Earned Income Credit Worksheet Form 2017

What is the Earned Income Credit Worksheet Form

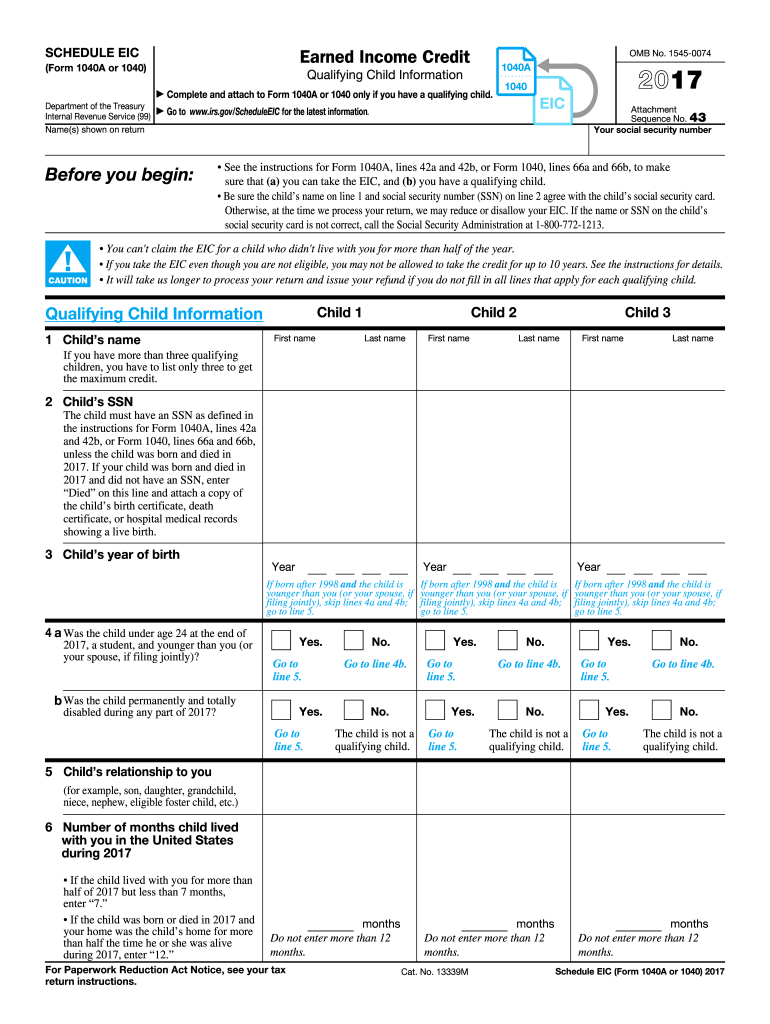

The Earned Income Credit Worksheet Form is a crucial document used by taxpayers in the United States to determine their eligibility for the Earned Income Tax Credit (EITC). This credit is designed to assist low to moderate-income working individuals and families by reducing their tax liability and potentially providing a refund. The worksheet helps taxpayers calculate the amount of credit they may qualify for based on their income, filing status, and number of dependents.

How to use the Earned Income Credit Worksheet Form

Using the Earned Income Credit Worksheet Form involves several steps. First, gather all necessary financial documents, including your W-2 forms and any other income statements. Next, complete the worksheet by following the provided instructions, which guide you through calculating your earned income and adjusting it for any applicable deductions. Ensure that you accurately report your filing status and the number of qualifying children, as these factors significantly influence the credit amount. After filling out the worksheet, review your calculations for accuracy before submitting your tax return.

Steps to complete the Earned Income Credit Worksheet Form

Completing the Earned Income Credit Worksheet Form requires careful attention to detail. Start by entering your total earned income from all sources, including wages, salaries, and self-employment income. Next, adjust this amount for any exclusions or deductions, such as certain disability payments. Then, identify your filing status—single, married filing jointly, or head of household—and list any qualifying children. Follow the worksheet's instructions to calculate your credit based on the income and family size. Finally, ensure all information is accurate and complete before including it with your tax return.

Eligibility Criteria

To qualify for the Earned Income Tax Credit, taxpayers must meet specific eligibility criteria. These include having earned income below a certain threshold, which varies depending on filing status and the number of qualifying children. Additionally, applicants must be U.S. citizens or resident aliens for the entire tax year. Individuals without qualifying children must be between the ages of 25 and 64. It is essential to review the current IRS guidelines to ensure compliance with all requirements before claiming the credit.

Form Submission Methods

The Earned Income Credit Worksheet Form can be submitted through various methods, depending on how you file your taxes. If you choose to file electronically, you can complete the worksheet using tax software that integrates the form into the filing process. Alternatively, if you prefer to file a paper return, you can print the completed worksheet and attach it to your tax return before mailing it to the IRS. Ensure that you keep a copy of the worksheet for your records, regardless of the submission method.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Earned Income Credit Worksheet Form. These guidelines outline the eligibility requirements, income limits, and necessary documentation needed to substantiate your claim. It is crucial to stay updated with any changes to the tax code that may affect the EITC. Taxpayers should refer to the IRS website or consult a tax professional for the most current information and instructions to ensure compliance and maximize their potential credit.

Quick guide on how to complete earned income credit worksheet 2017 form

Uncover the easiest method to complete and sign your Earned Income Credit Worksheet Form

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior approach to fill out and sign your Earned Income Credit Worksheet Form and comparable forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork efficiently and according to official standards - comprehensive PDF editing, management, protection, signing, and sharing tools are all at your fingertips within an intuitive interface.

Only a few steps are needed to complete the process of filling out and signing your Earned Income Credit Worksheet Form:

- Upload the editable template to the editor using the Get Form button.

- Verify what information must be provided in your Earned Income Credit Worksheet Form.

- Navigate between the fields using the Next button to avoid missing any details.

- Utilize Text, Check, and Cross tools to fill the blanks with your information.

- Update the content with Text boxes or Images from the toolbar above.

- Emphasize what is truly important or Blackout sections that are no longer relevant.

- Select Sign to create a legally binding electronic signature using any preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Earned Income Credit Worksheet Form in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers versatile file sharing. There’s no need to print out your templates when you need to submit them at the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct earned income credit worksheet 2017 form

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Which ITR form to fill if income is from interest earned on FD only?

Editing the answer for AY 2019–20 (FY 2018–19)ITR 1 is the appropriate return to be filed if income earned by you is oñly interest income. Also, if your interest income during the financial year is below Rs.250,000 please ensure that you are getting a refund of the entire TDS deducted by the bank.ITR 1 for AY 2019–20 is applicable for individuals being a resident other than not ordinarily resident having income from salaries, one house property, other sources (interest etc.) and having total income upto Rs.50 lakh.Summary points to note for applicability of ITR 1 for AY 2019–20:Persons not falling in the above category will have to wait for ITR 2 or 3 based on their circumstance.Non-residents cannot file in ITR 1. They have to use ITR 2 or 3 based on their facts.ITR 1 is not applicable for an Individual who is either Director in a company or has invested in Unlisted Equity Shares.Since residents will still be awaiting Form 16 (generally issued by company latest by June 2018), those individuals who have only interest income on which TDS was deducted and wish to claim a refund of the TDS, can file ITR 1 right awayIn many cases, Form 26AS will not be updated for interest earning individuals, as the banks are yet to file their TDS returns. Hence, it is highly recommended to such individuals to wait till May 31 (last date for TDS returns filing).If you are however sure that no one will be deducting any TDS in your name, then you can file immediately.NIL returns can be filed immediatelyThe due date for filing ITR 1 for AY 2019–20 is July 31, 2019. Once the ITR is filed, it takes about 2 months for the refunds to credit, if any, provided there are no mistakes in the ITR and everything is disclosed correctly.Hope the above was useful. For further clarifications/ assistance please feel free to get in touch at aditi.bhardwaj@outlook.com.Best regards,Aditiaditi.bhardwaj@outlook.com

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the earned income credit worksheet 2017 form

How to make an eSignature for the Earned Income Credit Worksheet 2017 Form online

How to make an electronic signature for your Earned Income Credit Worksheet 2017 Form in Google Chrome

How to make an electronic signature for signing the Earned Income Credit Worksheet 2017 Form in Gmail

How to generate an eSignature for the Earned Income Credit Worksheet 2017 Form straight from your mobile device

How to generate an electronic signature for the Earned Income Credit Worksheet 2017 Form on iOS

How to generate an eSignature for the Earned Income Credit Worksheet 2017 Form on Android

People also ask

-

What is the Earned Income Credit Worksheet Form?

The Earned Income Credit Worksheet Form is a crucial document that helps taxpayers determine their eligibility for the Earned Income Tax Credit (EITC). This form outlines the necessary criteria and calculations needed to claim this valuable credit, which can result in signNow tax savings. Utilizing the Earned Income Credit Worksheet Form correctly can ensure you maximize your potential refund.

-

How can I access the Earned Income Credit Worksheet Form through airSlate SignNow?

To access the Earned Income Credit Worksheet Form, simply log in to your airSlate SignNow account and navigate to the document section. You can easily upload, eSign, and send the worksheet directly to your clients or colleagues. Our platform simplifies the process, allowing you to manage all your important documents in one place.

-

Is the Earned Income Credit Worksheet Form available for free?

The Earned Income Credit Worksheet Form is typically available for free through the IRS website. However, with airSlate SignNow, you gain added features such as eSigning and document tracking for a small fee. This cost-effective solution enhances your ability to manage the Earned Income Credit Worksheet Form and other critical documents seamlessly.

-

What features does airSlate SignNow offer for managing the Earned Income Credit Worksheet Form?

airSlate SignNow offers a range of features for managing your Earned Income Credit Worksheet Form, including electronic signatures, custom templates, and document sharing capabilities. You can create, edit, and send your forms efficiently, which streamlines your workflow. Additionally, real-time notifications and tracking ensure you stay updated on document status.

-

Can I integrate airSlate SignNow with other software for the Earned Income Credit Worksheet Form?

Yes, airSlate SignNow allows for extensive integrations with various software platforms, enhancing the management of your Earned Income Credit Worksheet Form. You can connect with tools such as Google Drive, Dropbox, and CRM systems to streamline your processes. This integration capability makes it easier to access and share your documents across different applications.

-

What are the benefits of using airSlate SignNow for the Earned Income Credit Worksheet Form?

Using airSlate SignNow for the Earned Income Credit Worksheet Form provides several benefits, including increased efficiency, organization, and security. With features like eSigning, you can quickly obtain the necessary signatures, saving you time and reducing paper usage. Additionally, the platform keeps your documents safe with encryption and compliance standards.

-

Is airSlate SignNow suitable for small businesses that need the Earned Income Credit Worksheet Form?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses needing the Earned Income Credit Worksheet Form. Its affordability, user-friendly interface, and robust features make it an ideal choice for small enterprises looking to streamline their document processes and improve productivity.

Get more for Earned Income Credit Worksheet Form

Find out other Earned Income Credit Worksheet Form

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT