About Form 4797, Sales of Business Property IRS Tax Forms 2022

Overview of Form 4797

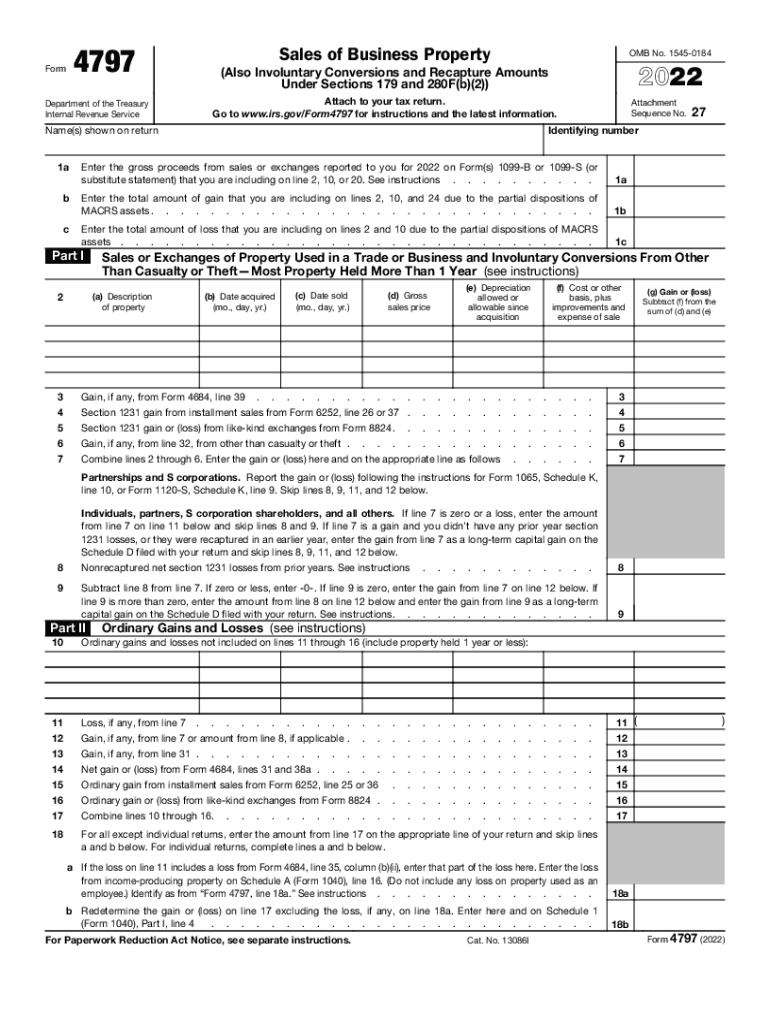

The IRS Form 4797 is used for reporting the sale of business property. This form is essential for taxpayers who have sold or exchanged property used in a trade or business, including real estate and depreciable assets. The form helps determine any gain or loss from the sale, which is crucial for accurate tax reporting. Understanding the specifics of this form can aid in ensuring compliance with IRS regulations and optimizing tax obligations.

Steps to Complete Form 4797

Completing the IRS Form 4797 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the property sold, including acquisition date, sale date, and the adjusted basis of the property. Next, fill out Part I for sales of property held for more than one year, detailing the asset's description, date acquired, and date sold. If applicable, complete Part II for property held for one year or less. Finally, calculate any gains or losses and transfer the results to your income tax return. It is advisable to review the form instructions thoroughly to ensure all sections are correctly filled out.

Legal Use of Form 4797

The legal use of Form 4797 is governed by IRS guidelines, which stipulate that it must be filed by taxpayers who sell or exchange business property. The form serves as a declaration of any gains or losses incurred from such transactions, which must be reported on the taxpayer's annual income tax return. Proper filing of Form 4797 is crucial for compliance with tax laws, as failure to report can lead to penalties and interest on unpaid taxes. Utilizing a reliable eSignature solution can enhance the legal validity of the completed form.

Filing Deadlines for Form 4797

Filing deadlines for Form 4797 align with the general tax return deadlines. Typically, the form must be submitted by April 15 of the year following the tax year in which the sale occurred. If you are unable to meet this deadline, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary fees.

Required Documents for Form 4797

When preparing to file Form 4797, it is important to gather all necessary documents to support your claims. Key documents include the original purchase agreement, any records of improvements made to the property, and previous tax returns that may show depreciation taken on the asset. Additionally, any closing statements from the sale and documentation of expenses related to the sale should be collected. Having these documents on hand will facilitate accurate reporting and help substantiate your entries on the form.

IRS Guidelines for Form 4797

The IRS provides specific guidelines for completing Form 4797, which include instructions on how to report various types of property sales. Taxpayers must distinguish between long-term and short-term transactions, as this affects the calculation of gains and losses. The IRS also outlines the treatment of depreciation recapture, which can impact the overall tax liability. Familiarizing yourself with these guidelines is crucial for ensuring compliance and accurate reporting of business property transactions.

Quick guide on how to complete about form 4797 sales of business property irs tax forms

Effortlessly Prepare About Form 4797, Sales Of Business Property IRS Tax Forms on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and without holdups. Handle About Form 4797, Sales Of Business Property IRS Tax Forms on any device with the airSlate SignNow applications for Android or iOS and streamline any document-centered process today.

The Easiest Way to Alter and Electronically Sign About Form 4797, Sales Of Business Property IRS Tax Forms with Ease

- Obtain About Form 4797, Sales Of Business Property IRS Tax Forms and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign About Form 4797, Sales Of Business Property IRS Tax Forms and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4797 sales of business property irs tax forms

Create this form in 5 minutes!

People also ask

-

What is form 4797, and why is it important?

Form 4797 is used to report the sale of business property, including depreciated assets. It is important for tax purposes, as it helps individuals and businesses accurately report gains or losses from these transactions. Understanding how to correctly fill out form 4797 is crucial to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with completing form 4797?

airSlate SignNow offers an intuitive eSignature solution that simplifies the process of completing form 4797. Users can easily fill out the form electronically, making it more efficient to gather necessary signatures and approvals. Our platform ensures your form 4797 is handled securely and quickly.

-

Is there a cost associated with using airSlate SignNow for form 4797?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to essential features like electronic signatures, document templates, and workflow automation, which can streamline the process of managing form 4797. A free trial is also available for new users to explore the platform.

-

Can I integrate airSlate SignNow with other software for form 4797 management?

Yes, airSlate SignNow seamlessly integrates with various software applications, including CRMs and accounting tools. This allows users to manage their form 4797 within their existing workflows, enhancing productivity and ensuring all documents are coordinated efficiently. Check our integrations page for a complete list of compatible applications.

-

What features does airSlate SignNow offer specifically for form 4797?

airSlate SignNow provides powerful features such as customizable templates, real-time tracking, and legally binding eSignatures for managing form 4797. These tools help streamline the submission process and ensure compliance and accuracy in reporting. The platform also provides audit trails for your records.

-

Is it secure to use airSlate SignNow for sensitive documents like form 4797?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure cloud storage, ensuring that your form 4797 and other sensitive documents are protected. We prioritize data security and compliance with regulations, giving users peace of mind while using our services.

-

Can I access my form 4797 from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly and allows you to access your form 4797 from any device. Whether you're in the office or on the go, you can review, edit, and sign documents seamlessly. This flexibility ensures that you can manage your form 4797 anytime and anywhere.

Get more for About Form 4797, Sales Of Business Property IRS Tax Forms

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage new hampshire

- Legal last will and testament form for married person with adult and minor children new hampshire

- Legal last will and testament form for civil union partner with adult and minor children new hampshire

- Mutual wills package with last wills and testaments for married couple with adult and minor children new hampshire form

- Legal last will and testament form for a widow or widower with adult children new hampshire

- Legal last will and testament form for widow or widower with minor children new hampshire

- Legal last will form for a widow or widower with no children new hampshire

- Legal last will and testament form for a widow or widower with adult and minor children new hampshire

Find out other About Form 4797, Sales Of Business Property IRS Tax Forms

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT