BA 101 North Carolina Department of Revenue 2015

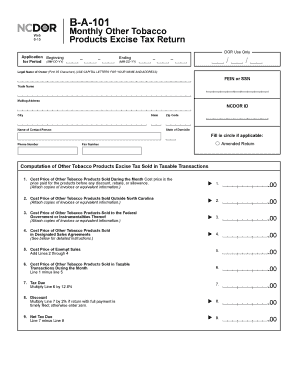

What is the BA 101 North Carolina Department Of Revenue

The BA 101 North Carolina Department of Revenue form is a tax-related document designed for businesses operating within the state. This form is essential for reporting various business activities and ensuring compliance with state tax regulations. It serves as a formal declaration of a business's income, expenses, and other financial details that the state requires for tax assessment purposes. Understanding this form is vital for any business entity to maintain compliance and avoid potential penalties.

How to use the BA 101 North Carolina Department Of Revenue

Using the BA 101 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements, expense reports, and any relevant tax documents. Next, fill out the form with accurate information, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form electronically through the North Carolina Department of Revenue's online portal or via traditional mail, depending on your preference and the submission guidelines.

Steps to complete the BA 101 North Carolina Department Of Revenue

Completing the BA 101 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as income statements and expense records.

- Access the BA 101 form through the North Carolina Department of Revenue website.

- Fill in the required fields accurately, including business name, address, and financial details.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing, following the specified submission guidelines.

Legal use of the BA 101 North Carolina Department Of Revenue

The BA 101 form must be used in accordance with North Carolina tax laws. It is legally binding, and any inaccuracies or omissions can lead to penalties. Businesses are required to file this form annually, and it is crucial to ensure that all information is truthful and complete. Compliance with the form's requirements helps maintain good standing with the state and avoids potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the BA 101 form are critical for compliance. Typically, businesses must submit this form by a specific date, often aligned with the end of the fiscal year. It is essential to check the North Carolina Department of Revenue's official calendar for the exact deadlines each year, as they may vary. Late submissions can result in penalties, so timely filing is crucial.

Required Documents

To complete the BA 101 form, several documents are necessary. These may include:

- Income statements detailing revenue generated.

- Expense reports that outline business costs.

- Previous tax returns for reference.

- Any other financial documentation relevant to the reporting period.

Having these documents ready will streamline the completion process and ensure accuracy in reporting.

Quick guide on how to complete ba 101 north carolina department of revenue

Your assistance manual on how to prepare your BA 101 North Carolina Department Of Revenue

If you’re wondering how to complete and submit your BA 101 North Carolina Department Of Revenue, here are some straightforward instructions on how to make tax submission less challenging.

To start, you only need to sign up for your airSlate SignNow account to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to amend answers when necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your BA 101 North Carolina Department Of Revenue in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your BA 101 North Carolina Department Of Revenue in our editor.

- Fill in the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and fix any mistakes.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please note that filing on paper can lead to return errors and postpone refunds. Naturally, before e-filing your taxes, check the IRS website for the declaration rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct ba 101 north carolina department of revenue

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How Strong is University of North Carolina at Chapel Hill's computer science department when compared to Stanford MIT, UT Austin, UMich?

I don't go to UNC but I've interacted with faculty there and have several friends who have taken CS courses at UNC. My impression is that you will get a solid (undergrad) CS education at UNC and going there won't close any doors, but if you're a superstar the department won't be able to challenge and nurture you to the extent that the other schools on your list will be able to.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I fill out the form for admission to a BA (Honours) in English at Allahabad University?

English is an arts subject,Shruty.As you're applying for Bachelor of Arts programme, it will definitely come under arts. In a central university, every subject is having a separate department and that doesn't mean it will change the subject's credibility.

Create this form in 5 minutes!

How to create an eSignature for the ba 101 north carolina department of revenue

How to generate an electronic signature for your Ba 101 North Carolina Department Of Revenue in the online mode

How to make an eSignature for the Ba 101 North Carolina Department Of Revenue in Google Chrome

How to create an eSignature for signing the Ba 101 North Carolina Department Of Revenue in Gmail

How to make an eSignature for the Ba 101 North Carolina Department Of Revenue straight from your smartphone

How to generate an electronic signature for the Ba 101 North Carolina Department Of Revenue on iOS

How to generate an eSignature for the Ba 101 North Carolina Department Of Revenue on Android

People also ask

-

What is BA 101 North Carolina Department Of Revenue?

BA 101 North Carolina Department Of Revenue refers to the basic understanding and requirements mandated by the North Carolina Department of Revenue. It encompasses the essential information businesses need to comply with state revenue regulations. Understanding this can help ensure accurate tax submissions and prevent penalties.

-

How can airSlate SignNow help with BA 101 North Carolina Department Of Revenue?

airSlate SignNow offers an intuitive platform for electronically signing and managing documents relevant to BA 101 North Carolina Department Of Revenue. By streamlining the documentation process, businesses can efficiently handle their compliance needs with the Department of Revenue. This reduces administrative burdens and helps ensure timely submissions.

-

What pricing plans are available for using airSlate SignNow for BA 101 North Carolina Department Of Revenue?

airSlate SignNow provides flexible pricing plans tailored to suit varying business needs, specifically for BA 101 North Carolina Department Of Revenue compliance. Pricing is competitive, ensuring that businesses of all sizes can benefit from digital document management. You can easily choose a plan that aligns with your transaction volume and business goals.

-

What features does airSlate SignNow include that are relevant to BA 101 North Carolina Department Of Revenue?

Key features of airSlate SignNow relevant to BA 101 North Carolina Department Of Revenue include secure eSignature capabilities, document templates, and automated workflows. These functionalities simplify the signing process, enhance document accuracy, and ensure compliance with state requirements. Additionally, you can track document status in real-time.

-

What are the benefits of using airSlate SignNow for BA 101 North Carolina Department Of Revenue?

Using airSlate SignNow for BA 101 North Carolina Department Of Revenue offers multiple benefits, such as increased efficiency and reduced turnaround times for document processing. It helps avoid errors often associated with manual document handling and provides a secure environment for sensitive information. Overall, it streamlines the compliance process for businesses.

-

Can airSlate SignNow integrate with other software for BA 101 North Carolina Department Of Revenue?

Yes, airSlate SignNow easily integrates with various third-party applications, enhancing its utility for BA 101 North Carolina Department Of Revenue compliance. This allows businesses to connect their existing tools, such as CRM and ERP systems, to streamline processes further. Integration helps in automating document workflows and improving data accuracy.

-

Is airSlate SignNow user-friendly for managing BA 101 North Carolina Department Of Revenue documentation?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for all users handling BA 101 North Carolina Department Of Revenue documentation. The intuitive interface and straightforward navigation allow both beginners and experienced users to efficiently manage their documents. Training resources and support are also available to enhance user experience.

Get more for BA 101 North Carolina Department Of Revenue

- Form 656 booklet offer in compromise

- How do i find a good irs tax attorney form

- Cnes v1legionnaires disease risk assessment form

- Offer in compromise e form rs login

- Form 4506 t request for transcript of tax return official

- How to report hazards unsafe conditions or practices with ps form 1767

- Alberta personal tax credits return form

- Energy performance level display card 469772911

Find out other BA 101 North Carolina Department Of Revenue

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself