Form Earned Income Credit 2011

What is the Form Earned Income Credit

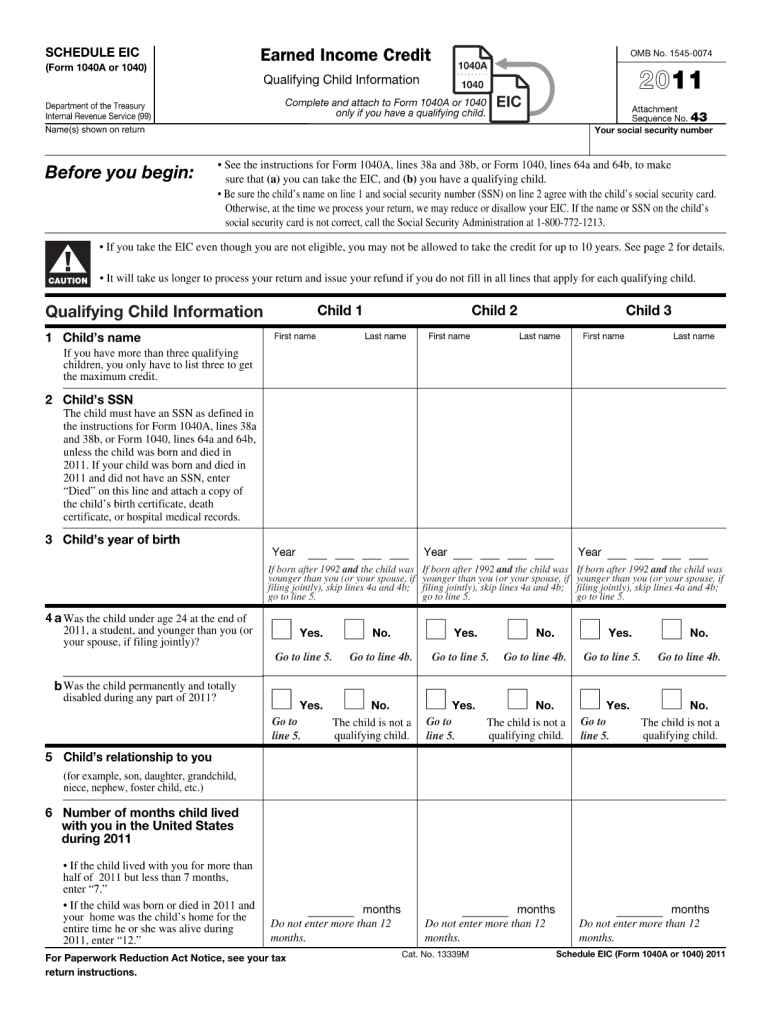

The Form Earned Income Credit (EIC) is a tax form used by eligible taxpayers in the United States to claim the Earned Income Tax Credit. This credit is designed to reduce the tax burden on low to moderate-income working individuals and families, providing them with a financial boost. The EIC can result in a significant refund, depending on the taxpayer's income level and number of qualifying children. Eligibility for this credit is determined by various factors, including income, filing status, and the number of dependents.

How to use the Form Earned Income Credit

Using the Form Earned Income Credit involves several steps. First, taxpayers must determine their eligibility based on income and family size. Next, they need to complete the form accurately, ensuring all required information is provided. This includes reporting income, filing status, and details about qualifying children. Once completed, the form can be submitted along with the annual tax return. Taxpayers can also use tax preparation software to simplify the process, ensuring they maximize their credit amount.

Steps to complete the Form Earned Income Credit

Completing the Form Earned Income Credit requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including W-2 forms, Social Security numbers, and other income records.

- Determine eligibility by reviewing the income limits and qualifying criteria for the credit.

- Fill out the form, ensuring all information is accurate and complete.

- Calculate the credit amount based on the instructions provided with the form.

- Attach the completed form to your federal tax return before submitting.

Eligibility Criteria

To qualify for the Earned Income Credit, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits, which vary based on filing status and the number of qualifying children.

- Filing a tax return, even if no tax is owed.

- Having a valid Social Security number for the taxpayer and any qualifying children.

- Being a U.S. citizen or resident alien for the entire year.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form Earned Income Credit is crucial for taxpayers. The deadline for submitting federal tax returns typically falls on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or legislative changes. Filing early is recommended to ensure timely processing and to avoid delays in receiving any refund.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form Earned Income Credit. The most common methods include:

- Online Submission: Many taxpayers choose to file electronically using tax preparation software, which can help ensure accuracy and expedite processing.

- Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address, depending on their state of residence.

- In-Person: Some individuals may prefer to file their taxes in person at designated tax assistance centers or through certified tax professionals.

Quick guide on how to complete 2011 form earned income credit

Easily Prepare Form Earned Income Credit on Any Device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form Earned Income Credit on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Form Earned Income Credit with ease

- Locate Form Earned Income Credit and click on Get Form to begin.

- Utilize our tools to submit your form efficiently.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would prefer to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Earned Income Credit to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form earned income credit

Create this form in 5 minutes!

How to create an eSignature for the 2011 form earned income credit

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is a Form Earned Income Credit?

The Form Earned Income Credit (EIC) is a tax incentive designed to benefit low to moderate-income workers. By filling out this form, eligible individuals can potentially receive a substantial refund from the IRS. Using airSlate SignNow, you can eSign and send your Form Earned Income Credit efficiently.

-

How can airSlate SignNow help me with my Form Earned Income Credit?

airSlate SignNow streamlines the process of completing and submitting your Form Earned Income Credit by allowing you to eSign documents quickly. The platform's intuitive interface ensures that you can easily manage your documents without hassle. Additionally, it provides a convenient way to keep track of your submissions.

-

Is there a cost associated with using airSlate SignNow for Form Earned Income Credit?

Yes, airSlate SignNow offers different pricing tiers depending on your needs. However, it remains a cost-effective solution for individuals and businesses looking to handle their Form Earned Income Credit. You can choose a plan that suits your usage frequency and requirements.

-

What features does airSlate SignNow offer for completing the Form Earned Income Credit?

airSlate SignNow provides multiple features, such as customizable templates, in-app integrations, and secure cloud storage. These tools simplify the process of filling out and signing your Form Earned Income Credit. Moreover, you can track changes and manage workflows efficiently.

-

Can I store my completed Form Earned Income Credit in airSlate SignNow?

Absolutely! Once you complete your Form Earned Income Credit, airSlate SignNow allows you to securely store and manage your documents in the cloud. This makes it easy to access your completed forms whenever needed, facilitating a hassle-free filing experience.

-

Does airSlate SignNow integrate with other software for submitting Form Earned Income Credit?

Yes, airSlate SignNow seamlessly integrates with various software, including cloud storage solutions and accounting platforms. This feature enhances your efficiency by allowing you to send your Form Earned Income Credit directly to your accounts or tax preparation software. Integration options help streamline your workflow.

-

What are the benefits of using airSlate SignNow for my Form Earned Income Credit?

Using airSlate SignNow for your Form Earned Income Credit offers numerous advantages, including speed, security, and accessibility. You can complete and eSign your forms quickly while ensuring data protection. This makes it easier to get your tax refund in a timely manner.

Get more for Form Earned Income Credit

- Jr firefighter application eureka fire protection district efpd form

- Ms post form

- Mississippi bcbs form

- Www studentinsurance kk com form

- Intra articular hyaluronan injections prior review form

- Www studentinsurance kk com 322840113 form

- Bcbsnc prov id tax id out of state only form

- Special spring raffle flemington raritan regional school frsd k12 nj form

Find out other Form Earned Income Credit

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed