Form 4797 2015

What is the Form 4797

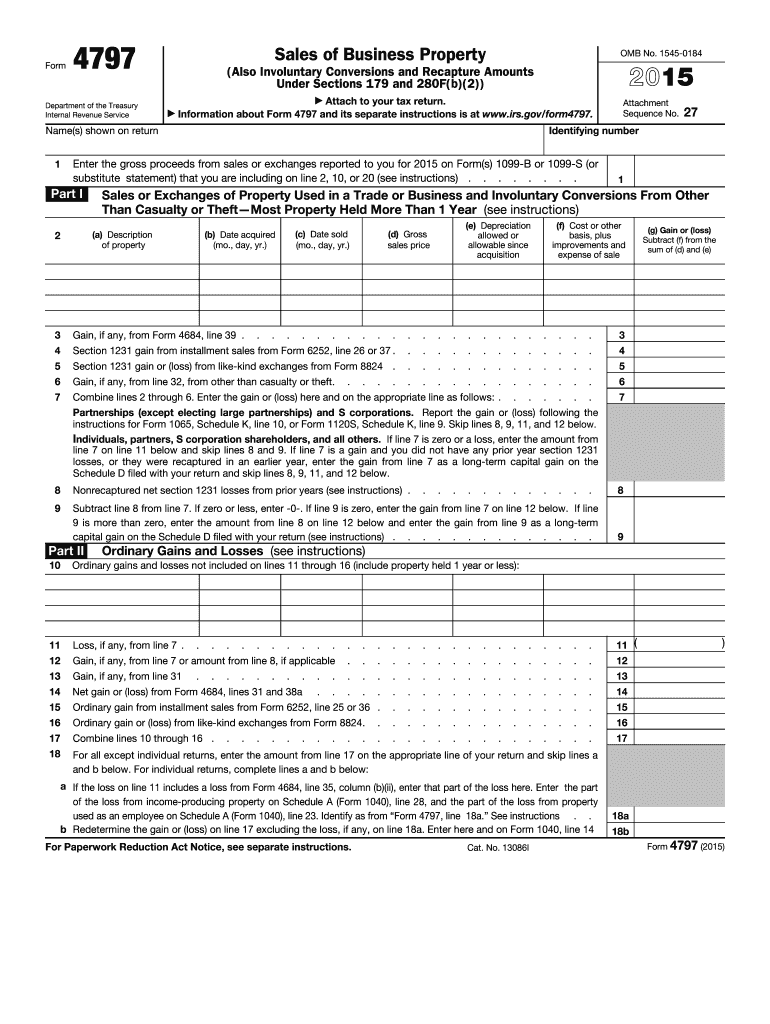

The Form 4797, officially titled "Sales of Business Property," is a tax form used by businesses and individuals in the United States to report the sale, exchange, or involuntary conversion of business property. This form is essential for reporting gains and losses from these transactions, which can affect the taxpayer's overall tax liability. It is particularly relevant for those who have sold real estate, equipment, or other business assets. Understanding the details and requirements of Form 4797 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 4797

Using Form 4797 involves several steps to ensure accurate reporting of business property transactions. Taxpayers must first determine if the asset sold qualifies for reporting on this form. Once confirmed, the taxpayer fills out the necessary sections, including details about the property, the date of sale, and the amount realized from the sale. It is important to categorize the transaction correctly, as different types of property may have specific tax implications. After completing the form, it should be submitted along with the taxpayer's annual income tax return.

Steps to complete the Form 4797

Completing Form 4797 requires careful attention to detail. Here are the key steps:

- Gather necessary information about the property sold, including acquisition date, sale date, and sale price.

- Determine the type of property and the nature of the transaction (e.g., sale, exchange).

- Fill out the form, ensuring to report any gains or losses accurately.

- Include any applicable depreciation recapture, if the property was depreciated.

- Review the completed form for accuracy before submission.

Legal use of the Form 4797

The legal use of Form 4797 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Taxpayers must ensure that all information is truthful and that they have supporting documentation for any claims made on the form. Failure to comply with IRS guidelines can lead to penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the form's requirements or its implications on tax liability.

Filing Deadlines / Important Dates

The filing deadlines for Form 4797 align with the general tax return deadlines. Typically, taxpayers must submit their completed forms by April fifteenth of the year following the tax year in which the transaction occurred. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns, including Form 4797.

Examples of using the Form 4797

Form 4797 is used in various scenarios involving business property transactions. For instance, if a business sells a piece of equipment that has been used for several years, the owner must report the sale on this form. Another example is when a commercial property is sold, and the owner needs to report any gains or losses from the transaction. Each scenario may involve different calculations, such as depreciation recapture, which must be accurately reported to reflect the correct tax liability.

Quick guide on how to complete 2015 form 4797

Effortlessly Prepare Form 4797 on Any Device

Digital document management has gained popularity among organizations and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Form 4797 on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form 4797 with Ease

- Locate Form 4797 and select Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 4797 and ensure exceptional communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 4797

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 4797

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 4797 and why is it important?

Form 4797 is used to report the sale of business property, including real estate and depreciated assets. Understanding how to complete Form 4797 accurately is crucial for tax compliance and can impact your overall tax liability. Using airSlate SignNow simplifies the eSigning process for Form 4797, ensuring that your documents are completed and submitted efficiently.

-

How can airSlate SignNow help with filling out Form 4797?

airSlate SignNow provides an intuitive platform that allows users to easily fill out Form 4797 online. With our document templates and eSignature capabilities, you can complete and send Form 4797 quickly, ensuring you meet your filing deadlines without hassle. Plus, our features enhance collaboration, allowing multiple users to review and sign the form seamlessly.

-

Is there a cost associated with using airSlate SignNow for Form 4797?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, starting with a free trial. By investing in airSlate SignNow, you gain access to features that streamline the completion and eSigning of Form 4797, which can save time and reduce administrative burdens. For detailed pricing, please visit our website.

-

What features does airSlate SignNow offer for managing Form 4797?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage, all of which are beneficial for managing Form 4797. You can also track the status of your document in real-time, ensuring you know when Form 4797 has been signed and submitted. This enhances your workflow and keeps your documents organized.

-

Can I integrate airSlate SignNow with other software for Form 4797 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems, accounting software, and cloud storage services. This allows you to streamline your workflow when preparing and filing Form 4797, ensuring all related documents are easily accessible and connected. Check our integration page for a full list of compatible applications.

-

How secure is airSlate SignNow when handling Form 4797?

Security is a top priority at airSlate SignNow. We use industry-standard encryption and comply with regulations to protect your sensitive information while handling documents like Form 4797. Our platform ensures that your data is safe during the eSigning process and that only authorized users can access your documents.

-

What are the benefits of using airSlate SignNow for Form 4797?

Using airSlate SignNow for Form 4797 streamlines the eSigning and document management process, saving you time and reducing errors. Its user-friendly interface makes it easy to complete and send forms, while the ability to track document statuses ensures you never miss a deadline. Additionally, it enhances collaboration among team members when preparing tax-related documents.

Get more for Form 4797

- Case ih combine inspection form

- Guidance on the use of concentration ranges pursuant to the form

- 2019 summer camp volunteer application form

- Horse rental riding and boarding agreement waiver of liability and assumption of risk form

- 2016 fll hit a thon pledge form

- Scholarship application form gisma business school

- Borang 9 ssm form

- Color correction client consent form

Find out other Form 4797

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors