PDF Form W 4 PDF IRS 2020

What is the W-4 Form?

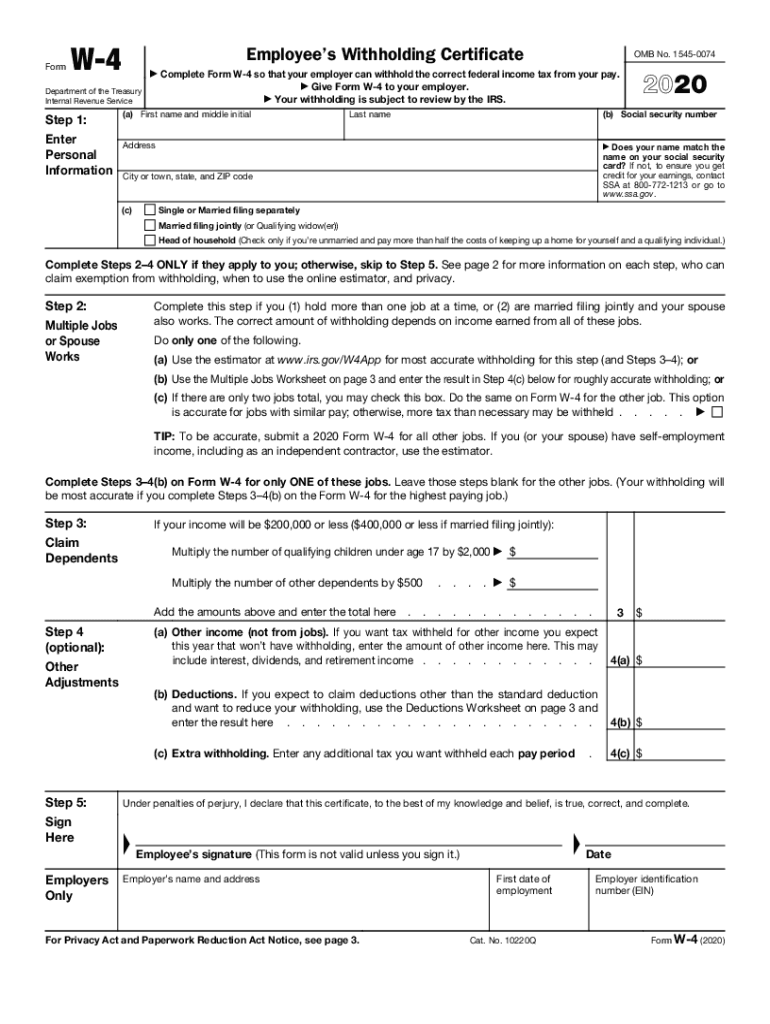

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted, which can prevent underpayment or overpayment of taxes throughout the year. The W-4 is essential for both employees and employers, as it directly impacts the employee's take-home pay and tax obligations.

Steps to Complete the W-4 Form

Completing the W-4 form involves several clear steps to ensure accurate withholding. Here’s a straightforward guide:

- Personal Information: Fill in your name, address, Social Security number, and filing status. This section identifies you and your tax situation.

- Multiple Jobs or Spouse Works: If applicable, indicate if you have more than one job or if your spouse also works. This helps calculate the correct withholding amount.

- Claim Dependents: If you have qualifying dependents, provide the number and total amount you plan to claim. This can reduce your taxable income.

- Other Adjustments: You can also indicate any additional income, deductions, or extra withholding you want from your paycheck.

- Signature: Finally, sign and date the form to validate it. Your employer needs this to process your withholding correctly.

Legal Use of the W-4 Form

The W-4 form is legally binding when completed and submitted to your employer. It complies with IRS regulations, ensuring that the withholding amounts are calculated based on the information you provide. It is important to keep the form updated, especially after significant life changes such as marriage, divorce, or the birth of a child, as these can affect your tax situation. Failure to submit an accurate W-4 can lead to incorrect withholding, resulting in potential penalties or a tax bill at the end of the year.

How to Obtain the W-4 Form

The W-4 form can be easily obtained from the IRS website or through your employer. Most employers provide a copy of the form during the onboarding process. If you need a blank W-4 form, you can download it in PDF format directly from the IRS website, ensuring you have the most current version. It is important to use the latest version of the form to comply with current tax laws.

Filing Deadlines / Important Dates

While the W-4 form does not have a specific filing deadline like tax returns, it is important to submit it to your employer as soon as possible after any changes in your tax situation. Employers typically require the W-4 to be completed before the first paycheck is issued. Additionally, if you make changes to your W-4, submit it promptly to ensure your withholding reflects your current financial situation.

Examples of Using the W-4 Form

Understanding how to use the W-4 form effectively can help you manage your tax withholding better. For instance:

- If you are a single individual with no dependents, you might choose to claim only yourself, resulting in higher withholding.

- A married couple with children may claim dependents to reduce their withholding, increasing their take-home pay.

- Individuals with multiple jobs should consider the total income from all jobs when completing their W-4 to avoid under-withholding.

Quick guide on how to complete pdf form w 4 pdf irs

Manage PDF Form W 4 PDF IRS effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, as you can access the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle PDF Form W 4 PDF IRS on any device using airSlate SignNow's Android or iOS apps and enhance any document-centered workflow today.

The simplest method to edit and electronically sign PDF Form W 4 PDF IRS with ease

- Find PDF Form W 4 PDF IRS and click Get Form to begin.

- Make use of the features we provide to finalize your document.

- Point out important sections of your documents or obscure confidential information with the tools offered by airSlate SignNow designed specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign PDF Form W 4 PDF IRS and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form w 4 pdf irs

Create this form in 5 minutes!

How to create an eSignature for the pdf form w 4 pdf irs

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a blank W4 form and why is it important?

A blank W4 form is a document used by employees to indicate their tax withholding preferences to their employer. It is important because it helps ensure that the correct amount of federal income tax is withheld from an employee's paycheck, impacting their financial planning and tax obligations.

-

How can I create a blank W4 using airSlate SignNow?

Creating a blank W4 using airSlate SignNow is straightforward. Our platform allows you to easily upload, edit, and fill out the W4 form digitally, ensuring that you can customize your tax withholding preferences with ease and safety.

-

Is there a cost associated with using airSlate SignNow for blank W4 forms?

Yes, airSlate SignNow offers a variety of pricing plans to suit different businesses, including an affordable option for those needing to handle blank W4 forms. By investing in our service, you gain access to eSigning capabilities and document management features that can greatly enhance your efficiency.

-

What features does airSlate SignNow offer for managing blank W4 forms?

airSlate SignNow provides a range of features for managing blank W4 forms, including easy editing, secure eSigning, and cloud storage. These features ensure that you can collaborate effectively with your employees while keeping your documents organized and accessible.

-

Can I automate the distribution of blank W4 forms using airSlate SignNow?

Yes, airSlate SignNow offers automation options that allow you to distribute blank W4 forms to your employees efficiently. You can set up workflows that automatically send the W4 forms for completion and signature, saving you time and improving accuracy.

-

Does airSlate SignNow integrate with payroll systems for blank W4 handling?

Absolutely! airSlate SignNow seamlessly integrates with popular payroll systems, allowing you to manage blank W4 forms alongside employee payroll data. This integration streamlines processes and ensures that tax information is synchronized across your systems.

-

What are the benefits of using airSlate SignNow for eSigning blank W4 forms?

Using airSlate SignNow for eSigning blank W4 forms provides numerous benefits, including enhanced security, compliance with legal requirements, and convenience for your employees. Digital eSigning speeds up the process and reduces paperwork, making tax season much simpler.

Get more for PDF Form W 4 PDF IRS

Find out other PDF Form W 4 PDF IRS

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple