W 4 Form 1999

What is the W-4 Form

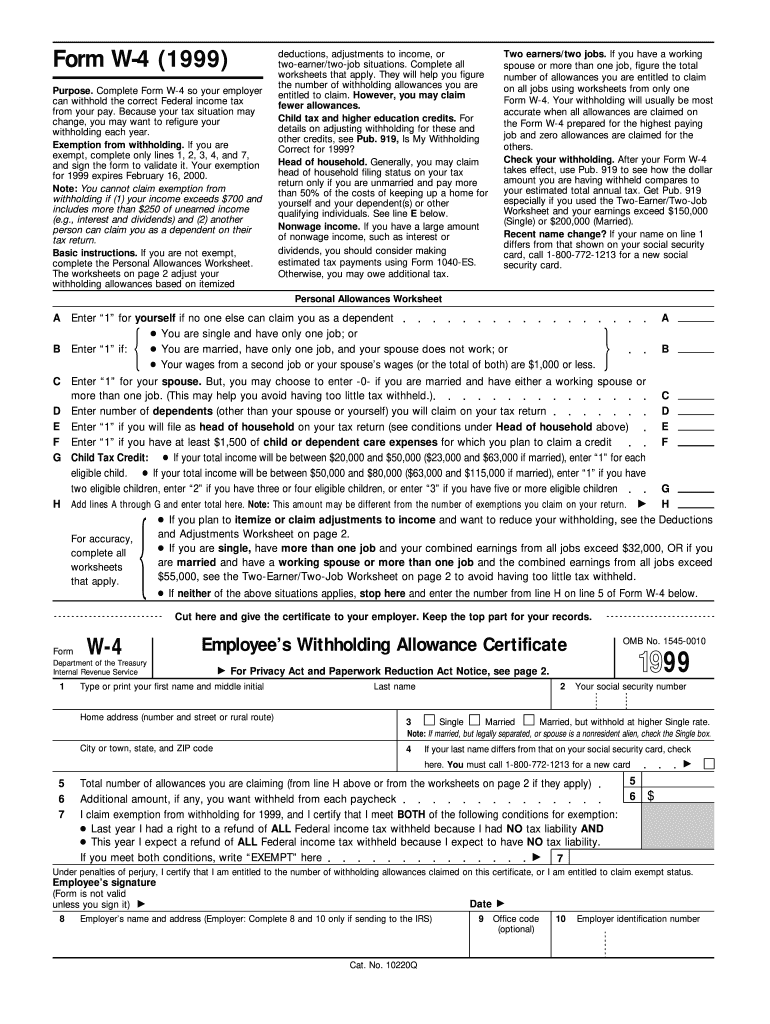

The W-4 Form, officially known as the Employee's Withholding Certificate, is a crucial document used in the United States for tax withholding purposes. Employees complete this form to inform their employers about their tax situation, including marital status and the number of allowances they wish to claim. This information helps employers determine the correct amount of federal income tax to withhold from employees' paychecks. Understanding how to fill out the W-4 Form accurately is essential for ensuring that the right amount of taxes is withheld throughout the year.

How to use the W-4 Form

Using the W-4 Form involves several steps that ensure accurate tax withholding. First, employees should obtain the form from their employer or download it directly from the IRS website. After filling out the required fields, including personal information and allowances, employees should submit the completed form to their employer. It is important to review and update the W-4 Form whenever there are significant life changes, such as marriage, divorce, or the birth of a child, as these can affect tax withholding needs.

Steps to complete the W-4 Form

Completing the W-4 Form requires careful attention to detail. Here are the steps to follow:

- Step 1: Enter personal information, including name, address, and Social Security number.

- Step 2: Indicate your filing status, such as single or married.

- Step 3: Claim dependents if applicable, which can reduce your taxable income.

- Step 4: Adjust your withholding by adding any additional amount you want withheld or claiming any deductions.

- Step 5: Sign and date the form to certify that the information provided is accurate.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the W-4 Form. Employees should ensure they are using the most current version of the form, as the IRS updates it periodically. It is also important to follow the instructions carefully to avoid errors that could lead to incorrect withholding. The IRS recommends that employees use the Tax Withholding Estimator available on their website to determine the appropriate number of allowances and any additional withholding amounts needed.

Legal use of the W-4 Form

The W-4 Form is legally binding once it is signed and submitted to the employer. Employers are required to withhold taxes based on the information provided in the form. Failure to provide accurate information can lead to under-withholding, resulting in tax liabilities at the end of the year. Additionally, the IRS has the authority to audit W-4 Forms to ensure compliance with tax laws. Therefore, it is essential for employees to understand their obligations and complete the form accurately.

Form Submission Methods

Employees can submit the W-4 Form to their employer through various methods, depending on the employer's policies. Common submission methods include:

- Online: Many employers have electronic systems for submitting the W-4 Form, allowing employees to complete and submit the form digitally.

- Mail: Employees may also choose to print the completed form and mail it directly to their employer's HR department.

- In-Person: Submitting the form in person can be an option for those who prefer direct communication with HR personnel.

Quick guide on how to complete 1999 w 4 form

Easily Prepare W 4 Form on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage W 4 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

Effortlessly Modify and eSign W 4 Form

- Obtain W 4 Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, frustrating form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign W 4 Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1999 w 4 form

Create this form in 5 minutes!

How to create an eSignature for the 1999 w 4 form

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a W 4 Form and why is it important?

The W 4 Form is a tax form used by employees to indicate their tax situation to their employer. It's crucial because it determines the amount of federal income tax to withhold from your paycheck, impacting your take-home pay and tax refund.

-

How does airSlate SignNow simplify the completion of the W 4 Form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out, sign, and send your W 4 Form electronically. This streamlines the process, reduces paperwork, and ensures that your information is securely stored and accessible.

-

Can I save my completed W 4 Form on airSlate SignNow for future use?

Yes, airSlate SignNow allows you to securely save your completed W 4 Form for future access. This feature helps you manage your tax documents efficiently and ensures you can quickly update your form when necessary.

-

Is airSlate SignNow compliant with IRS regulations regarding the W 4 Form?

Yes, airSlate SignNow complies with all relevant IRS regulations for the W 4 Form. Our platform ensures that your signed documents are legally valid, helping you stay compliant while simplifying your tax-filing process.

-

What pricing options are available for using airSlate SignNow to manage the W 4 Form?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, including options for individual users and enterprises. You can choose a plan based on your volume of documents, ensuring you receive the best value for managing your W 4 Form.

-

Can I integrate airSlate SignNow with my HR software when sending the W 4 Form?

Absolutely! airSlate SignNow seamlessly integrates with various HR software platforms, making it easy to send and receive W 4 Forms directly within your existing systems. This integration enhances workflow efficiency and helps ensure timely document management.

-

What are the benefits of using airSlate SignNow for electronic signatures on the W 4 Form?

Using airSlate SignNow for electronic signatures on the W 4 Form streamlines the signing process, saves time, and ensures documents are signed securely. Enhanced tracking features also allow you to stay informed about the status of your documents, making tax preparation easier.

Get more for W 4 Form

Find out other W 4 Form

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT