Form 4797 2016

What is the Form 4797

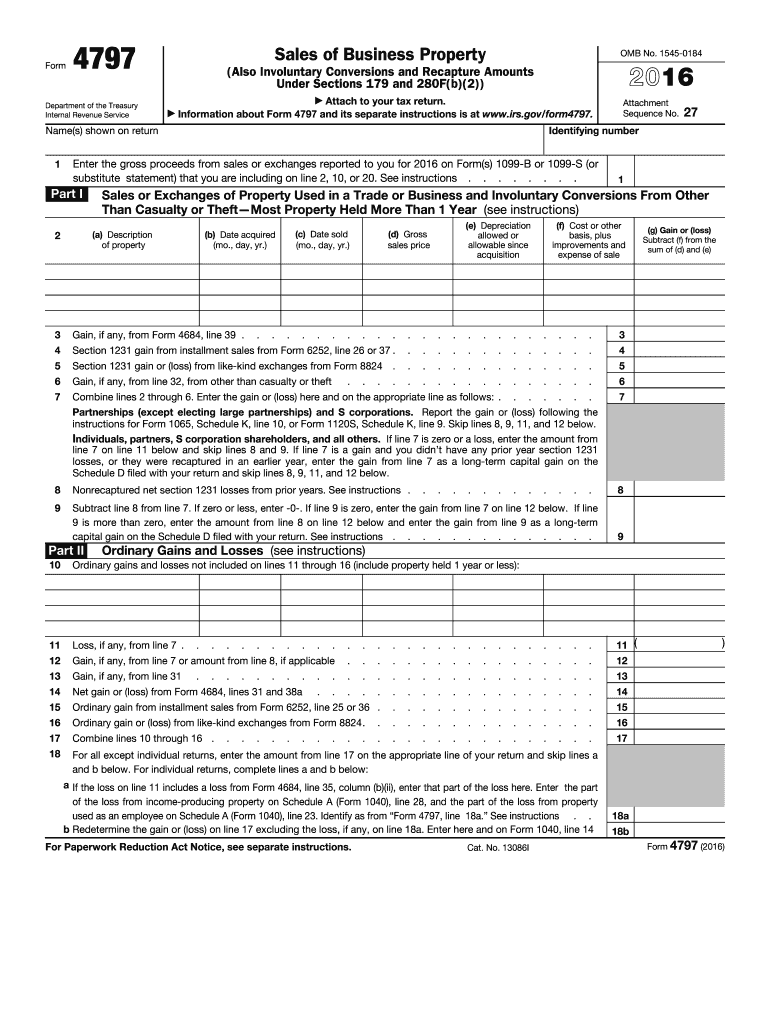

The Form 4797, officially known as the "Sales of Business Property," is a tax form used by businesses and individuals in the United States to report the sale or exchange of property used in a trade or business. This includes real estate, equipment, and other assets that have been held for more than one year. The form helps taxpayers calculate gains or losses from these transactions, which are then reported on their income tax returns. Understanding how to properly complete this form is essential for accurate tax reporting and compliance with IRS regulations.

How to use the Form 4797

Using the Form 4797 involves several steps that ensure accurate reporting of property sales. Taxpayers must first gather all relevant information about the property, including its purchase price, sale price, and any depreciation taken. The form is divided into sections that guide users through reporting different types of sales, such as outright sales, exchanges, and involuntary conversions. Each section requires specific details, including the date of acquisition, date of sale, and the adjusted basis of the property. It is crucial to follow the instructions carefully to ensure compliance and avoid errors.

Steps to complete the Form 4797

Completing the Form 4797 requires careful attention to detail. Here are the essential steps:

- Gather all necessary documents related to the property, including purchase and sale records.

- Determine the type of transaction: outright sale, exchange, or involuntary conversion.

- Calculate the adjusted basis of the property, which includes the original purchase price, plus improvements, minus any depreciation.

- Fill out the appropriate sections of the form, providing details about the sale price, date of sale, and other required information.

- Review the completed form for accuracy before submission.

Legal use of the Form 4797

The legal use of the Form 4797 is governed by IRS guidelines, which stipulate that it must be accurately completed and filed to report the sale of business property. Failure to comply with these requirements can result in penalties or audits. The form must be submitted along with the taxpayer’s annual income tax return, and it is important to retain copies of all supporting documentation for at least three years in case of an IRS inquiry. Understanding the legal implications of the form ensures that taxpayers remain compliant with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4797 align with the annual tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, a taxpayer can file for an extension, which generally allows an extra six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to keep track of these dates to ensure timely submission and compliance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 4797. These guidelines include instructions on what types of property transactions must be reported, how to calculate gains and losses, and the importance of accurate record-keeping. Taxpayers should refer to the IRS instructions for Form 4797, which detail the requirements for each section of the form and provide examples to clarify complex situations. Adhering to these guidelines is crucial for successful tax reporting.

Quick guide on how to complete 2016 form 4797

Manage Form 4797 effortlessly on any device

Web-based document management has become increasingly favored by enterprises and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Form 4797 on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Form 4797 without stress

- Locate Form 4797 and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 4797 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 4797

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 4797

How to make an electronic signature for the 2016 Form 4797 in the online mode

How to generate an eSignature for the 2016 Form 4797 in Chrome

How to make an electronic signature for putting it on the 2016 Form 4797 in Gmail

How to make an electronic signature for the 2016 Form 4797 straight from your smart phone

How to make an electronic signature for the 2016 Form 4797 on iOS devices

How to make an eSignature for the 2016 Form 4797 on Android OS

People also ask

-

What is Form 4797 and why is it important?

Form 4797 is a tax form used to report the sale of business property, including assets like real estate and depreciable property. It's important for business owners to accurately complete Form 4797 to ensure compliance with IRS regulations and to calculate any gains or losses from asset transactions.

-

How can airSlate SignNow assist with completing Form 4797?

airSlate SignNow offers an easy-to-use platform for filling out and eSigning documents, including Form 4797. With customizable templates and the ability to securely share documents, businesses can streamline their reporting process and ensure that their Form 4797 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 4797?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, which include features for eSigning and document management. By investing in airSlate SignNow, you gain access to tools that simplify the preparation and submission of important forms like Form 4797.

-

What features does airSlate SignNow provide for managing Form 4797?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure storage, making it easy to prepare Form 4797. Additionally, the platform ensures that all signatures are legally binding, enhancing the integrity of your submitted documents.

-

Can I integrate airSlate SignNow with other software for Form 4797 processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, allowing users to pull data directly for Form 4797. This integration streamlines the process and reduces the likelihood of errors in your tax filings.

-

How secure is airSlate SignNow when handling Form 4797?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and follows industry standards to protect sensitive information, ensuring that your Form 4797 and all related documents are secure from unauthorized access.

-

What are the benefits of using airSlate SignNow for Form 4797 submissions?

Using airSlate SignNow for Form 4797 submissions simplifies the eSigning process and minimizes paperwork. This efficiency can save time and reduce stress during tax season, allowing businesses to focus on growth rather than administrative tasks.

Get more for Form 4797

- Contract to employ law firm hourly fee with retainer form

- Hawaii commercial building or space lease form

- Ohio affidavit descent form

- Al lease agreement form

- Real estate purchase agreement indiana form

- Iowa articles of incorporation for domestic nonprofit corporation form

- Idaho limited liability company llc operating agreement form

- Az revocation form

Find out other Form 4797

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter