Form 4797 2011

What is the Form 4797

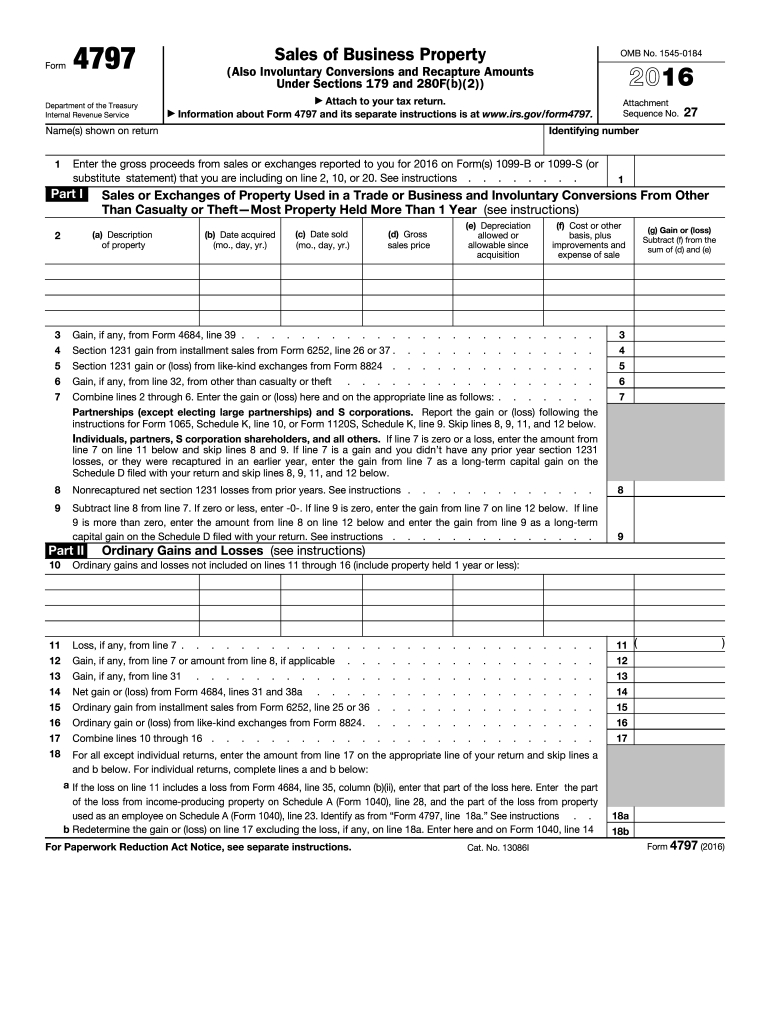

The Form 4797, officially known as the "Sales of Business Property," is a tax form used by businesses and individuals in the United States to report the sale or exchange of business property. This form is particularly important for reporting gains or losses from the sale of assets such as real estate, machinery, and equipment that are used in a trade or business. It helps taxpayers determine their tax obligations related to these transactions, ensuring compliance with IRS regulations.

How to use the Form 4797

Using the Form 4797 involves several steps that require attention to detail. Taxpayers must first gather all relevant information regarding the property sold, including the date of sale, selling price, and the adjusted basis of the property. Once this information is compiled, it is entered into the appropriate sections of the form. The form also requires the taxpayer to categorize the type of property sold and to calculate any gains or losses. Proper completion of this form is crucial for accurate tax reporting.

Steps to complete the Form 4797

Completing the Form 4797 involves a systematic approach:

- Gather necessary documentation, including purchase records and sale agreements.

- Determine the adjusted basis of the property, which includes the original purchase price and any improvements made.

- Identify the selling price and any associated costs of sale.

- Fill out the form by entering the required information in the designated sections, ensuring accuracy in calculations.

- Review the completed form for any errors before submission.

Legal use of the Form 4797

The legal use of the Form 4797 is governed by IRS guidelines, which dictate how and when it should be filed. This form must be submitted along with the taxpayer's annual income tax return. Failure to accurately report sales of business property can lead to penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of using this form is essential for compliance and to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4797 align with the annual tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, which generally allows for an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Examples of using the Form 4797

There are various scenarios in which the Form 4797 is applicable. For instance, if a business sells a piece of equipment for more than its adjusted basis, the gain must be reported on this form. Similarly, if a property is sold at a loss, that loss can also be reported, potentially offsetting other taxable income. Understanding these examples can help taxpayers effectively utilize the form to their advantage in tax planning.

Quick guide on how to complete form 4797 2011 190933

Prepare Form 4797 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can access the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle Form 4797 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form 4797 seamlessly

- Find Form 4797 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4797 and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797 2011 190933

Create this form in 5 minutes!

How to create an eSignature for the form 4797 2011 190933

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 4797 and why is it important?

Form 4797 is used to report the sale of business property and helps taxpayers calculate their gains or losses. Understanding this form is crucial for accurate reporting to the IRS, ensuring compliance and optimizing tax positions.

-

How can airSlate SignNow assist with completing Form 4797?

airSlate SignNow simplifies the process of completing Form 4797 by providing an easy-to-use platform for electronic signatures and document management. This streamlines the workflow, making it quicker to gather necessary signatures and finalize your tax documents.

-

Is airSlate SignNow cost-effective for filing Form 4797?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. This ensures that you can manage Form 4797 filing without overspending, while still maintaining high-quality service.

-

What features does airSlate SignNow offer that help with Form 4797?

airSlate SignNow includes features like customizable templates, secure eSignature capabilities, and document tracking, all of which enhance the experience when working on Form 4797. These features help you ensure accuracy and efficiency in managing your financial documents.

-

Can I integrate airSlate SignNow with other software for Form 4797 management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, allowing for efficient handling of Form 4797. This ensures that all parts of your business remain synchronized and provides a smooth workflow when dealing with tax documents.

-

How secure is my information while using airSlate SignNow for Form 4797?

airSlate SignNow prioritizes user security and employs advanced encryption methods to protect your information while you complete Form 4797. You can trust that your sensitive data is safe, providing peace of mind in your electronic documentation processes.

-

What are the benefits of using airSlate SignNow for my Form 4797?

Using airSlate SignNow for your Form 4797 offers benefits such as increased efficiency, lower costs, and enhanced accuracy. By digitizing your document workflow, you can reduce the time taken to complete tax forms and minimize errors that often lead to filing issues.

Get more for Form 4797

Find out other Form 4797

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter