4797 Form 2012

What is the 4797 Form

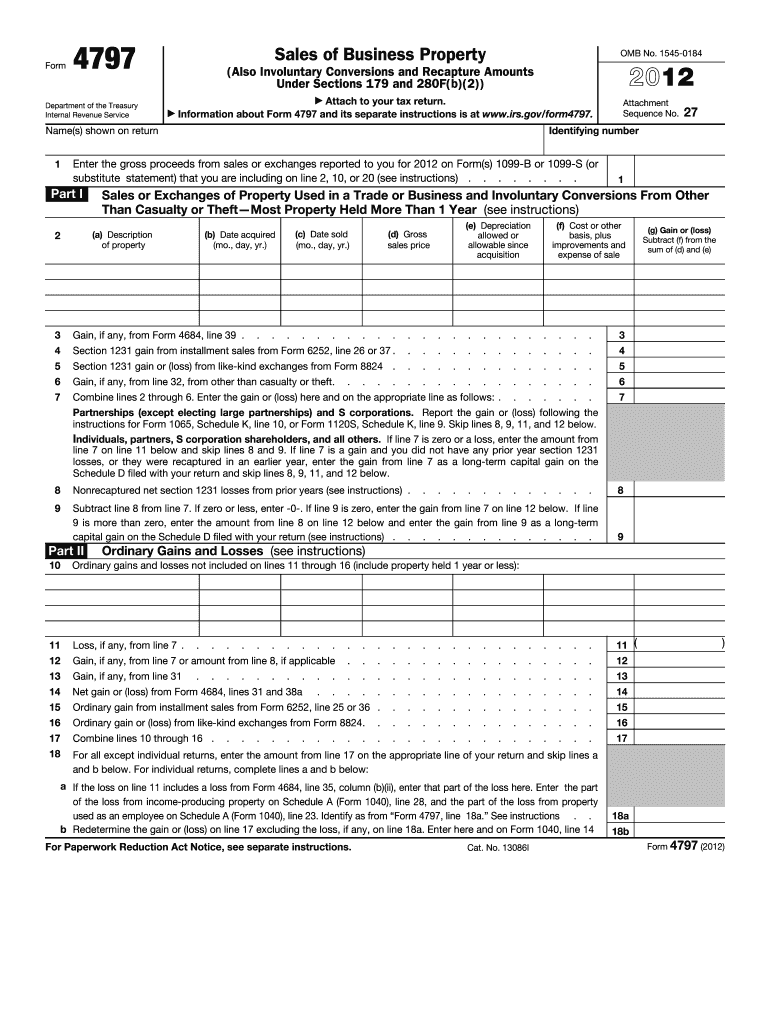

The 4797 Form, officially known as the "Sales of Business Property," is a tax form used by businesses and individuals to report the sale or exchange of property used in a trade or business. This form is essential for reporting gains or losses from the sale of assets such as real estate, machinery, or equipment. It helps taxpayers calculate the taxable income from these transactions and is typically filed with the Internal Revenue Service (IRS) as part of the annual tax return.

How to use the 4797 Form

Using the 4797 Form involves several steps. First, gather all necessary information regarding the property sold, including purchase price, selling price, and any adjustments made to the property. Next, complete the relevant sections of the form, detailing the type of property and the nature of the transaction. It is crucial to accurately report any gains or losses, as this will affect your overall tax liability. Finally, submit the completed form along with your tax return by the designated deadline.

Steps to complete the 4797 Form

Completing the 4797 Form requires careful attention to detail. Here are the steps to follow:

- Start by entering your name and taxpayer identification number at the top of the form.

- List each property sold in Part I or Part II, depending on whether it is a business property or a capital asset.

- Provide the date of acquisition and sale for each property.

- Calculate the adjusted basis of each property, which includes the original purchase price plus any improvements made.

- Determine the amount realized from the sale, which is the selling price minus selling expenses.

- Calculate any gain or loss for each transaction and summarize the totals at the end of the form.

Legal use of the 4797 Form

The 4797 Form is legally binding when filled out correctly and submitted to the IRS. To ensure compliance, it is essential to follow IRS guidelines and maintain accurate records of all transactions reported on the form. Additionally, e-signatures can be used for electronic submissions, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Filing the 4797 Form must align with the annual tax return deadlines. Typically, individual taxpayers must submit their tax returns by April 15. However, if you are unable to meet this deadline, you can file for an extension, which generally provides an additional six months. It is important to keep track of any changes in deadlines, especially if they are affected by federal holidays or other events.

Examples of using the 4797 Form

Common scenarios for using the 4797 Form include:

- Reporting the sale of a commercial building used for business operations.

- Documenting the sale of machinery or equipment that is no longer needed.

- Reporting gains or losses from the exchange of property as part of a business restructuring.

Each of these examples requires careful documentation and accurate reporting to ensure compliance with IRS regulations.

Quick guide on how to complete 2012 4797 form

Complete 4797 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without issues. Handle 4797 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign 4797 Form with ease

- Locate 4797 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign 4797 Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 4797 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 4797 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is a 4797 Form, and why do I need it?

The 4797 Form is used for reporting the sale of business property, including real estate and machinery. If you're selling assets, you need to file this form to ensure compliance with IRS regulations. airSlate SignNow simplifies the process of completing and eSigning your 4797 Form, making tax season less stressful.

-

How can airSlate SignNow assist me with the 4797 Form?

airSlate SignNow offers a user-friendly platform for electronically signing and managing your 4797 Form. You can easily fill out the form, invite others to sign, and store your documents securely in one place. Streamlining your paperwork not only saves time but also minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 4797 Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to features designed to facilitate the completion of forms like the 4797 Form, ensuring businesses can operate efficiently at a cost-effective rate. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for processing the 4797 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services. This capability ensures that you can manage your documents, including the 4797 Form, alongside other essential business tools, increasing overall efficiency.

-

What are the benefits of using airSlate SignNow for the 4797 Form?

Using airSlate SignNow for your 4797 Form simplifies the eSigning process, enhances document security, and improves workflow efficiency. You can track your document's status in real-time, ensuring that all necessary signatures are obtained promptly. This results in faster processing and helps you stay compliant with tax regulations.

-

Is it safe to store my 4797 Form documents on airSlate SignNow?

Yes, airSlate SignNow prioritizes data security, implementing encryption and secure data storage protocols to protect your 4797 Form and other documents. With robust privacy measures in place, you can rest assured that your sensitive information is safe from unauthorized access.

-

How do I get started with airSlate SignNow for my 4797 Form?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating and managing your 4797 Form right away. Our intuitive interface guides you through the necessary steps, making it accessible for users of all experience levels.

Get more for 4797 Form

- Tip 12b05 04 revenue law library florida department of form

- Form st 10010 i320quarterly schedule fr instructions sales

- Real property income amp expense rpie nycgov form

- Certificate of estate tax payment and real property form

- Form rp 467919application for partial tax exemption for

- Tda withdraw al application nyc board of education form

- Instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1

- Applicable for the tax period june 1 2020 to august 31 2020 only form

Find out other 4797 Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document