Form W 4 Employee's Withholding Certificate 2023

What is the Form W-4 Employee's Withholding Certificate

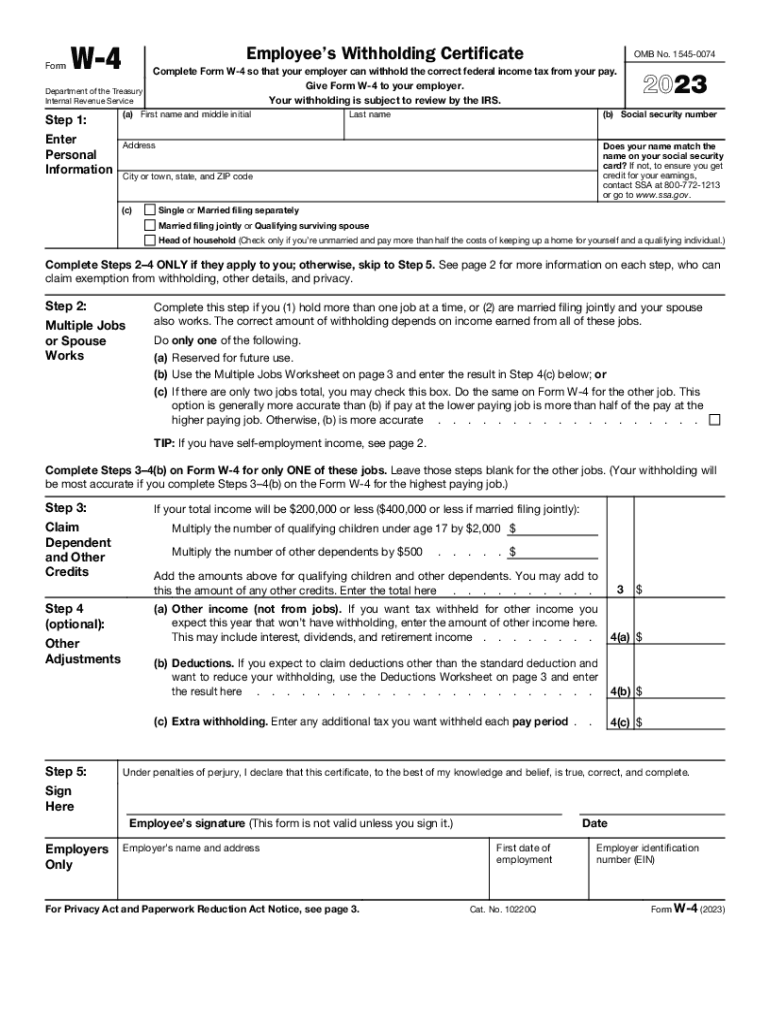

The Form W-4, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to indicate their tax withholding preferences to their employer. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. By accurately completing the W-4, employees can ensure that they have the right amount withheld, avoiding underpayment or overpayment of taxes throughout the year.

Steps to complete the Form W-4 Employee's Withholding Certificate

Completing the Form W-4 involves several key steps to ensure accuracy and compliance with IRS guidelines. Here are the main steps:

- Personal Information: Fill out your name, address, Social Security number, and filing status in the first section.

- Multiple Jobs or Spouse Works: If applicable, indicate if you have more than one job or if your spouse works. This helps to adjust your withholding appropriately.

- Claim Dependents: If you have qualifying children or dependents, provide the necessary information to claim the Child Tax Credit or other credits.

- Other Adjustments: You can also indicate any additional income or deductions that may affect your withholding.

- Signature: Finally, sign and date the form to validate your information.

How to obtain the Form W-4 Employee's Withholding Certificate

The Form W-4 can be easily obtained through various channels. It is available on the official IRS website, where you can download the latest version in PDF format. Additionally, many employers provide the form directly to their employees during the onboarding process. It is also possible to request a copy from your human resources department if you need a replacement or an updated version.

Legal use of the Form W-4 Employee's Withholding Certificate

The legal validity of the Form W-4 is essential for both employees and employers. When completed accurately, the form serves as a legally binding document that dictates how much tax will be withheld from an employee's paycheck. To ensure compliance, it is important to follow IRS guidelines and update the form as necessary, especially after major life changes such as marriage, divorce, or the birth of a child. Employers must retain the completed forms for their records and ensure that they are processed correctly to avoid legal complications.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W-4. It is important to refer to these guidelines to ensure compliance and accuracy. The IRS updates the form periodically, so it is crucial to use the most current version. Additionally, the IRS offers a Tax Withholding Estimator tool on its website, which can help employees determine the appropriate withholding amount based on their individual tax situation. Understanding these guidelines can help minimize tax liabilities and ensure that employees are not caught off guard during tax season.

Form Submission Methods

Once the Form W-4 is completed, it must be submitted to the employer. There are several methods for submission:

- Online Submission: Many employers allow employees to submit the form electronically through their HR platforms.

- Mail: If required, employees can print the form and mail it directly to their employer's HR department.

- In-Person: Employees may also deliver the completed form in person to their HR representative.

Quick guide on how to complete form w 4 employees withholding certificate 625900111

Effortlessly Prepare Form W 4 Employee's Withholding Certificate on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly solution to conventional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Form W 4 Employee's Withholding Certificate on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Form W 4 Employee's Withholding Certificate

- Obtain Form W 4 Employee's Withholding Certificate and select Get Form to begin.

- Make use of the tools available to complete your form.

- Mark important sections of the documents or redact confidential information with the tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form W 4 Employee's Withholding Certificate to ensure optimal communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 4 employees withholding certificate 625900111

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding certificate 625900111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 4 form 2023 PDF, and why is it important?

The W 4 form 2023 PDF is an essential tax form used by employees to indicate their tax withholding preferences. It helps employers determine the amount of federal income tax to withhold from an employee's paycheck. Completing this form accurately is vital to avoid over- or under-withholding taxes.

-

How can I easily fill out the W 4 form 2023 PDF online?

You can fill out the W 4 form 2023 PDF online using airSlate SignNow’s user-friendly platform. Our solution allows you to complete the form digitally, ensuring that it's easy to enter your information and make any necessary adjustments. Once completed, you can eSign and send it to your employer securely.

-

Is there a cost associated with using airSlate SignNow for the W 4 form 2023 PDF?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. However, our solution is designed to be cost-effective, letting you efficiently manage your documents including the W 4 form 2023 PDF without breaking the bank. You can choose a plan that fits your requirements and budget.

-

What features does airSlate SignNow offer for the W 4 form 2023 PDF?

airSlate SignNow provides a range of features for completing the W 4 form 2023 PDF, including eSignature capabilities, document templates, and easy sharing options. Additionally, it ensures compliance with legal standards, making it a reliable tool for managing tax forms. Our platform allows you to track signatures and maintain document security.

-

Can I integrate airSlate SignNow with other tools for managing the W 4 form 2023 PDF?

Yes, airSlate SignNow integrates seamlessly with various business applications and tools. This allows you to streamline your workflow when managing the W 4 form 2023 PDF, automating processes and reducing manual tasks. Popular integrations include CRM systems, cloud storage, and project management software.

-

How does airSlate SignNow ensure the security of my W 4 form 2023 PDF?

airSlate SignNow prioritizes your data security by utilizing industry-standard encryption and compliance measures. When you fill out and send your W 4 form 2023 PDF through our platform, you can rest assured that your personal and financial information is well-protected. We adhere to strict security protocols to safeguard your documents.

-

What are the benefits of using airSlate SignNow for the W 4 form 2023 PDF?

Using airSlate SignNow for the W 4 form 2023 PDF offers several benefits, including increased efficiency and reduced turnaround time on document completion. Our platform simplifies the eSignature process, allowing for quick approvals. Moreover, you can access your documents from anywhere, making it convenient and flexible for users.

Get more for Form W 4 Employee's Withholding Certificate

- Pasrr ct form

- Notice of nonrenewal form

- Crs dispute form

- Substitute w 9 vendor update form

- Deposit receipt and offer to rent or lease form

- Authorization to release information related to a residential lease applicant

- Instructions for form it 2105 estimated income tax payment voucher for individuals new york state new york city yonkers mctmt 772030007

- Receivables purchase agreement template form

Find out other Form W 4 Employee's Withholding Certificate

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later