Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 or 1040 SR, Earned IncomeAbout Schedule EIC Form 2021

Understanding the Federal 1040 Schedule EIC Earned Income Tax Credit

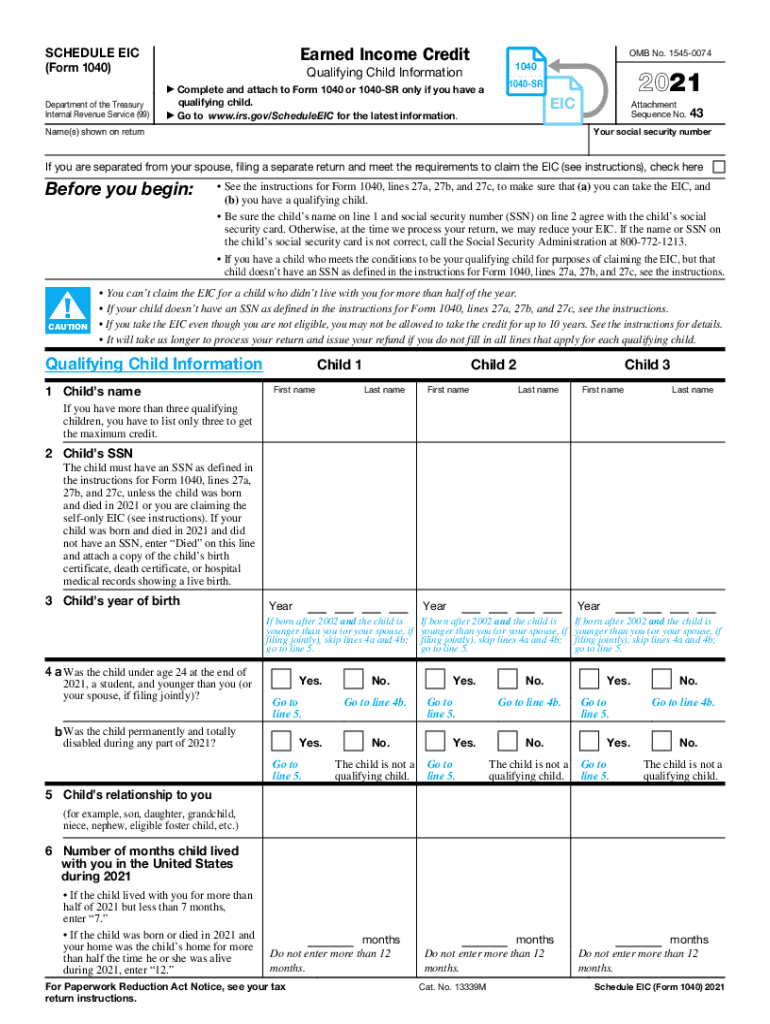

The Federal 1040 Schedule EIC is a crucial form for taxpayers who qualify for the earned income credit (EIC). This credit is designed to assist low to moderate-income working individuals and families by reducing their tax liability. To be eligible, taxpayers must meet specific income thresholds and have qualifying children or meet certain criteria if they do not. The Schedule EIC must be attached to the Form 1040 or Form 1040-SR when filing taxes.

Steps to Complete the Federal 1040 Schedule EIC Earned Income Tax Credit

Completing the Schedule EIC involves several steps to ensure accuracy and compliance with IRS requirements. Begin by gathering necessary documents, such as your W-2 forms and any other income statements. Next, determine your eligibility by checking the income limits and qualifying criteria. Fill out the form by providing your earned income details, the number of qualifying children, and their Social Security numbers. Finally, review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for the Earned Income Tax Credit

Eligibility for the earned income credit is primarily based on income, filing status, and the number of qualifying children. To qualify, your earned income and adjusted gross income must fall below specified thresholds, which may vary each tax year. Additionally, you must be a U.S. citizen or a resident alien for the entire tax year. If you do not have qualifying children, you can still claim the credit if you meet age and residency requirements.

Required Documents for Filing Schedule EIC

To complete the Schedule EIC, certain documents are necessary to verify income and eligibility. Essential documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Social Security numbers for qualifying children

- Proof of residency for you and your children

Having these documents ready will streamline the process of filling out the form and ensure that you meet all requirements.

IRS Guidelines for the Earned Income Tax Credit

The IRS provides specific guidelines for claiming the earned income credit. These guidelines outline the eligibility criteria, income limits, and necessary documentation. It is essential to follow these guidelines closely to avoid delays or issues with your tax return. The IRS also updates these guidelines annually, so reviewing the latest information before filing is advisable.

Form Submission Methods for Schedule EIC

Taxpayers can submit the Schedule EIC through various methods, including online filing, mailing a paper return, or in-person submission at designated locations. Online filing is often the most efficient method, allowing for faster processing and potential refunds. If you choose to file by mail, ensure that you send the form to the correct IRS address based on your state of residence. In-person submissions may be available at certain tax preparation services or IRS offices.

Quick guide on how to complete federal 1040 schedule eic earned income tax credit about schedule eic form 1040 or 1040 sr earned incomeabout schedule eic form

Complete Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form seamlessly

- Locate Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from a device of your choice. Modify and eSign Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal 1040 schedule eic earned income tax credit about schedule eic form 1040 or 1040 sr earned incomeabout schedule eic form

Create this form in 5 minutes!

How to create an eSignature for the federal 1040 schedule eic earned income tax credit about schedule eic form 1040 or 1040 sr earned incomeabout schedule eic form

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the earned income credit and how does it work?

The earned income credit (EIC) is a refundable tax credit designed to help low-to-moderate-income working individuals and families. It reduces the amount of tax owed and can result in a refund. airSlate SignNow can help you effortlessly sign documents related to your tax filings, ensuring you don’t miss out on eligible credits like the earned income credit.

-

How can airSlate SignNow help me with earned income credit documentation?

AirSlate SignNow provides a streamlined platform for signing and managing your documents electronically, which is vital when claiming your earned income credit. With our easy-to-use interface, you can quickly gather signatures and send documents, ensuring you have everything needed for your tax claims.

-

Are there any fees associated with claiming my earned income credit using airSlate SignNow?

Using airSlate SignNow comes with a cost-effective pricing model that can fit within most budgets. By utilizing our platform to eSign documents for your earned income credit claims, you can save time and reduce potential errors, making it a sound investment for your tax preparation process.

-

What features does airSlate SignNow offer to enhance my earned income credit process?

airSlate SignNow offers features like customizable templates, automated reminders, and secure document storage that can simplify your earned income credit claims. These tools help ensure that you meet deadlines while maintaining compliance and accuracy in your submissions.

-

Can airSlate SignNow integrate with other accounting software for earned income credit claims?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your experience when claiming the earned income credit. These integrations allow for efficient data transfer and document management, streamlining your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for earned income credit documentation?

The benefits of using airSlate SignNow for your earned income credit documentation include enhanced efficiency, reduced paperwork, and improved accuracy. Our platform ensures that your documents are signed securely and stored safely, making it easier for you to manage your tax credits.

-

How secure is my information when using airSlate SignNow for earned income credit?

Security is a top priority at airSlate SignNow. Your information related to the earned income credit is protected with advanced encryption and secure cloud storage, ensuring that your sensitive data remains confidential and safe throughout the signing process.

Get more for Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form

- Siding contract for contractor mississippi form

- Refrigeration contract for contractor mississippi form

- Drainage contract for contractor mississippi form

- Mississippi contract contractor form

- Plumbing contract for contractor mississippi form

- Brick mason contract for contractor mississippi form

- Roofing contract for contractor mississippi form

- Electrical contract for contractor mississippi form

Find out other Federal 1040 Schedule EIC Earned Income Tax Credit About Schedule EIC Form 1040 Or 1040 SR, Earned IncomeAbout Schedule EIC Form

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy