Form W 4 Employee's Withholding Certificate 2024-2026

What is the Form W-4 Employee's Withholding Certificate

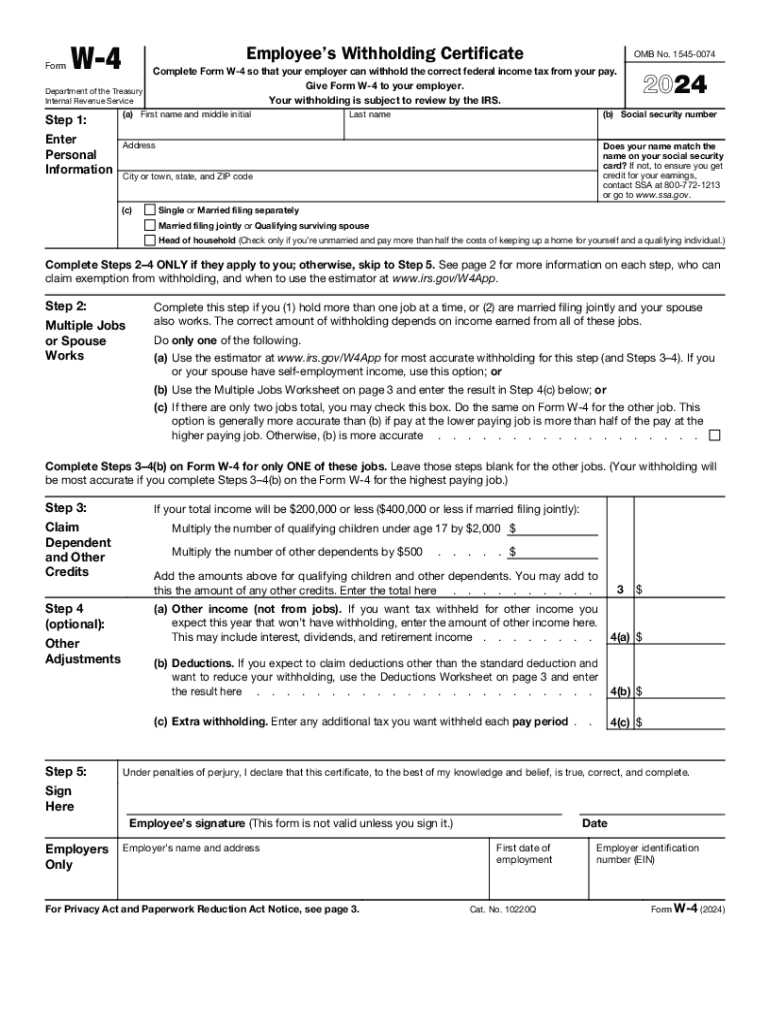

The Form W-4, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. By completing this form, employees can specify the amount of federal income tax to withhold from their paychecks, which helps ensure they do not owe a large tax bill at the end of the year. The W-4 form is particularly important for new employees or those who have experienced significant life changes, such as marriage, divorce, or the birth of a child, as these factors can influence tax withholding needs.

Steps to complete the Form W-4 Employee's Withholding Certificate

Completing the Form W-4 involves several straightforward steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status (single, married, etc.).

- Multiple Jobs or Spouse Works: If applicable, indicate if you have multiple jobs or if your spouse works, which may require adjustments to your withholding.

- Claim Dependents: List any dependents you can claim for tax purposes, which can reduce your taxable income.

- Other Adjustments: If you wish to request additional withholding or claim deductions, fill in the relevant sections.

- Signature: Sign and date the form to certify that the information provided is accurate.

How to obtain the Form W-4 Employee's Withholding Certificate

The Form W-4 can be easily obtained from various sources. It is available on the official IRS website, where you can download a PDF version for printing. Employers often provide the form during the onboarding process, so new hires should check with their HR department. Additionally, many tax preparation software programs include the form as part of their services, allowing users to fill it out digitally.

IRS Guidelines

The IRS provides specific guidelines for completing the Form W-4. It is important to follow these guidelines closely to ensure accurate withholding. The IRS recommends using the online withholding calculator available on their website to help determine the appropriate amount to withhold based on individual circumstances. Regularly updating the W-4 is also advised, especially after major life events or changes in income, to maintain proper tax withholding.

Legal use of the Form W-4 Employee's Withholding Certificate

The Form W-4 is a legal document that must be filled out accurately to comply with federal tax laws. Employers are required to keep the completed forms on file and use the information to calculate the appropriate amount of federal income tax to withhold from employees' paychecks. Misrepresentation or failure to submit a W-4 can lead to penalties for both the employee and employer, making it essential to provide truthful and complete information.

Form Submission Methods (Online / Mail / In-Person)

Employees can submit the Form W-4 to their employer in several ways. The most common method is to hand in a printed copy directly to the HR or payroll department. Some employers may also allow electronic submission through their payroll systems. It is important to confirm the submission method preferred by the employer, as policies may vary. Once submitted, the employer is responsible for processing the information and adjusting the payroll withholding accordingly.

Quick guide on how to complete form w 4 employees withholding certificate 702793575

Complete Form W 4 Employee's Withholding Certificate seamlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form W 4 Employee's Withholding Certificate on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and electronically sign Form W 4 Employee's Withholding Certificate effortlessly

- Obtain Form W 4 Employee's Withholding Certificate and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Form W 4 Employee's Withholding Certificate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 4 employees withholding certificate 702793575

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding certificate 702793575

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS W-4 form and why is it important?

The IRS W-4 form is used by employees to determine the amount of federal income tax to withhold from their paychecks. Filling out the IRS W-4 form correctly ensures compliance with tax regulations and helps you manage your finances efficiently throughout the year.

-

How can airSlate SignNow help me with my IRS W-4 form?

airSlate SignNow enables users to easily create, send, and eSign the IRS W-4 form, streamlining the process for both employers and employees. With our platform, you can customize your form, ensuring that it meets your specific requirements while also keeping it legally compliant.

-

Is there a cost associated with using airSlate SignNow for the IRS W-4 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our plans are cost-effective, making it affordable for businesses of all sizes to manage tax-related documents like the IRS W-4 form efficiently.

-

Can airSlate SignNow integrate with my current HR software for the IRS W-4 form?

Absolutely! airSlate SignNow offers seamless integrations with numerous HR and payroll software platforms. This means you can easily manage the IRS W-4 form alongside your other HR processes, ensuring everything is cohesive and up-to-date.

-

What features does airSlate SignNow provide for signing the IRS W-4 form?

airSlate SignNow provides a user-friendly interface for eSigning the IRS W-4 form, along with features like templates, document tracking, and secure storage. These features enhance your workflow efficiency and provide peace of mind when dealing with important tax documents.

-

How does airSlate SignNow ensure the security of my IRS W-4 forms?

Security is a top priority at airSlate SignNow. When handling the IRS W-4 form, our platform utilizes advanced encryption and security protocols to protect your sensitive data, ensuring that only authorized users have access to your documents.

-

Can I store the completed IRS W-4 forms within airSlate SignNow?

Yes, once you've eSigned your IRS W-4 form, you can easily store it within the secure airSlate SignNow platform. This allows for organized document management and quick access whenever you need to retrieve your tax forms.

Get more for Form W 4 Employee's Withholding Certificate

- Renewed and extended for similar periods thereafter unless terminated pursuant to this article form

- Of payment of rent co signerguarantor is jointly severally and individually liable with lessee form

- This notice given on the day of 20 form

- Motorcycles shall be parked in the area designated for all motor vehicles form

- The leased premises described in said commercial lease form

- Form me 864 1lt

- Pro rated rent due form

- Signature new name form

Find out other Form W 4 Employee's Withholding Certificate

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now