Form 8863 Education Credits American Opportunity and Lifetime Learning Credits 2024

What is the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

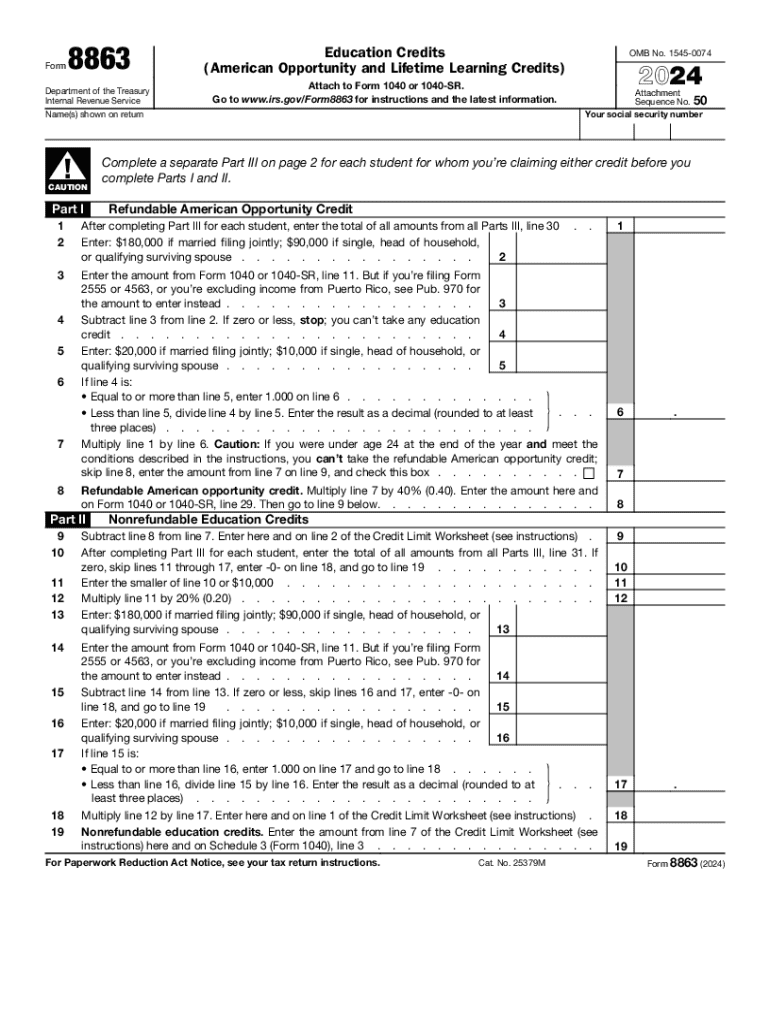

The Form 8863 is used by taxpayers to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making higher education more accessible. The American Opportunity Credit is available for eligible students for the first four years of higher education, while the Lifetime Learning Credit applies to students enrolled in eligible educational institutions, regardless of the number of years they have been in school.

How to use the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

To utilize Form 8863 effectively, taxpayers must first determine their eligibility for the American Opportunity Credit or the Lifetime Learning Credit. This involves gathering necessary information such as tuition costs, enrollment status, and personal tax details. Once eligibility is confirmed, the form should be filled out accurately, detailing the educational expenses incurred. After completing the form, it can be submitted with the federal tax return to claim the credits.

Steps to complete the Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

Completing Form 8863 involves several key steps:

- Gather all relevant documents, including Form 1098-T, which reports tuition payments.

- Determine the amount of qualified education expenses incurred during the tax year.

- Fill out Part I for the American Opportunity Credit or Part II for the Lifetime Learning Credit, providing details on eligible students and expenses.

- Calculate the credit amount using the provided worksheets within the form.

- Transfer the calculated credit to the appropriate line on the federal tax return.

Eligibility Criteria

Eligibility for the education credits claimed on Form 8863 is based on several factors. For the American Opportunity Credit, students must be enrolled at least half-time in a degree or certificate program and must not have completed four years of higher education before the tax year. The Lifetime Learning Credit is available for any post-secondary education and does not have a limit on the number of years it can be claimed. Additionally, income thresholds apply, which may reduce or eliminate the credits based on modified adjusted gross income.

Required Documents

When filing Form 8863, certain documents are essential to support the claim for education credits. These include:

- Form 1098-T from the educational institution, detailing tuition payments.

- Receipts or statements for any additional qualified expenses, such as books and supplies.

- Taxpayer identification information, including Social Security numbers for all students claimed.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines when submitting Form 8863. Generally, the deadline for filing federal tax returns is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that Form 8863 is submitted by this date to avoid penalties and to receive any potential refunds promptly.

Handy tips for filling out Form 8863 Education Credits American Opportunity And Lifetime Learning Credits online

Quick steps to complete and e-sign Form 8863 Education Credits American Opportunity And Lifetime Learning Credits online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for maximum straightforwardness. Use signNow to electronically sign and share Form 8863 Education Credits American Opportunity And Lifetime Learning Credits for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 education credits american opportunity and lifetime learning credits 765770254

Create this form in 5 minutes!

How to create an eSignature for the form 8863 education credits american opportunity and lifetime learning credits 765770254

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help me understand how to IRS?

airSlate SignNow simplifies the process of managing IRS documents by providing an intuitive platform for eSigning and sending important forms. With our solution, you can easily prepare and send documents that comply with IRS requirements, ensuring you understand how to IRS effectively.

-

What features does airSlate SignNow offer for IRS-related documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to assist you in handling IRS documents. These features help you streamline your workflow and ensure that you know how to IRS without any hassle.

-

Is airSlate SignNow cost-effective for managing IRS forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using our service, you can save time and resources while learning how to IRS efficiently, making it a cost-effective solution for your document management needs.

-

Can I integrate airSlate SignNow with other tools to manage IRS documents?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software, to help you manage IRS documents more effectively. This integration allows you to streamline your processes and understand how to IRS within your existing workflows.

-

What are the benefits of using airSlate SignNow for IRS submissions?

Using airSlate SignNow for IRS submissions offers numerous benefits, including enhanced security, faster processing times, and improved accuracy. Our platform ensures that you can confidently navigate how to IRS while minimizing the risk of errors in your submissions.

-

How does airSlate SignNow ensure the security of my IRS documents?

airSlate SignNow employs advanced encryption and security protocols to protect your IRS documents. By using our platform, you can rest assured that your sensitive information is safe while you learn how to IRS and manage your documents securely.

-

What support does airSlate SignNow provide for IRS-related inquiries?

We offer comprehensive customer support to assist you with any IRS-related inquiries. Our team is knowledgeable about how to IRS and can guide you through the process, ensuring you have the resources you need to succeed.

Get more for Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

Find out other Form 8863 Education Credits American Opportunity And Lifetime Learning Credits

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word