Form 4797 2013

What is the Form 4797

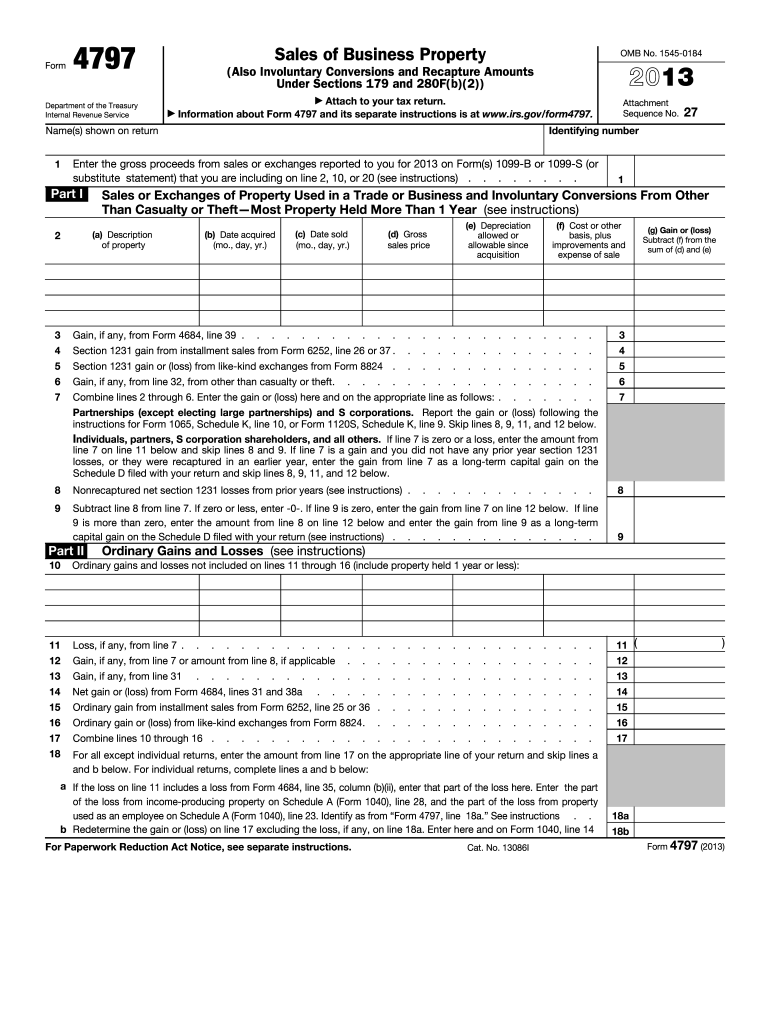

The Form 4797 is a tax form used by businesses and individuals in the United States to report the sale of business property. This includes assets such as real estate, equipment, and other tangible property used in a trade or business. The form is essential for calculating gains or losses from these sales, which can affect the taxpayer's overall tax liability. Understanding the purpose and requirements of Form 4797 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 4797

To effectively use Form 4797, taxpayers must first gather relevant documentation regarding the sale of business property. This includes details about the asset sold, the sale price, and any associated costs. Once the necessary information is collected, the taxpayer can fill out the form, indicating the type of property sold and calculating any gains or losses. The completed form should then be submitted with the taxpayer's annual income tax return. Proper use of Form 4797 ensures that taxpayers accurately report their transactions and comply with IRS guidelines.

Steps to complete the Form 4797

Completing Form 4797 involves several key steps:

- Gather all necessary information about the business property sold, including purchase price, sale price, and any improvements made.

- Determine the type of property being reported, as this affects how the gains or losses are calculated.

- Fill out the form by entering the required information in the appropriate sections, ensuring accuracy in calculations.

- Review the completed form for any errors or omissions before submission.

- Submit Form 4797 along with your annual tax return by the specified deadline.

Legal use of the Form 4797

Form 4797 must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all transactions related to the sale of business property and adhering to guidelines for calculating gains and losses. Failure to comply with these regulations can lead to penalties, audits, or other legal consequences. It is important for taxpayers to understand their obligations when using Form 4797 to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing Form 4797. Typically, the form is due on the same date as the individual's income tax return, which is usually April 15 for most taxpayers. However, if the taxpayer requires an extension, they may file for an extension to submit their return, including Form 4797. It is crucial to be aware of these deadlines to avoid late filing penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Form 4797 can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission through tax preparation software that supports e-filing.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may be limited.

Choosing the right submission method can streamline the filing process and ensure timely delivery to the IRS.

Quick guide on how to complete 2013 form 4797

Complete Form 4797 seamlessly on any device

Digital document management has increasingly gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Form 4797 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Form 4797 effortlessly

- Obtain Form 4797 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important portions of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form 4797 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 4797

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 4797

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is Form 4797 and how can airSlate SignNow help with it?

Form 4797 is used to report the sale of business property. With airSlate SignNow, you can easily eSign and send your Form 4797 securely, ensuring that your documents are processed efficiently and accurately. Our platform streamlines the signing process, saving you time and reducing paperwork.

-

How much does it cost to use airSlate SignNow for completing Form 4797?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it affordable for everyone looking to complete Form 4797. Our plans start at a competitive rate, allowing users to eSign and manage documents without breaking the bank. You can choose the plan that best fits your requirements and budget.

-

Can I integrate airSlate SignNow with other software for managing Form 4797?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage your Form 4797 alongside other business tools. This integration helps enhance productivity by streamlining your workflow, and you can connect with platforms like Google Drive, Salesforce, and more for a comprehensive document management solution.

-

What are the benefits of using airSlate SignNow for Form 4797?

Using airSlate SignNow for Form 4797 provides several benefits, including enhanced security for your documents, ease of use, and quick turnaround times. Our platform ensures that your Form 4797 is eSigned and sent in a secure environment, minimizing the risk of errors and delays.

-

Is airSlate SignNow compliant with legal standards for signing Form 4797?

Absolutely! airSlate SignNow complies with all legal requirements for electronic signatures, making it a reliable choice for signing Form 4797. Our platform adheres to the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding and recognized by authorities.

-

How can I track the status of my Form 4797 sent through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form 4797 at any time. Our platform provides real-time notifications and updates, allowing you to see when your document has been viewed, signed, or completed. This transparency helps you stay informed throughout the signing process.

-

What features does airSlate SignNow offer for managing Form 4797?

airSlate SignNow offers a variety of features for managing Form 4797, including customizable templates, bulk sending, and mobile access. These features make it simple to create, send, and eSign your Form 4797, ensuring that you have a smooth experience from start to finish.

Get more for Form 4797

- Initial next to each to acknowledge safety precautions form

- Florida medical clinic hiring patient care coordinator form

- Revenue from gift cards redeemable for both goods and form

- Please fill out both sides of this form and bring it with you

- Leader in me parent application letter form

- Generic pediatric new pt pakcet form

- Children s physician group printable referral form choa

- Fill in forms automatically computer google chrome help

Find out other Form 4797

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast