Form 1041 T Allocation of Estimated Tax Payments to Beneficiaries under Code Section 643g 2022

Understanding Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g

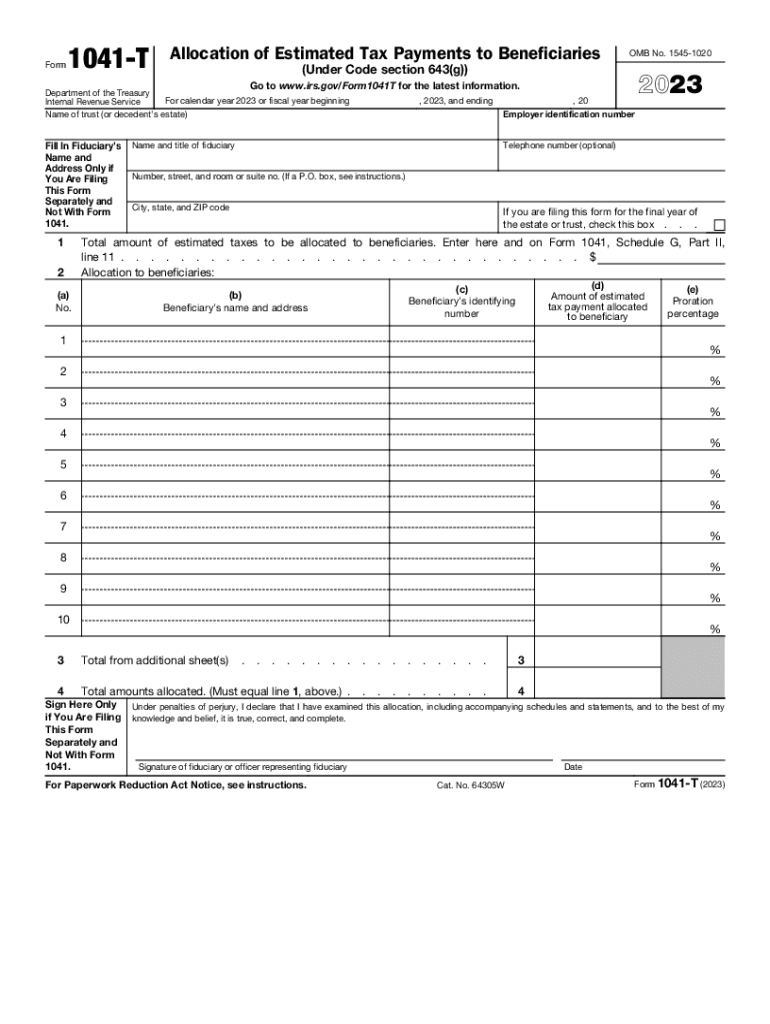

The Form 1041 T is utilized by estates and trusts to allocate estimated tax payments to beneficiaries under Internal Revenue Code Section 643(g). This form is essential for ensuring that beneficiaries receive their fair share of any estimated tax payments made by the estate or trust. The allocation allows beneficiaries to claim their portion of the estimated taxes on their individual tax returns, which can help reduce their overall tax liability. Understanding the purpose and implications of this form is crucial for both fiduciaries and beneficiaries involved in estate and trust management.

Steps to Complete Form 1041 T

Completing Form 1041 T involves several key steps to ensure accurate allocation of estimated tax payments. First, gather all necessary information regarding the estate or trust, including the total estimated tax payments made. Next, determine the beneficiaries and their respective shares of the income. The form requires you to input the total estimated tax payments and allocate these amounts based on the beneficiaries' shares. After filling out the form, review it for accuracy and completeness before submitting it along with the estate's Form 1041. This careful process helps prevent errors that could lead to complications for both the estate and the beneficiaries.

Legal Use of Form 1041 T

The legal framework surrounding Form 1041 T is rooted in the Internal Revenue Code, specifically Section 643(g), which governs the allocation of estimated tax payments. This form must be used correctly to ensure compliance with federal tax regulations. Failure to allocate these payments properly can result in tax liabilities for both the estate and the beneficiaries. It is advisable for fiduciaries to consult with tax professionals or legal advisors to ensure that the form is completed in accordance with applicable laws and regulations, thereby protecting the interests of all parties involved.

Key Elements of Form 1041 T

Form 1041 T includes several critical components that must be accurately completed. These elements consist of the estate or trust's name, the tax identification number, the total estimated tax payments made, and the specific allocations to each beneficiary. Additionally, it is important to include the beneficiaries' names and their respective shares of the income. Each section of the form must be filled out carefully to reflect the accurate distribution of estimated tax payments, which is essential for both tax reporting and compliance purposes.

Filing Deadlines for Form 1041 T

Filing deadlines for Form 1041 T align with the due dates for Form 1041, which is typically the fifteenth day of the fourth month following the close of the tax year for the estate or trust. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. It's important to adhere to these deadlines to avoid penalties and interest on unpaid taxes. Fiduciaries should maintain a calendar of important dates to ensure timely filing and compliance with tax obligations.

Examples of Using Form 1041 T

Consider a scenario where an estate has made estimated tax payments totaling $10,000, and there are two beneficiaries, each entitled to fifty percent of the income. In this case, Form 1041 T would allocate $5,000 of the estimated tax payments to each beneficiary. This allocation allows each beneficiary to claim their share on their individual tax returns, potentially lowering their tax liabilities. Such examples illustrate the practical application of the form and the importance of accurate allocations in estate and trust management.

Quick guide on how to complete form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g

Easily prepare Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g effortlessly

- Obtain Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specially offers for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a standard ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g

Create this form in 5 minutes!

How to create an eSignature for the form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g?

The Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g is a tax form used by estates and trusts to allocate estimated tax payments made on behalf of beneficiaries. This form helps ensure that each beneficiary receives their fair share of tax benefits. Understanding how to properly complete this form is critical to managing tax liabilities effectively.

-

How can airSlate SignNow help with Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g?

airSlate SignNow offers a streamlined solution for eSigning and sending documents, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. Our platform simplifies the entire process, ensuring that you can manage tax-related documents efficiently and securely, saving valuable time and effort.

-

Is there a cost associated with using airSlate SignNow for tax forms like the Form 1041 T?

Yes, there is a cost associated with using airSlate SignNow for managing tax forms, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. However, our pricing plans are designed to be cost-effective, enabling businesses to benefit from a robust eSignature solution without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 1041 T?

airSlate SignNow provides features that make managing Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g easy, including customizable templates, secure eSigning workflows, and document tracking. These features ensure that you can complete forms accurately while maintaining compliance and secure handling of sensitive information.

-

Can I integrate airSlate SignNow with other software to manage Form 1041 T?

Absolutely! airSlate SignNow offers integrations with various software platforms to enhance your document management with Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. This allows for seamless workflows that can improve efficiency and data accuracy across your business processes.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g, provides numerous benefits such as increased efficiency, reduced processing time, and enhanced security. Our platform ensures that you can handle all your document needs with confidence, knowing they are legally binding and compliant.

-

How does airSlate SignNow ensure the security of my Form 1041 T documents?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures to protect your documents, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. You can rest assured that your sensitive tax information is secure in our platform, with access controls to safeguard your materials.

Get more for Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g

- Change of details for an australian financial services asic form

- Form 19 notice of proposed entry to premises residential tenancy

- Virginia beach police department vbgovcom form

- Trs forms

- 2020 missouri employer reporting of 1099 instructions and specifications handbook form

- Toll free number 1 form

- Notification of demolition and renovation operations form

- A guide for organizing domestic limited liability companies in illinois form

Find out other Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will