W 4 Form 2016

What is the W-4 Form

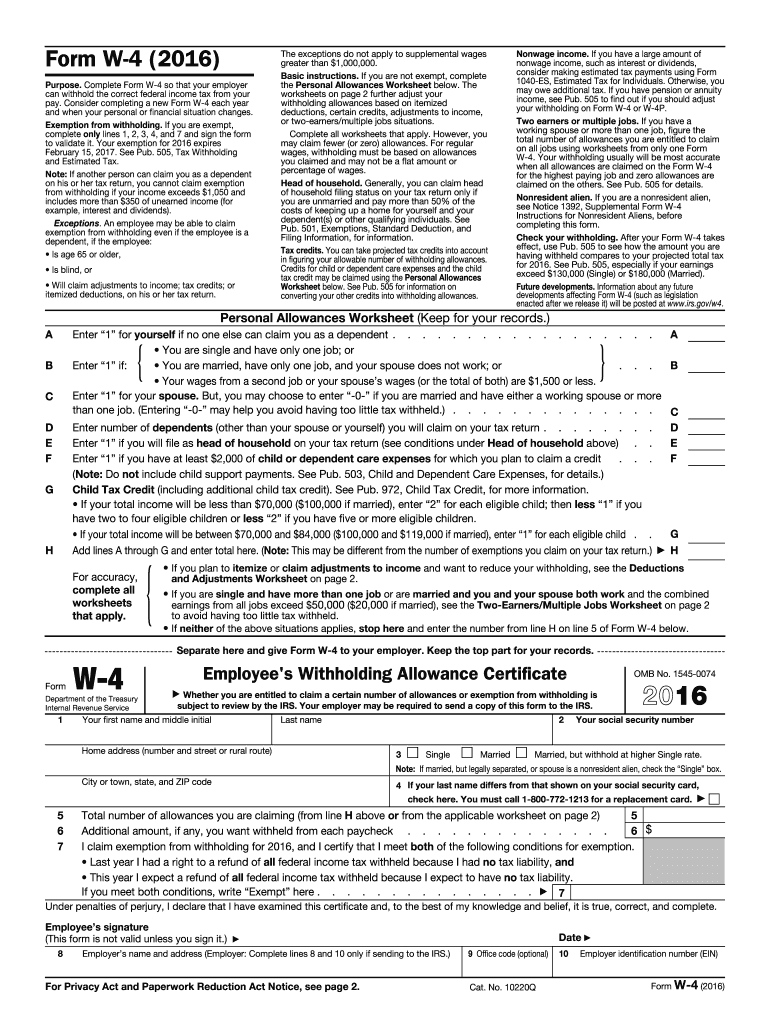

The W-4 Form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about the amount of federal income tax to withhold from their paycheck. This form helps ensure that the correct amount of tax is withheld throughout the year, which can prevent underpayment or overpayment of taxes when filing a tax return. The W-4 Form is particularly important for new employees, those who have had changes in personal circumstances, or anyone looking to adjust their withholding status.

How to use the W-4 Form

Using the W-4 Form involves several straightforward steps. First, employees must complete the form by providing personal information, including their name, address, Social Security number, and filing status. Next, they should indicate the number of allowances they wish to claim, which affects the amount of tax withheld. The form also allows for additional withholding amounts if desired. Once completed, the employee submits the W-4 Form to their employer, who will then adjust the withholding accordingly. It is advisable to review and update the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child.

Steps to complete the W-4 Form

Completing the W-4 Form requires attention to detail to ensure accurate withholding. Here are the steps to follow:

- Provide your personal information, including your name, address, and Social Security number.

- Select your filing status, such as single, married, or head of household.

- Determine the number of allowances you wish to claim based on your situation, which can reduce the amount withheld.

- Consider any additional amounts you want withheld from each paycheck.

- Sign and date the form before submitting it to your employer.

Legal use of the W-4 Form

The W-4 Form is legally binding when completed accurately and submitted to the employer. It is essential to ensure that the information provided is truthful and reflects the employee's current tax situation. Misrepresenting information on the W-4 can lead to penalties from the IRS, including fines or additional taxes owed. Employers are required to keep the W-4 Form on file for their employees and must adhere to the withholding amounts specified on the form.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the W-4 Form, including how to complete it and the implications of the information provided. The IRS updates the form periodically, so it is important to use the most current version. Additionally, the IRS offers resources and tools to help employees calculate their withholding accurately, including the IRS Withholding Estimator, which can assist in determining the appropriate number of allowances to claim.

Form Submission Methods

Employees can submit the W-4 Form to their employer through various methods. The most common method is to provide a printed copy of the completed form directly to the employer's human resources or payroll department. Many employers also accept electronic submissions, allowing employees to fill out and send the form digitally. Regardless of the submission method, it is important to ensure that the form is submitted promptly to allow for accurate withholding in upcoming pay periods.

Quick guide on how to complete 2016 w 4 form

Effortlessly Prepare W 4 Form on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Handle W 4 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign W 4 Form with Ease

- Find W 4 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes requiring you to print new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and electronically sign W 4 Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 w 4 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 w 4 form

How to generate an electronic signature for the 2016 W 4 Form in the online mode

How to make an eSignature for your 2016 W 4 Form in Google Chrome

How to make an eSignature for putting it on the 2016 W 4 Form in Gmail

How to make an eSignature for the 2016 W 4 Form straight from your smart phone

How to generate an electronic signature for the 2016 W 4 Form on iOS

How to make an electronic signature for the 2016 W 4 Form on Android

People also ask

-

What is a W 4 Form and why is it important?

The W 4 Form, also known as the Employee's Withholding Certificate, is a crucial document that employees fill out to inform their employer of their tax withholding preferences. Completing the W 4 Form accurately ensures that the correct amount of federal income tax is withheld from your paycheck, which can help you avoid owing taxes at the end of the year.

-

How can airSlate SignNow help with the W 4 Form?

With airSlate SignNow, you can easily create, send, and eSign your W 4 Form online. Our platform streamlines the process, allowing you to fill out the form electronically, ensuring accuracy and saving time compared to traditional paper methods.

-

Is there a cost associated with using airSlate SignNow for the W 4 Form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, including plans specifically designed for managing documents like the W 4 Form. Our cost-effective solution ensures that you get the best value while simplifying your document signing process.

-

What features does airSlate SignNow offer for managing W 4 Forms?

airSlate SignNow provides several features for managing W 4 Forms, including customizable templates, electronic signatures, and secure document storage. These features make it easy to handle your W 4 Form efficiently and securely, enhancing your overall workflow.

-

Can I integrate airSlate SignNow with other applications for W 4 Form management?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage your W 4 Form alongside your existing tools. This integration can enhance your productivity by automating workflows and keeping all your documents organized in one place.

-

Is airSlate SignNow secure for handling sensitive documents like the W 4 Form?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry standards, ensuring that your W 4 Form and other sensitive documents are protected. You can trust our platform to keep your information secure while you eSign and share documents.

-

What are the benefits of using airSlate SignNow for the W 4 Form compared to traditional methods?

Using airSlate SignNow for your W 4 Form offers several benefits over traditional methods, such as faster processing time, reduced paper waste, and improved accuracy. Our electronic solution allows for quick edits and instant delivery, making the entire experience more efficient for both employers and employees.

Get more for W 4 Form

- Black mold testing receipt form

- Oregon deq asn6 form

- Ohio drc victim services form

- Personal fund threshold pft notification revenue commissioners revenue form

- Gsp retroactivity application form board of certified

- Food pantry sign in total elderly bfeednycbborgb feednyc form

- Name 780728487 form

- Notice of cessation of business corporate affairs commission cacnigeria form

Find out other W 4 Form

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile