Offer in Compromise E Form RS Login 2023

Understanding IRS Debt Forgiveness and the Offer In Compromise

IRS debt forgiveness refers to the process by which taxpayers can settle their tax debts for less than the full amount owed. One of the primary methods for achieving this is through the Offer In Compromise (OIC) program. This program allows eligible taxpayers to negotiate a settlement with the IRS, potentially reducing their tax liability significantly. The Offer In Compromise form, known as Form 656, is essential for initiating this process. It requires detailed financial information to determine the taxpayer's ability to pay and the amount the IRS is willing to accept.

Eligibility Criteria for the Offer In Compromise

To qualify for an Offer In Compromise, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include:

- Demonstrating an inability to pay the full tax liability.

- Filing all required tax returns.

- Making all required estimated tax payments for the current year.

Additionally, the IRS considers the taxpayer's income, expenses, asset equity, and overall financial situation. Understanding these criteria is crucial before submitting an application.

Steps to Complete the Offer In Compromise Form

Completing the Offer In Compromise form, Form 656, involves several important steps:

- Gather necessary financial documents, including income statements, bank statements, and expense records.

- Complete Form 656, ensuring all information is accurate and comprehensive.

- Include the required application fee and initial payment, if applicable.

- Submit the form to the appropriate IRS address based on your location.

Each step is critical to ensure the application is processed efficiently and increases the chances of acceptance.

Required Documents for Submission

When submitting an Offer In Compromise, certain documents are required to support your application. These may include:

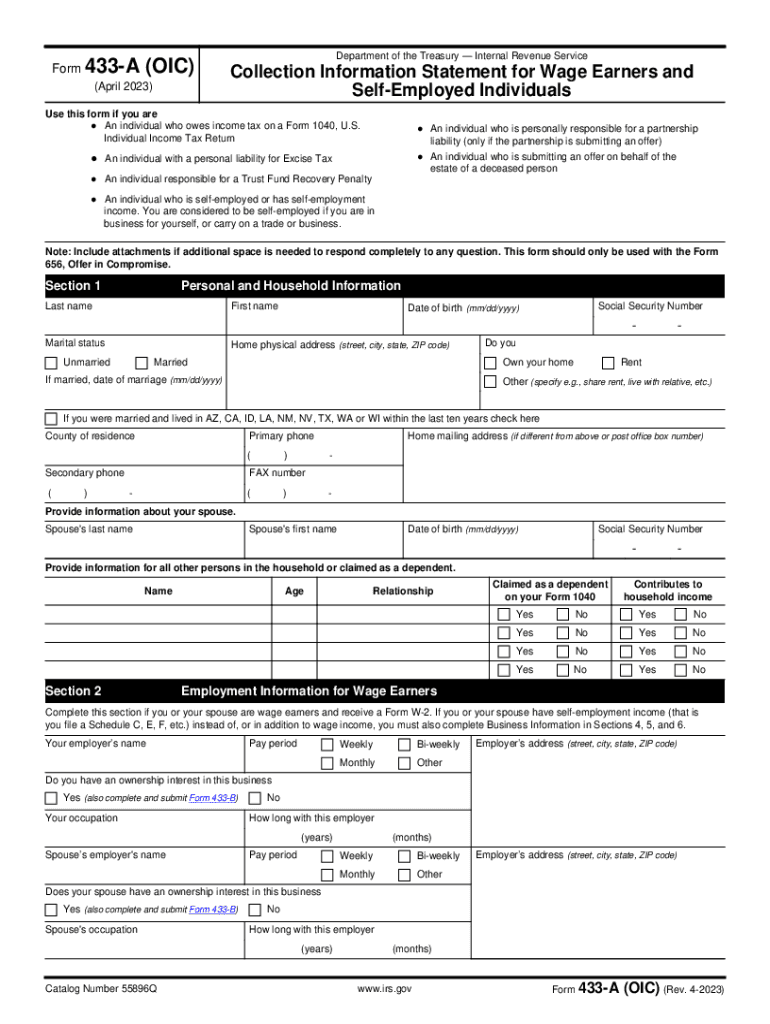

- Form 433-A (OIC) or Form 433-B (OIC), which detail your financial situation.

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and necessary living costs.

Providing complete and accurate documentation helps the IRS evaluate your offer more effectively.

IRS Guidelines for Offer In Compromise

The IRS has established guidelines that govern the Offer In Compromise process. These guidelines outline how offers are evaluated, the criteria for acceptance, and the timeline for processing applications. Taxpayers should be aware that the IRS may require additional information during the review process, and communication with the IRS is essential to address any inquiries or requests promptly.

Form Submission Methods

Taxpayers can submit their Offer In Compromise forms through various methods. These include:

- Online submission through the IRS website, if eligible.

- Mailing the completed form to the designated IRS address.

- In-person submission at a local IRS office, although this option may require an appointment.

Choosing the appropriate submission method can affect the processing time and overall experience.

Quick guide on how to complete offer in compromise e form rs login

Complete Offer In Compromise E Form RS Login effortlessly on any device

Virtual document management has become increasingly favored by enterprises and individuals alike. It offers a superb eco-friendly option to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Offer In Compromise E Form RS Login on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Offer In Compromise E Form RS Login without hassle

- Locate Offer In Compromise E Form RS Login and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Offer In Compromise E Form RS Login and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct offer in compromise e form rs login

Create this form in 5 minutes!

How to create an eSignature for the offer in compromise e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS debt forgiveness and how can it help me?

IRS debt forgiveness refers to programs that allow qualified taxpayers to reduce their tax liabilities to the IRS. By understanding these options, individuals can alleviate financial burdens and achieve greater financial freedom. Utilizing services like airSlate SignNow can simplify the documentation process required for applying for IRS debt forgiveness.

-

How does airSlate SignNow assist with IRS debt forgiveness processes?

airSlate SignNow streamlines the process of sending and signing documents required for IRS debt forgiveness applications. Our platform ensures that all paperwork is efficiently handled, reducing the hassle of traditional methods. This allows customers to focus on their financial goals rather than administrative tasks.

-

Are there any fees associated with using airSlate SignNow for IRS debt forgiveness?

airSlate SignNow offers a cost-effective solution with affordable pricing plans to suit various budgets. While using our platform for IRS debt forgiveness, you can expect transparent pricing without hidden fees. We aim to provide exceptional value while helping you manage your documents effectively.

-

Can I integrate airSlate SignNow with other financial software for IRS debt forgiveness?

Absolutely! airSlate SignNow can be easily integrated with various financial software and tools that assist with IRS debt forgiveness. This seamless integration allows you to export and manage documents effortlessly, ensuring a smooth workflow in your financial management process.

-

What types of documents can I eSign through airSlate SignNow for IRS debt forgiveness?

You can eSign a variety of documents related to IRS debt forgiveness through airSlate SignNow, including financial statements, tax forms, and proposals. Our platform supports various file formats, making it easy to manage and submit all necessary documentation. This ensures you meet deadlines and maintain compliance throughout the process.

-

Is airSlate SignNow compliant with IRS regulations for debt forgiveness?

Yes, airSlate SignNow adheres to all relevant regulations, ensuring that our platform is fully compliant for IRS debt forgiveness processes. Security and compliance are our top priorities, and we implement robust measures to protect your sensitive information. You can trust airSlate SignNow to handle your critical documents safely and efficiently.

-

Can I use airSlate SignNow on mobile devices for IRS debt forgiveness?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to manage your IRS debt forgiveness documents on the go. With our user-friendly mobile app, you can eSign, send, and track documents without being tied to a desktop computer. This flexibility empowers you to handle important tasks anytime, anywhere.

Get more for Offer In Compromise E Form RS Login

- Guaranty or guarantee of payment of rent wisconsin form

- Letter from landlord to tenant as notice of default on commercial lease wisconsin form

- Residential or rental lease extension agreement wisconsin form

- Wisconsin lease form

- Apartment lease rental application questionnaire wisconsin form

- Wi lease form

- Salary verification form for potential lease wisconsin

- Landlord agreement to allow tenant alterations to premises wisconsin form

Find out other Offer In Compromise E Form RS Login

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online