About Schedule EIC Form 1040 or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form 2022

Understanding the Schedule EIC Form 1040

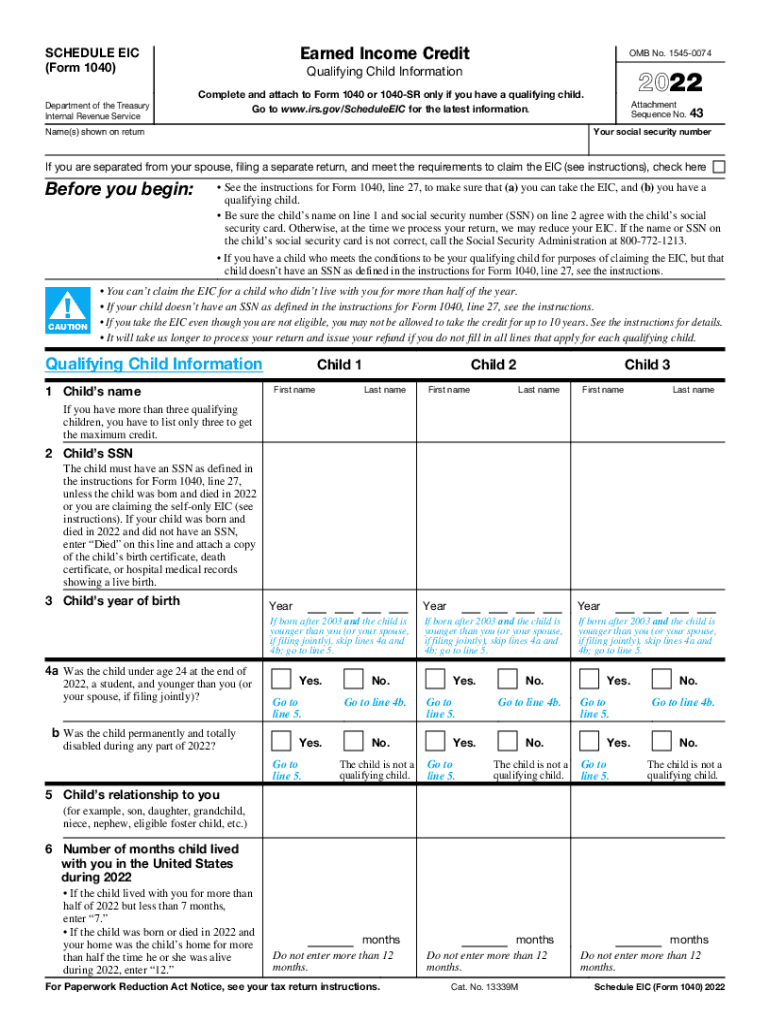

The Schedule EIC form is an essential document for taxpayers seeking to claim the Earned Income Tax Credit (EITC). This form is typically filed alongside Form 1040 or Form 1040-SR. The EITC is designed to benefit low to moderate-income workers by reducing their tax burden and potentially providing a refund. To qualify for the credit, taxpayers must meet specific income thresholds and have qualifying children or meet certain criteria if they do not have children.

Eligibility Criteria for the Earned Income Credit

To qualify for the Earned Income Credit, taxpayers must meet several eligibility requirements. These include:

- Having earned income from employment or self-employment

- Meeting specific income limits based on filing status and number of qualifying children

- Filing a federal tax return, even if no tax is owed

- Being a U.S. citizen or resident alien for the entire tax year

- Having a valid Social Security number

Taxpayers without qualifying children may still be eligible if they meet certain age and residency requirements.

Steps to Complete the Schedule EIC Form

Completing the Schedule EIC form involves several steps to ensure accuracy and compliance with IRS guidelines. Here’s a straightforward process:

- Gather necessary documents, including your W-2 forms and any other income statements.

- Determine your eligibility based on the income limits and qualifying children.

- Fill out the Schedule EIC form, providing information about your earned income and qualifying children.

- Attach the completed Schedule EIC to your Form 1040 or Form 1040-SR when filing your tax return.

- Review your entire tax return for accuracy before submission.

Legal Use of the Schedule EIC Form

The Schedule EIC form is legally binding when filled out and submitted correctly. It is crucial to ensure that all information provided is accurate and truthful. Misrepresentation or errors can lead to penalties or disqualification from receiving the credit. The IRS may audit claims, so maintaining proper documentation is essential to substantiate eligibility for the Earned Income Credit.

IRS Guidelines for the Earned Income Credit

The IRS provides detailed guidelines regarding the Earned Income Credit, including eligibility requirements, income limits, and filing procedures. Taxpayers can access these guidelines through the IRS website or through official publications. Understanding these guidelines helps ensure compliance and maximizes potential benefits from the credit.

Required Documents for Filing

When preparing to file the Schedule EIC form, taxpayers should have several documents ready:

- W-2 forms from employers

- Records of any self-employment income

- Social Security numbers for all qualifying children

- Any other relevant income documentation

Having these documents organized will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete about schedule eic form 1040 or 1040 sr earned incomefederal 1040 schedule eic earned income tax creditabout schedule eic form

Complete About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without holdups. Manage About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form effortlessly

- Locate About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form and click Get Form to begin.

- Utilize the tools we supply to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule eic form 1040 or 1040 sr earned incomefederal 1040 schedule eic earned income tax creditabout schedule eic form

Create this form in 5 minutes!

People also ask

-

What is the earned income credit table 2021?

The earned income credit table 2021 is a guideline provided by the IRS that outlines the income limits and credit amounts for individuals and families eligible for the Earned Income Tax Credit (EITC). It is designed to help lower-income earners receive financial benefits during tax filing. Knowing how to interpret this table can help you maximize your refunds.

-

How can airSlate SignNow help with tax documents related to the earned income credit table 2021?

airSlate SignNow simplifies the process of sending and eSigning tax documents related to the earned income credit table 2021. Our platform ensures that all your documents are securely signed and stored, making it easy to organize and file your taxes efficiently. This is particularly useful if you need to submit your forms quickly to meet tax deadlines.

-

Are there specific features in airSlate SignNow that assist with tax preparation for the earned income credit table 2021?

Yes, airSlate SignNow offers features like document templates, real-time collaboration, and automated workflows that can streamline tax preparation associated with the earned income credit table 2021. These tools help ensure that you have all necessary documents ready and compliant with IRS requirements, making tax season less stressful.

-

What pricing options does airSlate SignNow offer for businesses handling the earned income credit table 2021?

airSlate SignNow provides several pricing tiers to accommodate businesses of all sizes managing documents related to the earned income credit table 2021. Our plans are designed to be cost-effective while offering robust features to meet your business needs, especially during peak tax times. You can easily select a plan based on your volume of documents and required features.

-

Can I integrate airSlate SignNow with other accounting software for handling earned income credit documents?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, which can enhance your workflow when dealing with the earned income credit table 2021. This integration allows for smooth data exchange, ensuring that all tax documents are correctly prepared and filed without any redundant entry.

-

What benefits does using airSlate SignNow provide for businesses working with the earned income credit table 2021?

Utilizing airSlate SignNow offers numerous benefits for businesses dealing with the earned income credit table 2021, including improved efficiency, compliance assurance, and enhanced security for sensitive tax documents. Additionally, our user-friendly interface allows your team to quickly learn and adopt the platform, saving time during the crucial tax season.

-

Is there customer support available for questions related to the earned income credit table 2021?

Yes, airSlate SignNow offers dedicated customer support to assist with any inquiries regarding the earned income credit table 2021. Our team is knowledgeable about tax document processes and is ready to help you navigate any challenges that may arise. You can access support through multiple channels, including phone and live chat.

Get more for About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form

- Ny corrective deed form

- Quitclaim deed from corporation to corporation new york form

- Warranty deed from corporation to corporation new york form

- Quitclaim deed from corporation to two individuals new york form

- Warranty deed from corporation to two individuals new york form

- Warranty deed from individual to a trust new york form

- Warranty deed from husband and wife to a trust new york form

- Lien new york form

Find out other About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeFederal 1040 Schedule EIC Earned Income Tax CreditAbout Schedule EIC Form

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later