Schedule Eic Form 2009

What is the Schedule EIC Form

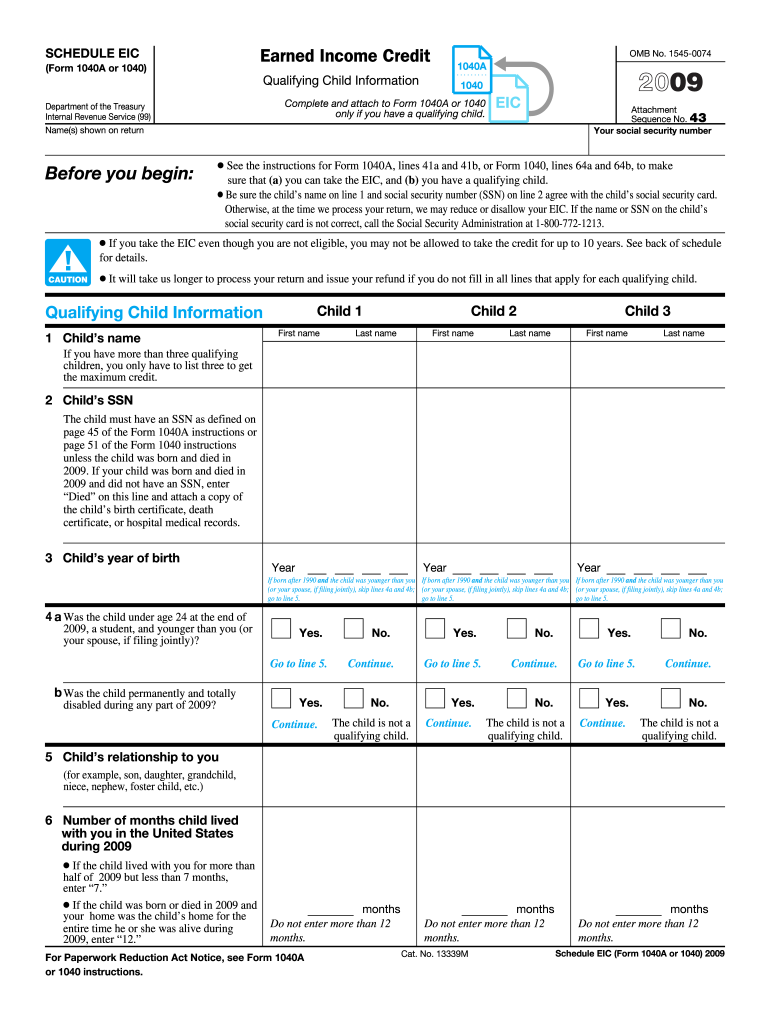

The Schedule EIC Form is a tax document used by eligible taxpayers in the United States to claim the Earned Income Tax Credit (EITC). This credit is designed to assist low to moderate-income workers by reducing their tax liability and potentially providing a refund. The Schedule EIC is specifically used to report qualifying children and determine the amount of the credit for which a taxpayer may be eligible. Understanding this form is crucial for maximizing tax benefits and ensuring compliance with IRS regulations.

How to use the Schedule EIC Form

Using the Schedule EIC Form involves several key steps. First, ensure that you meet the eligibility criteria for the Earned Income Tax Credit. Next, gather necessary information about your qualifying children, including their Social Security numbers and relationship to you. Complete the form by following the instructions provided, ensuring that all information is accurate and complete. Finally, attach the Schedule EIC to your Form 1040 or Form 1040-SR when filing your federal tax return. This integration is essential for the IRS to process your claim for the credit.

Steps to complete the Schedule EIC Form

Completing the Schedule EIC Form requires careful attention to detail. Start by entering your personal information, including your name and Social Security number. Next, provide information about your qualifying children, ensuring that you include their names, Social Security numbers, and the months they lived with you during the tax year. Be sure to check the eligibility requirements for each child, as this can affect your credit amount. After filling out all necessary sections, review the form for accuracy before submitting it with your tax return.

Legal use of the Schedule EIC Form

The Schedule EIC Form must be used in accordance with IRS guidelines to ensure its legal validity. Taxpayers must accurately report their income and the number of qualifying children to avoid penalties. Misrepresentation or errors can lead to audits or disqualification from receiving the credit. It is important to maintain documentation that supports your claims, such as proof of residency for your children. Adhering to these legal requirements helps safeguard against potential issues with the IRS.

Eligibility Criteria

To qualify for the Earned Income Tax Credit and use the Schedule EIC Form, taxpayers must meet specific criteria. These include having earned income from employment or self-employment, meeting income limits based on filing status, and having at least one qualifying child. Additionally, the taxpayer must be a U.S. citizen or resident alien for the entire tax year. Understanding these eligibility criteria is essential for ensuring that you can successfully claim the credit and benefit from its advantages.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule EIC Form coincide with the annual tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about these important dates to avoid late filing penalties and ensure timely receipt of any potential refunds associated with the Earned Income Tax Credit.

Form Submission Methods (Online / Mail / In-Person)

The Schedule EIC Form can be submitted through various methods, depending on how you choose to file your taxes. If you are using tax software or an online tax service, the form can be completed electronically and submitted directly to the IRS. Alternatively, you can print the completed form and mail it along with your tax return. In some cases, taxpayers may opt to file in person at designated IRS offices or authorized tax preparation locations. Each method has its own advantages, so choose the one that best suits your needs.

Quick guide on how to complete 2009 schedule eic form

Effortlessly Prepare Schedule Eic Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Schedule Eic Form on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and eSign Schedule Eic Form with Ease

- Find Schedule Eic Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your PC.

Forget about losing or misplacing files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Schedule Eic Form and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 schedule eic form

Create this form in 5 minutes!

How to create an eSignature for the 2009 schedule eic form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Schedule Eic Form?

The Schedule Eic Form is used for claiming the Earned Income Credit (EIC) when filing your taxes. This form helps determine eligibility for tax benefits, ensuring that you can take full advantage of your credits. With airSlate SignNow, completing and sending your Schedule Eic Form is simple and secure.

-

How can airSlate SignNow assist with the Schedule Eic Form?

airSlate SignNow provides a streamlined platform for creating, editing, and signing your Schedule Eic Form electronically. Our easy-to-use interface allows you to fill out the form quickly and ensures compliance with all tax requirements. Plus, eSigning features make it easy to get necessary approvals effortlessly.

-

Is using airSlate SignNow for the Schedule Eic Form cost-effective?

Yes, airSlate SignNow is a cost-effective solution for managing your Schedule Eic Form and other documents. We offer various pricing plans to fit different business needs, ensuring you get the best value for our secure eSigning services. Avoid unnecessary costs associated with traditional paper methods by using our platform.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow offers a variety of features for managing your Schedule Eic Form and documents, such as customizable templates, secure storage, and real-time tracking. Our platform allows you to automate workflows and collaborate with team members effectively. These features enhance your efficiency during tax season.

-

Can I integrate airSlate SignNow with other software for my Schedule Eic Form?

Absolutely! airSlate SignNow seamlessly integrates with numerous third-party applications, which makes it easy to manage your Schedule Eic Form alongside your other business tools. This integration allows you to streamline your document workflow and maintain consistency across all platforms used in your operations.

-

What are the benefits of eSigning my Schedule Eic Form with airSlate SignNow?

eSigning your Schedule Eic Form with airSlate SignNow offers numerous benefits, including enhanced security, quicker turnaround times, and reduced paper usage. You can sign documents from anywhere and ensure that your tax filings are submitted promptly. This method simplifies the process and keeps everything organized.

-

Is airSlate SignNow user-friendly for tax professionals working on Schedule Eic Forms?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for tax professionals working on Schedule Eic Forms. No technical knowledge is required to use our platform, and we provide comprehensive support to assist you. This user-friendly approach allows for efficient document management during the tax season.

Get more for Schedule Eic Form

- Important information and funeral planning guide

- Essentail goaltending form

- Cibc pre authorized debit form pdf

- Certificate of automobile insurance final form

- Exhibition2016 space contract canadian music week form

- Medication reconciliation form

- Wfg canada form

- Application for accessible parking permit bill walker mpp form

Find out other Schedule Eic Form

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application