Instructions for Form 944 Internal Revenue Service IRS Tax Forms 2022-2026

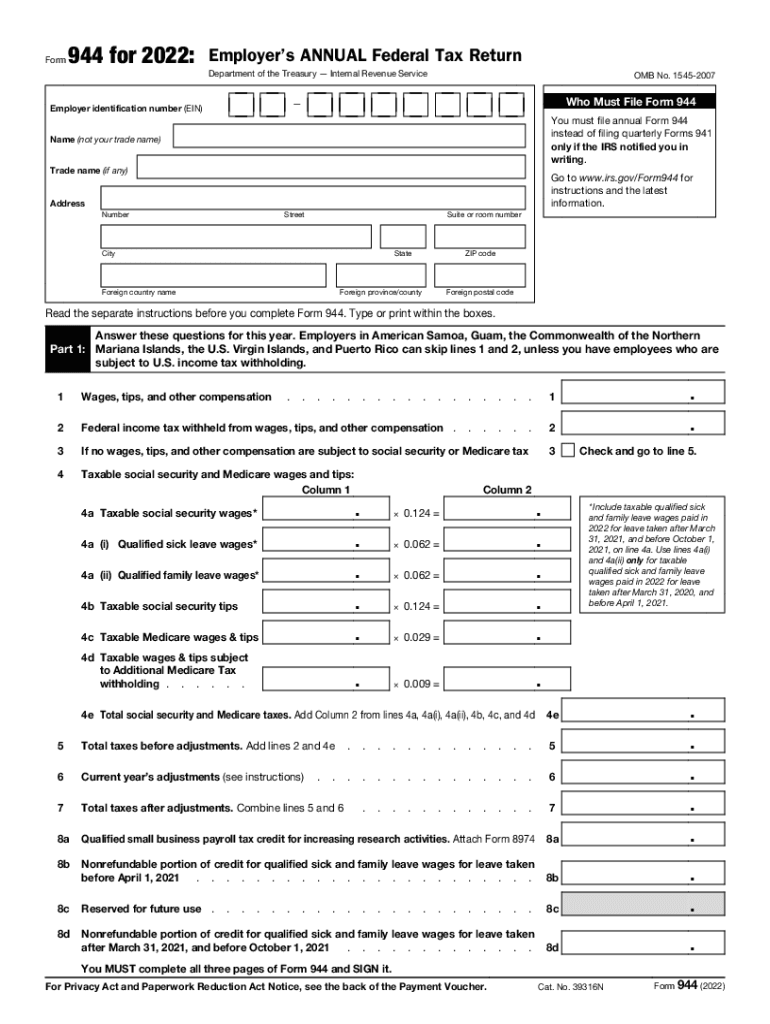

What is Form 944?

The Form 944 is an annual tax return used by small employers to report their Federal Insurance Contributions Act (FICA) taxes. This form is specifically designed for businesses that have a low payroll tax liability, allowing them to file once a year instead of quarterly. The Internal Revenue Service (IRS) requires eligible employers to use this form to report wages and calculate the taxes owed for Social Security and Medicare. Understanding the purpose and requirements of Form 944 is essential for compliance with federal tax regulations.

Steps to Complete Form 944

Completing Form 944 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the total wages paid to employees and the corresponding tax amounts. Next, accurately fill out each section of the form, which includes reporting employee wages, calculating the FICA taxes owed, and providing any adjustments if applicable. After completing the form, review it carefully for any errors before submitting it to the IRS. Ensuring that all information is correct can help avoid penalties and delays in processing.

Filing Deadlines for Form 944

Employers must adhere to specific deadlines when filing Form 944. The form is due annually on January 31 for the previous calendar year. If January 31 falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for employers to be aware of these deadlines to avoid late fees and penalties. Staying informed about filing dates can help ensure timely compliance with IRS regulations.

Penalties for Non-Compliance with Form 944

Failure to file Form 944 on time or inaccuracies in the submitted information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, incorrect reporting of wages or taxes can lead to further complications, including audits or additional tax liabilities. Understanding the potential consequences of non-compliance emphasizes the importance of accurate and timely filing.

Digital vs. Paper Version of Form 944

Employers have the option to file Form 944 either digitally or on paper. The digital version offers several advantages, including faster processing times and reduced risk of errors. When filing electronically, employers can also receive immediate confirmation of receipt from the IRS. Conversely, paper filings may take longer to process and can be susceptible to mailing delays. Choosing the appropriate filing method can impact the efficiency of tax reporting.

IRS Guidelines for Form 944

The IRS provides detailed guidelines for completing and filing Form 944. These guidelines outline eligibility criteria, filing procedures, and instructions for reporting wages and taxes. Employers should familiarize themselves with these guidelines to ensure compliance and avoid common pitfalls. Adhering to IRS instructions can facilitate a smoother filing process and minimize the risk of errors.

Quick guide on how to complete instructions for form 944 2022internal revenue service irs tax forms

Effortlessly Prepare Instructions For Form 944 Internal Revenue Service IRS Tax Forms on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without any holdups. Handle Instructions For Form 944 Internal Revenue Service IRS Tax Forms on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Instructions For Form 944 Internal Revenue Service IRS Tax Forms

- Locate Instructions For Form 944 Internal Revenue Service IRS Tax Forms and select Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize essential sections of the documents or obscure sensitive information using the features specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to preserve your alterations.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Instructions For Form 944 Internal Revenue Service IRS Tax Forms and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 944 2022internal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow 944?

The pricing for airSlate SignNow 944 varies based on the subscription plan you choose. We offer basic, business, and enterprise plans that cater to different needs and budgets. Each plan provides unique features to enhance your document signing experience, ensuring you find the perfect fit for your organization.

-

What features does airSlate SignNow 944 offer?

airSlate SignNow 944 offers a range of powerful features, including document templates, in-person signing, and advanced security options. With a user-friendly interface, you'll find it easy to send and eSign documents efficiently. The platform also allows for real-time collaboration, enhancing productivity for teams.

-

How can airSlate SignNow 944 benefit my business?

By using airSlate SignNow 944, your business can save time and streamline operations through electronic signatures. This solution minimizes paper usage and accelerates turnaround times on important documents. With airSlate SignNow, you can enhance customer satisfaction and improve overall efficiency.

-

Is airSlate SignNow 944 compliant with legal requirements?

Yes, airSlate SignNow 944 complies with various legal standards such as the ESIGN Act and UETA, ensuring that your electronic signatures are legally binding. This compliance guarantees that your documents carry the same legal weight as traditional signatures. You can trust airSlate SignNow for secure and compliant eSigning.

-

What integrations does airSlate SignNow 944 support?

airSlate SignNow 944 supports numerous integrations with popular business applications such as Salesforce, Google Workspace, and Microsoft Office. These integrations help streamline your workflow, allowing you to manage documents directly from platforms you already use. This connectivity enhances the overall efficiency of your processes.

-

Can I try airSlate SignNow 944 before committing?

Absolutely! airSlate SignNow 944 offers a free trial, allowing you to explore its features and capabilities without any commitment. This trial period lets you experience the ease of sending and eSigning documents, giving you confidence in your decision to choose our solution for your business needs.

-

How secure is airSlate SignNow 944?

Security is a priority with airSlate SignNow 944. Our platform employs robust encryption protocols and secure data storage to protect your documents. Additionally, we implement strict user authentication methods to ensure that only authorized personnel have access to your sensitive information.

Get more for Instructions For Form 944 Internal Revenue Service IRS Tax Forms

- Living trust for individual who is single divorced or widow or widower with no children ohio form

- Living trust for individual who is single divorced or widow or widower with children ohio form

- Living trust for husband and wife with one child ohio form

- Living trust for husband and wife with minor and or adult children ohio form

- Amendment to living trust ohio form

- Living trust property record ohio form

- Financial account transfer to living trust ohio form

- Assignment to living trust ohio form

Find out other Instructions For Form 944 Internal Revenue Service IRS Tax Forms

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document