Form 1040 Schedule EIC 2024-2026

Understanding Form 1040 Schedule EIC

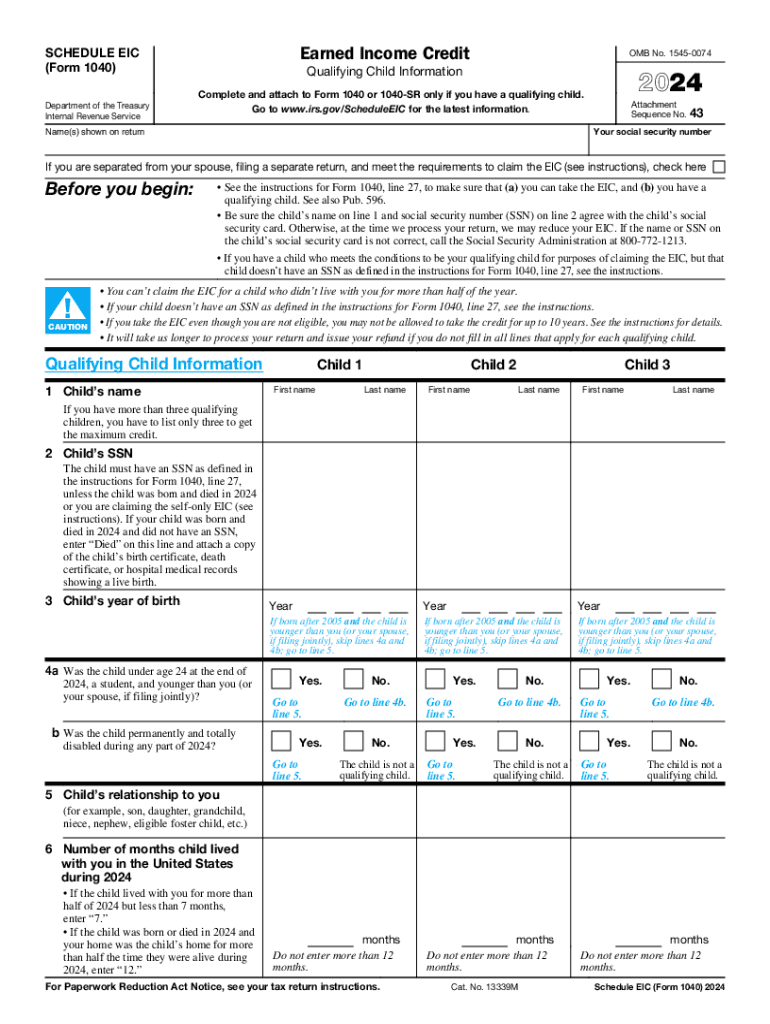

The Form 1040 Schedule EIC is a crucial document used to claim the earned income tax credit (EITC). This credit is designed to assist low to moderate-income working individuals and families by reducing the amount of tax owed and potentially providing a refund. The schedule is attached to the Form 1040 or Form 1040-SR when filing your federal tax return. It is essential for taxpayers who qualify based on their income level and number of qualifying children.

Eligibility Criteria for the Earned Income Tax Credit

To qualify for the earned income tax credit, taxpayers must meet specific eligibility requirements, including:

- Having earned income from employment or self-employment.

- Meeting income thresholds based on filing status and number of qualifying children.

- Being a U.S. citizen or resident alien for the entire year.

- Filing a federal tax return, even if no tax is owed.

- Having a valid Social Security number.

Taxpayers without qualifying children can also claim the credit, but they must meet additional criteria, such as being at least 25 years old but under 65.

Steps to Complete the Form 1040 Schedule EIC

Completing the Form 1040 Schedule EIC involves several key steps:

- Gather necessary documents, including your W-2s and any other income statements.

- Determine your eligibility by reviewing the income limits and qualifying child criteria.

- Fill out the schedule by providing your earned income and the number of qualifying children.

- Calculate the credit amount using the EIC table provided in the IRS instructions.

- Attach the completed Schedule EIC to your Form 1040 or Form 1040-SR before submission.

Ensure all information is accurate to avoid delays in processing your tax return.

Obtaining the Form 1040 Schedule EIC

The Form 1040 Schedule EIC can be easily obtained from the IRS website. It is available as a downloadable PDF, which allows you to print and fill it out manually. Additionally, tax preparation software often includes this form, making it convenient to complete your tax return electronically. If you prefer to receive a physical copy, you can request it by calling the IRS or visiting a local IRS office.

IRS Guidelines for the Earned Income Tax Credit

The IRS provides comprehensive guidelines for claiming the earned income tax credit. These guidelines include information on eligibility, how to calculate the credit, and the importance of accurate reporting. It is essential to refer to the latest IRS publications, as rules and income limits may change annually. Taxpayers are encouraged to review the IRS website for updates and additional resources related to the earned income tax credit.

Filing Deadlines for the Earned Income Tax Credit

Filing deadlines for the earned income tax credit align with the general tax filing deadlines. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure they file their returns on time to avoid penalties and to receive any refunds associated with the earned income tax credit promptly.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule eic

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule eic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the earned income tax credit?

The earned income tax credit (EITC) is a tax benefit for working individuals and couples, particularly those with children. It reduces the amount of tax owed and may result in a refund. Understanding the EITC can help you maximize your tax benefits when using airSlate SignNow for document signing.

-

How can airSlate SignNow help with earned income tax credit documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to the earned income tax credit. With our platform, you can easily send tax forms for eSignature, ensuring that all necessary documentation is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for earned income tax credit forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage your earned income tax credit documentation without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for tax professionals handling earned income tax credit claims?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning. These tools are particularly beneficial for tax professionals managing earned income tax credit claims, streamlining the process and enhancing client satisfaction.

-

Can I integrate airSlate SignNow with other software for managing earned income tax credit applications?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage earned income tax credit applications. This integration helps ensure that all your documents are in one place, simplifying your workflow.

-

What are the benefits of using airSlate SignNow for earned income tax credit submissions?

Using airSlate SignNow for earned income tax credit submissions offers numerous benefits, including faster processing times and reduced paperwork. Our platform enhances collaboration and ensures that all parties can sign documents securely and efficiently.

-

How secure is airSlate SignNow when handling earned income tax credit documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and compliance measures to protect your earned income tax credit documents, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for Form 1040 Schedule EIC

Find out other Form 1040 Schedule EIC

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure