Form 4797 2023

What is the Form 4797

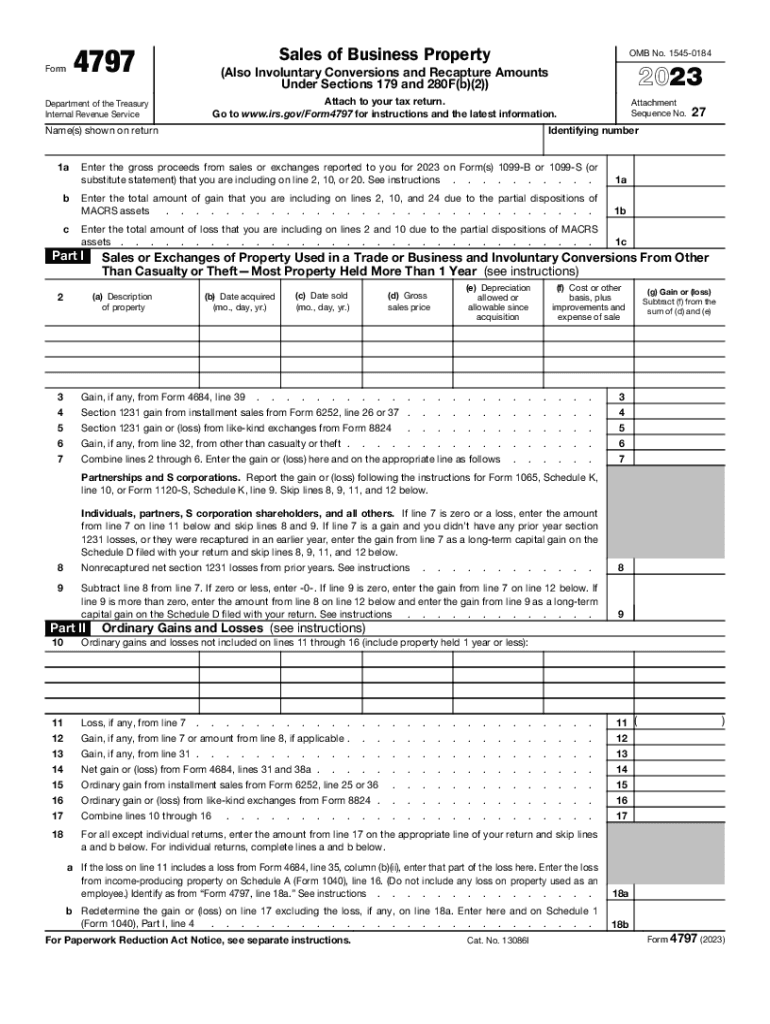

The Form 4797 is a tax form used in the United States to report the sale of business property. This includes property used in a trade or business, as well as certain types of real estate. The form is essential for taxpayers who need to report gains or losses from the sale, exchange, or involuntary conversion of property. It helps determine the appropriate tax treatment of these transactions, including whether the gains are subject to capital gains tax or ordinary income tax.

How to use the Form 4797

To use the Form 4797, taxpayers must gather all relevant information regarding the property sold. This includes the date of acquisition, date of sale, selling price, and any adjustments to the basis of the property. The form is divided into several sections, each designed to capture specific types of transactions. Taxpayers will report the details of the sale and calculate any gain or loss. This information is then transferred to the appropriate lines on their income tax return, typically Form 1040.

Steps to complete the Form 4797

Completing the Form 4797 involves several key steps:

- Gather all necessary documentation related to the property, including purchase and sale records.

- Determine the type of property being sold and the applicable sections of the form.

- Fill out Part I for the sale of assets used in a trade or business, or Part II for the sale of real estate.

- Calculate the gain or loss by subtracting the adjusted basis from the selling price.

- Transfer the calculated amounts to your income tax return.

Legal use of the Form 4797

The Form 4797 must be used in compliance with IRS regulations. It is legally required for reporting sales of business property to ensure accurate tax reporting. Failure to file this form when required can lead to penalties and interest on unpaid taxes. Taxpayers should ensure they understand the legal implications of their transactions and maintain accurate records to support their filings.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 4797. These guidelines include instructions on how to report different types of property sales, including Section 1252, Section 291, and Section 1255 properties. Taxpayers should refer to the IRS instructions for the Form 4797 for detailed information on eligibility, reporting requirements, and any changes from previous years. Staying informed about IRS updates is crucial for accurate tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4797 align with the standard tax return deadlines. Typically, this form must be submitted by April 15 of the tax year following the sale of the property. If additional time is needed, taxpayers may file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties. It is essential to keep track of these dates to ensure timely and accurate submissions.

Quick guide on how to complete form 4797

Complete Form 4797 smoothly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your forms swiftly and without complications. Handle Form 4797 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 4797 effortlessly

- Find Form 4797 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Form 4797 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797

Create this form in 5 minutes!

How to create an eSignature for the form 4797

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 4797 example, and why is it important?

A form 4797 example refers to a template or sample of the IRS form used for reporting the sale of business property. This form is crucial for ensuring accurate tax reporting and compliance, making it essential for businesses that sell assets. Understanding how to fill out this form can minimize errors and promote better financial practices.

-

How does airSlate SignNow support the completion of a form 4797 example?

airSlate SignNow provides an intuitive platform that allows users to upload, edit, and eSign documents, including a form 4797 example. With our easy-to-use features, you can quickly fill out necessary fields and securely send the document for signatures. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow when filling out a form 4797 example?

airSlate SignNow offers various pricing plans tailored to fit different business needs, starting with a free trial. Pricing is designed to be cost-effective, especially for small to medium-sized businesses needing to manage documents like the form 4797 example. You can compare our plans on our website to find the one that suits you best.

-

Can I integrate airSlate SignNow with other software when working on a form 4797 example?

Yes, airSlate SignNow offers seamless integration with various platforms, including CRM systems, cloud storage, and accounting software. This means you can easily import or export your form 4797 example and work efficiently across existing tools. Integrations streamline your workflow, enhancing overall productivity.

-

What features should I look for in an airSlate SignNow solution to manage a form 4797 example?

When managing a form 4797 example with airSlate SignNow, consider features like eSignature capability, templates, and document tracking. These functionalities simplify the process, ensuring that the form can be completed and signed promptly. Additionally, advanced security measures help protect sensitive financial information.

-

Is there a mobile app for airSlate SignNow to manage my form 4797 example?

Yes, airSlate SignNow has a mobile app that allows you to manage your documents, including the form 4797 example, on the go. This flexibility ensures that you can complete and sign documents from anywhere, making it easier to handle urgent requests or client needs. The mobile experience is designed to be user-friendly and efficient.

-

What benefits does airSlate SignNow provide for businesses using a form 4797 example?

Using airSlate SignNow for a form 4797 example provides several benefits, including reducing turnaround times and enhancing accuracy. The platform’s eSigning capabilities ensure that all parties can sign quickly, while document templates minimize errors. This ultimately leads to a more streamlined and effective document management process.

Get more for Form 4797

Find out other Form 4797

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney