Eic Table Earned Income Credit 2023

What is the EIC Table Earned Income Credit

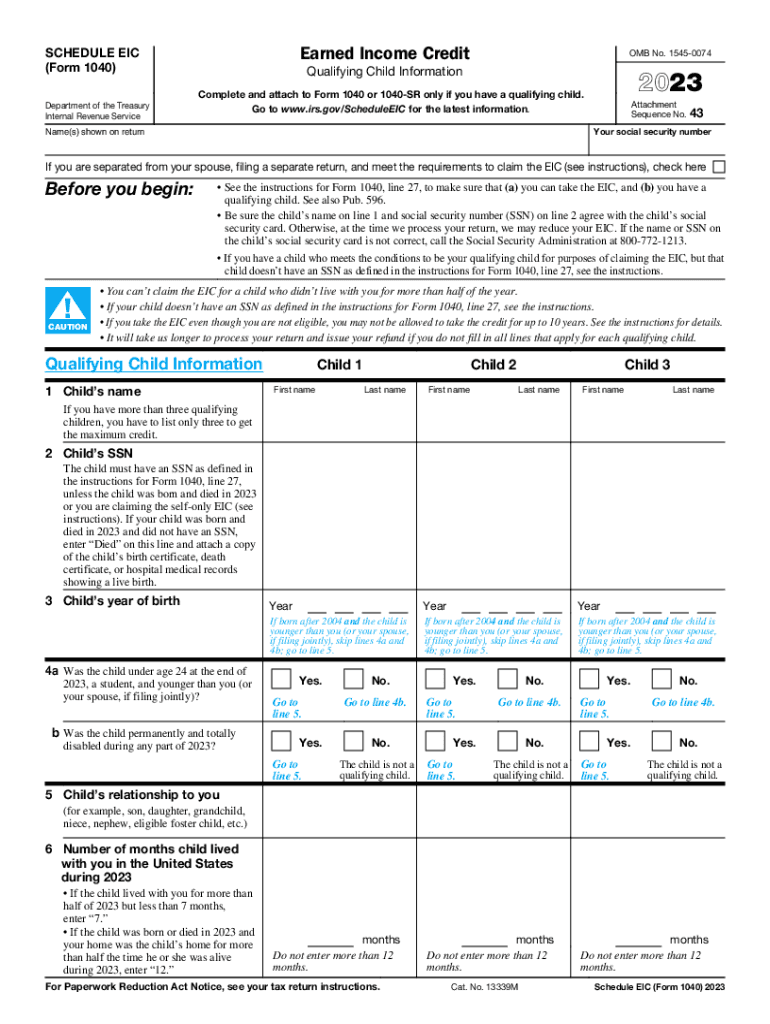

The Earned Income Credit (EIC) is a tax benefit designed to assist low to moderate-income working individuals and families. The EIC table provides a structured overview of the credit amounts available based on income levels and the number of qualifying children. This table is essential for taxpayers to determine their eligibility and the potential credit amount they may receive when filing their federal tax returns.

How to use the EIC Table Earned Income Credit

To utilize the EIC table effectively, taxpayers should first identify their earned income and the number of qualifying children they have. Once this information is gathered, individuals can locate their income level on the EIC table for the year 2023. The corresponding credit amount will indicate how much they can claim on their tax return. It is important to ensure that all calculations are accurate to maximize the benefits of the credit.

Eligibility Criteria

Eligibility for the Earned Income Credit is determined by several factors, including filing status, income level, and the number of qualifying children. Taxpayers must meet specific income thresholds, which vary based on whether they have no children, one child, two children, or three or more children. Additionally, individuals must be between the ages of twenty-five and sixty-five and have a valid Social Security number. Understanding these criteria is crucial for determining eligibility for the credit.

IRS Guidelines

The Internal Revenue Service (IRS) provides detailed guidelines on claiming the Earned Income Credit. Taxpayers should refer to IRS publications and instructions for the 2023 tax year, which outline the necessary steps for claiming the credit, including how to fill out the required forms. Adhering to these guidelines ensures compliance and helps avoid potential issues during tax filing.

Steps to complete the EIC Table Earned Income Credit

Completing the Earned Income Credit involves several steps:

- Gather all necessary financial documents, including W-2 forms and any other income statements.

- Determine your filing status and the number of qualifying children.

- Refer to the EIC table for 2023 to find your income level and corresponding credit amount.

- Complete the IRS Form 1040 or 1040-SR, including the EIC calculations.

- Double-check all entries for accuracy before submission.

Required Documents

To claim the Earned Income Credit, taxpayers must provide specific documentation. This typically includes:

- Proof of earned income, such as W-2 forms or self-employment income documentation.

- Social Security numbers for all qualifying children.

- Any additional forms that may be required based on individual circumstances.

Quick guide on how to complete eic table earned income credit

Complete Eic Table Earned Income Credit effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Eic Table Earned Income Credit on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest method to edit and electronically sign Eic Table Earned Income Credit with ease

- Obtain Eic Table Earned Income Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign Eic Table Earned Income Credit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct eic table earned income credit

Create this form in 5 minutes!

How to create an eSignature for the eic table earned income credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the earned income credit 2023 table?

The earned income credit 2023 table provides information on the income limits and credit amounts for eligible taxpayers. It helps individuals understand how much they can qualify for based on their income and number of dependents, assisting in maximizing their tax benefits.

-

How can I use the earned income credit 2023 table for tax planning?

Utilizing the earned income credit 2023 table can signNowly enhance your tax planning strategy. By understanding the thresholds and credit amounts, you can make informed decisions about your finances, ensuring that you meet the requirements to receive the maximum credit during tax season.

-

Is there a cost associated with accessing the earned income credit 2023 table?

Accessing the earned income credit 2023 table is typically free and available through various tax resources and government websites. As an added benefit, using airSlate SignNow allows you to eSign important documents such as tax forms without hidden fees, making the process efficient and cost-effective.

-

What features does airSlate SignNow offer that relate to the earned income credit 2023 table?

airSlate SignNow offers features that simplify document management and eSigning, crucial for tax documentation related to the earned income credit 2023 table. By streamlining these processes, you can efficiently gather and sign essential documents to claim your credits without hassle.

-

How can airSlate SignNow benefit individuals filing for the earned income credit?

By using airSlate SignNow, individuals can easily manage their tax documents, ensuring they have everything needed to file for the earned income credit. The platform's easy-to-use interface allows users to focus on maximizing their eligible credits based on the 2023 table and simplifies the eSigning process.

-

Does airSlate SignNow integrate with tax preparation software?

Yes, airSlate SignNow integrates smoothly with various tax preparation software, making it easier for users to file their taxes while considering the earned income credit 2023 table. This ensures that all necessary documents are synchronized, facilitating a better overall filing experience.

-

Can I track the status of my documents related to the earned income credit?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including those related to the earned income credit 2023 table. You can ensure all required forms are completed and submitted on time, reducing the risk of issues with your tax filings.

Get more for Eic Table Earned Income Credit

- Www hoodrivercounty govverticalsiteshood river county employment opportunity job posting hood form

- Www sbu edudocsdefault sourcehuman resources department po box 2450 employment application form

- Beeocb statement bishopville police department bishopvillepd form

- Www hendersonvillecc com images applicationforhendersonville country club application for form

- Www ssvfd4 org content frontst stephens fire department inc ssvfd4 org form

- Town of westminster 11 south st westminster ma 01473 form

- Employee direct deposit enrollment form 571848674

- Offer letter on company letterhead form

Find out other Eic Table Earned Income Credit

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form