Form 2013

What is the 2013 Form?

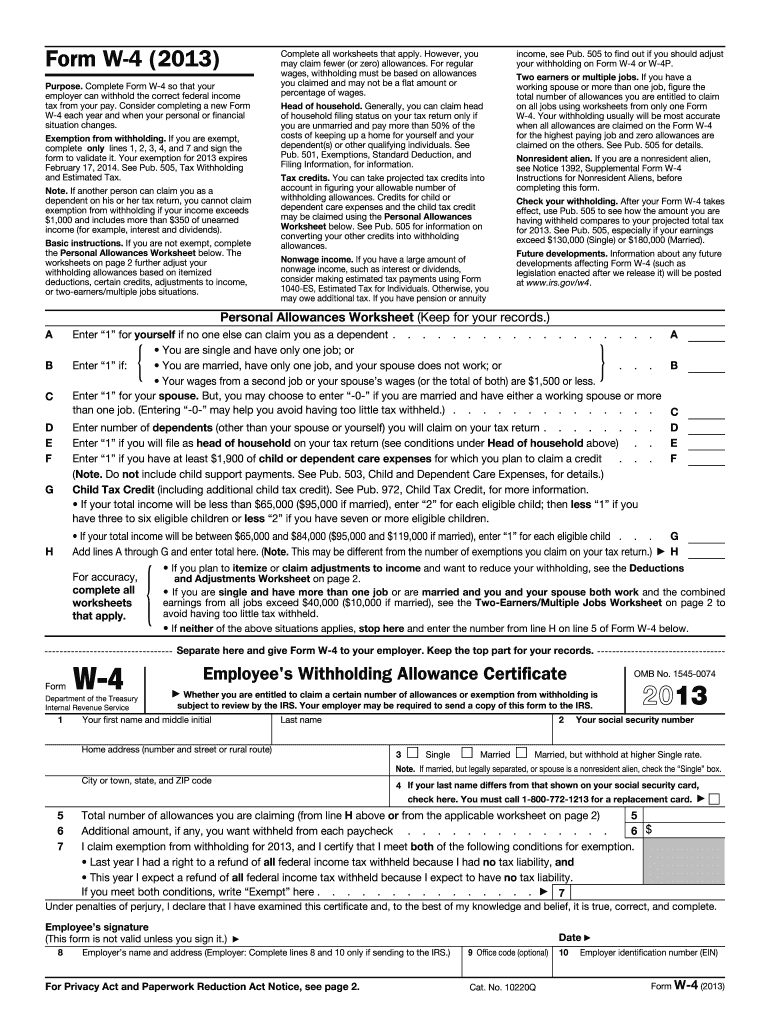

The 2013 form, commonly referred to as the 2013 W-4, is a tax form used by employees in the United States to indicate their tax situation to their employer. This form helps employers determine the amount of federal income tax to withhold from an employee's paycheck. The W-4 form is essential for ensuring that the correct amount of taxes is withheld, which can help prevent underpayment or overpayment of taxes throughout the year.

How to Use the 2013 Form

To use the 2013 W-4 form effectively, employees should accurately complete the sections that pertain to their personal and financial situation. This includes providing information about marital status, number of dependents, and any additional income or deductions. Once completed, the form should be submitted to the employer's payroll department. It is advisable to review and update the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child, to ensure correct withholding.

Steps to Complete the 2013 Form

Completing the 2013 W-4 form involves several key steps:

- Obtain a copy of the form, which can be downloaded from the IRS website or requested from your employer.

- Fill in your personal information, including your name, address, Social Security number, and filing status.

- Indicate the number of allowances you are claiming, which will affect your withholding amount.

- If applicable, provide information for additional income or deductions.

- Sign and date the form before submitting it to your employer.

Legal Use of the 2013 Form

The 2013 W-4 form is legally binding once it is completed and submitted to an employer. It is important to provide accurate information to avoid potential penalties from the IRS for underreporting income or failing to withhold sufficient taxes. Employers are required to keep the form on file and use it to calculate the appropriate withholding amounts for each employee.

IRS Guidelines for the 2013 Form

The IRS provides specific guidelines for completing the 2013 W-4 form. Employees should refer to the instructions included with the form to ensure compliance with current tax laws. The IRS also updates its guidelines periodically, so it is crucial to stay informed about any changes that may affect withholding calculations. For detailed information, employees can consult the IRS website or contact a tax professional.

Form Submission Methods

The completed 2013 W-4 form can be submitted to the employer through various methods, including:

- In-person delivery to the payroll or human resources department.

- Mailing the form directly to the employer's payroll office.

- Submitting the form electronically, if the employer offers an online submission option.

Quick guide on how to complete 2013 form 6954604

Prepare Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and without complications. Handle Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign Form with ease

- Locate Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Edit and electronically sign Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 6954604

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 6954604

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What features does the airSlate SignNow Form offer for document signing?

The airSlate SignNow Form provides a user-friendly interface that allows you to create, send, and eSign documents effortlessly. With customizable templates, you can tailor each Form to meet your specific needs, enhancing your workflow efficiency. Additionally, you can track document status in real-time, ensuring that you never miss a signature.

-

How does airSlate SignNow Form improve my business's efficiency?

By utilizing the airSlate SignNow Form, businesses can streamline their document signing process, reducing the time spent on paperwork. The automated reminders and notifications ensure that all parties are kept informed, which speeds up the signing process. This efficiency leads to faster transactions and improved customer satisfaction.

-

Is there a free trial available for the airSlate SignNow Form?

Yes, airSlate SignNow offers a free trial for users to explore the capabilities of the Form. This allows you to test features like eSigning, document templates, and integrations without any financial commitment. It's a great way to see how the Form can fit into your business processes.

-

What types of documents can I use with the airSlate SignNow Form?

You can use the airSlate SignNow Form to sign a variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different industries. Whether you need to send a simple Form or complex agreements, airSlate SignNow can handle it.

-

How much does the airSlate SignNow Form cost?

The pricing for the airSlate SignNow Form varies based on the features and the number of users. There are different subscription plans available, allowing businesses to choose a package that best fits their needs. For detailed pricing information, visit our pricing page to compare options.

-

Can I integrate the airSlate SignNow Form with other applications?

Absolutely! The airSlate SignNow Form easily integrates with various applications such as Google Workspace, Salesforce, and Microsoft Office. These integrations help streamline your workflow by connecting your existing tools with our eSigning solution, making document management seamless.

-

What security measures does airSlate SignNow Form provide for my documents?

The airSlate SignNow Form prioritizes the security of your documents with advanced encryption and authentication protocols. Your documents are stored securely, and access is controlled through user permissions, ensuring that sensitive information remains protected. We comply with major data protection regulations to safeguard your data.

Get more for Form

- Call bsc medical care solutions phone number blue form

- Recipient designation form recipient designation form

- New client form harbor animal hospital

- Health plan form palo alto unified school district pausd

- Ihss riverside county form

- Hcpc foster care medical contact form kern county public

- Blue shield of california and blue shield of california form

- Potrerocpt form

Find out other Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors