Form 4797 Sales of Business Property Also Involuntary Conversions and Recapture Amounts under Sections 179 and 280Fb2 2020

Understanding Form 4797: Sales of Business Property

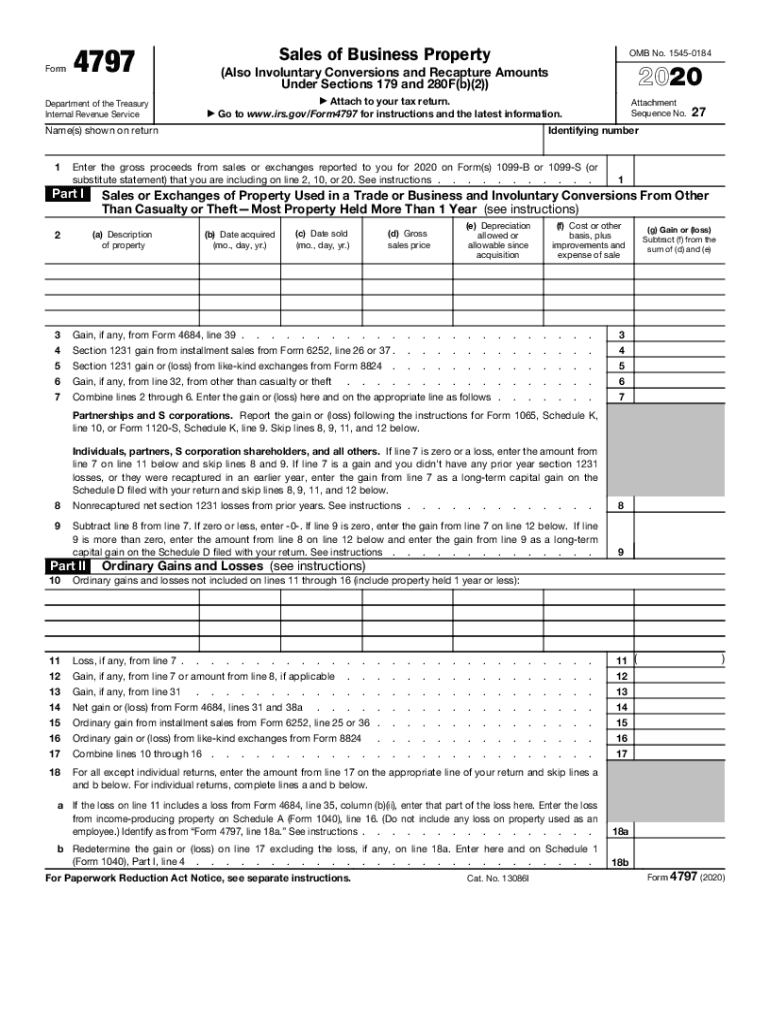

The Form 4797, officially known as the Sales of Business Property, is essential for reporting the sale or exchange of business assets. This form is particularly relevant for taxpayers who have engaged in involuntary conversions, such as property lost due to theft or natural disasters. Additionally, it addresses recapture amounts under Sections 179 and 280F(b)(2), which pertain to depreciation deductions for business property. Completing this form accurately is crucial for compliance with IRS regulations and to ensure proper tax treatment of gains or losses from these transactions.

Steps to Complete Form 4797

Filling out the Form 4797 involves several steps to ensure accuracy and compliance. Begin by gathering all relevant information regarding the business property sold, including purchase price, selling price, and any adjustments. Follow these steps:

- Provide your name, address, and taxpayer identification number at the top of the form.

- Report the details of the property sold, including the type of property and the date of sale.

- Calculate the gain or loss from the sale by subtracting the adjusted basis from the selling price.

- Complete the sections related to involuntary conversions if applicable.

- Review the form for accuracy before submission.

Legal Use of Form 4797

The legal use of Form 4797 is governed by IRS guidelines, ensuring that taxpayers report sales of business property correctly. The form must be filed with your annual tax return, and accurate reporting is essential to avoid penalties. It is important to maintain documentation supporting the figures reported, such as sale contracts and records of depreciation. Non-compliance can lead to audits and potential fines, emphasizing the need for careful completion and submission of this form.

Filing Deadlines for Form 4797

Form 4797 must be filed with your annual tax return, which is typically due on April 15 for most taxpayers. If you require additional time, you can file for an extension, but ensure that Form 4797 is included in your tax return by the extended deadline. Keeping track of these deadlines is crucial to avoid late fees and ensure compliance with tax regulations.

Examples of Using Form 4797

Form 4797 can be utilized in various scenarios involving the sale of business property. For instance, if a business owner sells a commercial building, they would report the sale on this form, detailing the purchase price and any depreciation taken. Another example includes reporting a loss from property damaged in a natural disaster, where the owner may need to report the involuntary conversion. These examples illustrate the form's importance in accurately reflecting the financial outcomes of business transactions.

IRS Guidelines for Form 4797

The IRS provides specific guidelines for completing Form 4797, which include instructions on how to report different types of property sales. It is important to follow these guidelines closely to ensure compliance. The IRS outlines the necessary documentation and calculations needed to support the figures reported on the form. Familiarizing yourself with these guidelines can help in accurately completing the form and understanding the implications of the reported transactions.

Quick guide on how to complete 2020 form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and 280fb2

Effortlessly Prepare Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 with Ease

- Locate Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and 280fb2

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 4797 sales of business property also involuntary conversions and recapture amounts under sections 179 and 280fb2

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is form 4797 and how is it used?

Form 4797 is a crucial document used for reporting the sale of business property, including real estate. By understanding how to fill out form 4797 accurately, businesses can ensure they meet IRS requirements and avoid penalties. airSlate SignNow can simplify the process of signing and sharing this form electronically.

-

How does airSlate SignNow facilitate the completion of form 4797?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign form 4797 seamlessly. With templates and intuitive editing tools, you can easily fill out the necessary information while maintaining compliance with IRS standards. This streamlines the filing process and saves you valuable time.

-

Is there a cost to use airSlate SignNow for form 4797?

Yes, airSlate SignNow offers various pricing plans designed to meet your business needs, making it a cost-effective solution for managing form 4797. You can choose from individual, business, or enterprise plans that provide various features tailored to suit different sizes of organizations. Each plan allows for unlimited document signing, including form 4797.

-

Can I integrate airSlate SignNow with other software for managing form 4797?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, such as Google Drive, Salesforce, and Microsoft Office. This means you can manage your documents, including form 4797, from your preferred productivity tools without hassle. Integration streamlines your workflow and improves efficiency.

-

What security measures does airSlate SignNow provide for form 4797?

AirSlate SignNow prioritizes security, using advanced encryption methods to protect your documents, including form 4797. All data is stored securely, ensuring that your sensitive financial information remains confidential. Additionally, electronic signatures are legally binding and compliant, offering peace of mind in your transactions.

-

Can I track the status of my form 4797 with airSlate SignNow?

Yes, airSlate SignNow features robust tracking capabilities that allow you to monitor the status of your form 4797 in real-time. You’ll receive notifications when the form is viewed, signed, or completed, offering complete visibility into your document management process. This helps ensure timely submissions and enhances accountability.

-

How user-friendly is airSlate SignNow when preparing form 4797?

AirSlate SignNow is designed with user experience in mind, making it straightforward for anyone to prepare form 4797. With drag-and-drop functionality and easy-to-follow prompts, even users with minimal technical skills can complete their documents quickly. Comprehensive support resources are also available to assist you as needed.

Get more for Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2

- Chaabi bank online form

- Genuine intention to study form university of chester

- Park gate pharmacy fill online printable fillable form

- Application council tax reduction form

- Application for school bus service format

- Permitted work form

- Wwwcheckstercomblogreference check via emailreference check via email checkster form

- Conwy council blue badge renewal form

Find out other Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280Fb2

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer