W 4 Form 2014

What is the W-4 Form

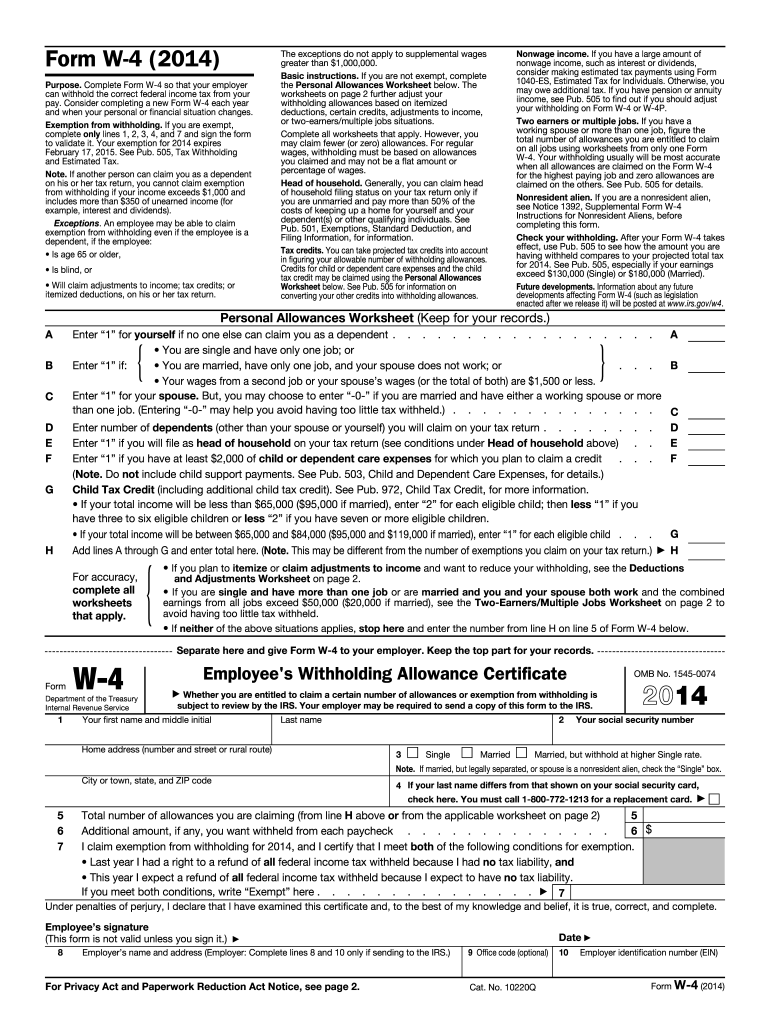

The W-4 Form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing the W-4 Form, employees can ensure that they are not overpaying or underpaying their taxes throughout the year. Understanding the W-4 Form is essential for effective tax planning and compliance.

How to Use the W-4 Form

Using the W-4 Form involves several straightforward steps. First, employees need to obtain the form from their employer or download it from the IRS website. Next, they should fill out the form by providing personal information, including their name, address, Social Security number, and filing status. Employees can also indicate the number of allowances they wish to claim, which affects their withholding amount. After completing the form, it should be submitted to the employer, who will use it to adjust the tax withholding accordingly.

Steps to Complete the W-4 Form

Completing the W-4 Form requires careful attention to detail. Here are the key steps:

- Begin by entering your personal information in the designated fields.

- Select your filing status, which can be single, married filing jointly, married filing separately, or head of household.

- Determine the number of allowances you wish to claim based on your financial situation and dependents.

- If applicable, include any additional amount you want withheld from each paycheck.

- Review the form for accuracy before signing and dating it.

- Submit the completed form to your employer’s payroll department.

Legal Use of the W-4 Form

The W-4 Form is legally binding and must be completed accurately to comply with IRS regulations. Employers are required to withhold the correct amount of federal income tax based on the information provided. Failure to submit a W-4 Form can result in the employer withholding taxes at the highest rate, which may not reflect the employee's actual tax liability. It is important for employees to update their W-4 Form whenever they experience significant life changes, such as marriage, divorce, or the birth of a child, to ensure proper withholding.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the W-4 Form. Employees should refer to the IRS instructions to understand how to calculate their allowances and withholding amounts. The IRS also updates the W-4 Form periodically, so it is essential to use the most current version. Additionally, the IRS offers a withholding calculator on its website to help employees determine the appropriate amount of tax to withhold based on their individual circumstances.

Form Submission Methods

The W-4 Form can be submitted to an employer through various methods, depending on the company's policies. Common submission methods include:

- In-person delivery to the payroll or human resources department.

- Email submission, if the employer allows electronic forms.

- Mailing a hard copy to the employer's designated address.

Regardless of the method chosen, it is important to ensure that the form is submitted promptly to avoid any delays in tax withholding adjustments.

Quick guide on how to complete w 4 2014 form

Effortlessly prepare W 4 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage W 4 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign W 4 Form with ease

- Find W 4 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether through email, text message (SMS), an invitation link, or download it to your computer.

Eliminate issues of lost or misplaced files, cumbersome form navigation, or mistakes that require printing fresh document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign W 4 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4 2014 form

Create this form in 5 minutes!

How to create an eSignature for the w 4 2014 form

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the W 4 Form and why is it important?

The W 4 Form is an IRS document that employees fill out to indicate their tax situation to their employer. This form helps determine the amount of federal income tax withholding from an employee's paycheck. Understanding how to correctly fill out and update your W 4 Form is crucial for accurate tax withholding and avoiding tax surprises at the end of the year.

-

How can airSlate SignNow help with the W 4 Form?

airSlate SignNow streamlines the process of sending, signing, and managing the W 4 Form electronically. With our easy-to-use platform, you can create, send, and eSign your W 4 Form quickly, ensuring that your tax documentation is handled efficiently and securely. This reduces the time spent on paperwork and enhances compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the W 4 Form?

Yes, airSlate SignNow offers a variety of pricing plans to cater to different business needs. Our plans are cost-effective and provide access to essential features for managing documents like the W 4 Form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the W 4 Form?

airSlate SignNow provides several features for managing the W 4 Form, including customizable templates, electronic signatures, secure cloud storage, and real-time tracking. These features make it easy for businesses to collect, store, and manage W 4 Forms, ensuring a smooth and compliant process.

-

Can I integrate airSlate SignNow with other applications for W 4 Form management?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to streamline your W 4 Form management process. Whether you need to connect with payroll systems, HR software, or other tools, our platform enables seamless integration for improved efficiency.

-

How secure is the information on the W 4 Form when using airSlate SignNow?

Your data security is our top priority. When you use airSlate SignNow for the W 4 Form, all information is encrypted and stored securely in compliance with industry standards. This ensures that sensitive tax information remains protected throughout the signing and storage process.

-

What are the benefits of using airSlate SignNow for the W 4 Form compared to traditional methods?

Using airSlate SignNow for the W 4 Form offers several advantages over traditional methods. It reduces paperwork, minimizes errors, and speeds up the signing process, allowing for quicker tax compliance. Additionally, our platform provides a user-friendly interface that makes it easy for both employers and employees to manage their W 4 Forms.

Get more for W 4 Form

Find out other W 4 Form

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy