Form 4797 1996

What is the Form 4797

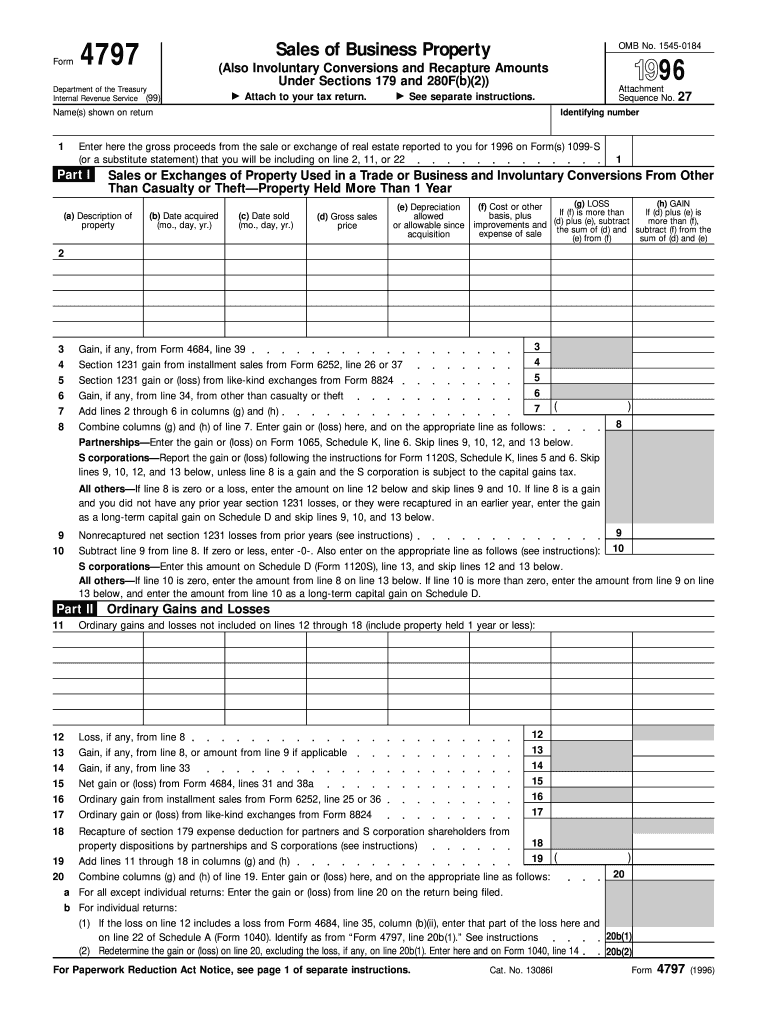

The Form 4797, officially known as the Sales of Business Property, is a tax form used by businesses and individuals to report the sale or exchange of business property. This form is essential for reporting gains or losses from the disposition of assets such as real estate, machinery, and equipment. It is primarily utilized by sole proprietors, partnerships, corporations, and other entities engaged in business activities. Understanding the purpose and requirements of Form 4797 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 4797

Using Form 4797 involves several steps to ensure accurate reporting of business property transactions. First, gather all necessary documentation related to the sale or exchange of the property, including purchase prices, sale prices, and any depreciation taken. Next, complete the form by providing details about the property, including the type of property, the date of acquisition, and the date of sale. Additionally, report any gains or losses from the transaction. Finally, submit the completed form along with your tax return to the IRS. Proper use of Form 4797 helps prevent errors and potential penalties.

Steps to complete the Form 4797

Completing Form 4797 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Identify the type of property being sold or exchanged and provide the acquisition date and sale date.

- Calculate the adjusted basis of the property, which includes the original cost minus any depreciation.

- Report the sales price of the property and calculate the gain or loss by subtracting the adjusted basis from the sales price.

- Complete the relevant sections for any like-kind exchanges or involuntary conversions if applicable.

- Review the form for accuracy and ensure all calculations are correct before submission.

Legal use of the Form 4797

The legal use of Form 4797 is governed by IRS regulations, which stipulate how to report the sale of business property. To ensure compliance, it is important to accurately report all transactions and maintain proper records. The form must be filed in conjunction with your annual tax return, and any discrepancies can lead to audits or penalties. Additionally, electronic signatures are accepted for e-filing, provided they meet the legal requirements established by the IRS. Using a reliable e-signature tool can enhance the security and validity of your submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 4797. These guidelines include instructions on determining the adjusted basis, reporting gains and losses, and understanding the implications of like-kind exchanges. Taxpayers should refer to the IRS instructions for Form 4797 for detailed information on eligibility, filing requirements, and deadlines. Staying informed about IRS guidelines is essential for ensuring accurate reporting and avoiding potential issues with tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 4797 align with the overall tax return deadlines. Generally, the form must be submitted by April 15 of the year following the tax year in which the sale or exchange occurred. If you require additional time, you may file for an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties. Keeping track of these important dates helps ensure timely compliance with IRS requirements.

Quick guide on how to complete form 4797 1996

Complete Form 4797 easily on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly, without any delays. Handle Form 4797 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and electronically sign Form 4797 effortlessly

- Locate Form 4797 and then click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you would like to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 4797 and ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797 1996

Create this form in 5 minutes!

How to create an eSignature for the form 4797 1996

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 4797 and why is it important?

Form 4797 is used for reporting the sale of business property, including depreciation recapture. This form is essential for businesses that need to report gains and losses from the sale of assets. Accurate filing of Form 4797 can help ensure compliance with tax regulations and optimize potential tax liabilities.

-

How does airSlate SignNow simplify the submission of Form 4797?

airSlate SignNow streamlines the submission of Form 4797 by allowing users to fill out, sign, and send the form electronically. With its intuitive interface, you can easily manage the documentation process, ensuring that all forms are completed accurately and submitted on time. This feature reduces the chances of errors and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for Form 4797?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs and budgets. These plans provide access to essential tools for managing Form 4797, including advanced features such as integrations and analytics. You can choose the plan that fits your business requirements and scale as needed.

-

Can I integrate Form 4797 processing with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with numerous popular business applications, allowing seamless processing of Form 4797 alongside your existing workflow systems. These integrations enhance productivity by enabling automatic updates and data sharing between platforms, saving you time and reducing manual input.

-

What features does airSlate SignNow offer specifically for Form 4797?

airSlate SignNow offers a range of features for efficiently managing Form 4797, including template creation, digital signatures, and automated reminders. Users can customize their forms and setup workflows to expedite the signing process. Additionally, the platform ensures security and compliance when handling sensitive tax documents.

-

How can using airSlate SignNow benefit my business when filing Form 4797?

Using airSlate SignNow to file Form 4797 can signNowly enhance your business efficiency by automating document workflows and reducing administrative burdens. This cost-effective solution allows for better time management, allowing you to focus on other critical tasks. Compliance and accuracy are also improved, minimizing the risk of costly tax errors.

-

Is customer support available for issues related to Form 4797 on airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to Form 4797. Whether you need help with navigating the platform or specific inquiries about the form itself, the support team is available through various channels to ensure you're covered. Fast and efficient assistance is a key part of their service.

Get more for Form 4797

- Tax free exchange package idaho form

- Landlord tenant sublease package idaho form

- Buy sell agreement package idaho form

- Option to purchase package idaho form

- Amendment of lease package idaho form

- Annual financial checkup package idaho form

- Bill of sale package idaho form

- Living wills and health care package idaho form

Find out other Form 4797

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free