your business documents are safe from unauthorized access, maintaining the integrity of your dispute resolution processes.

Get more for Tva Fraud Dispute

Find out other Tva Fraud Dispute

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts