Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts 2024-2026

What is the Form 5329

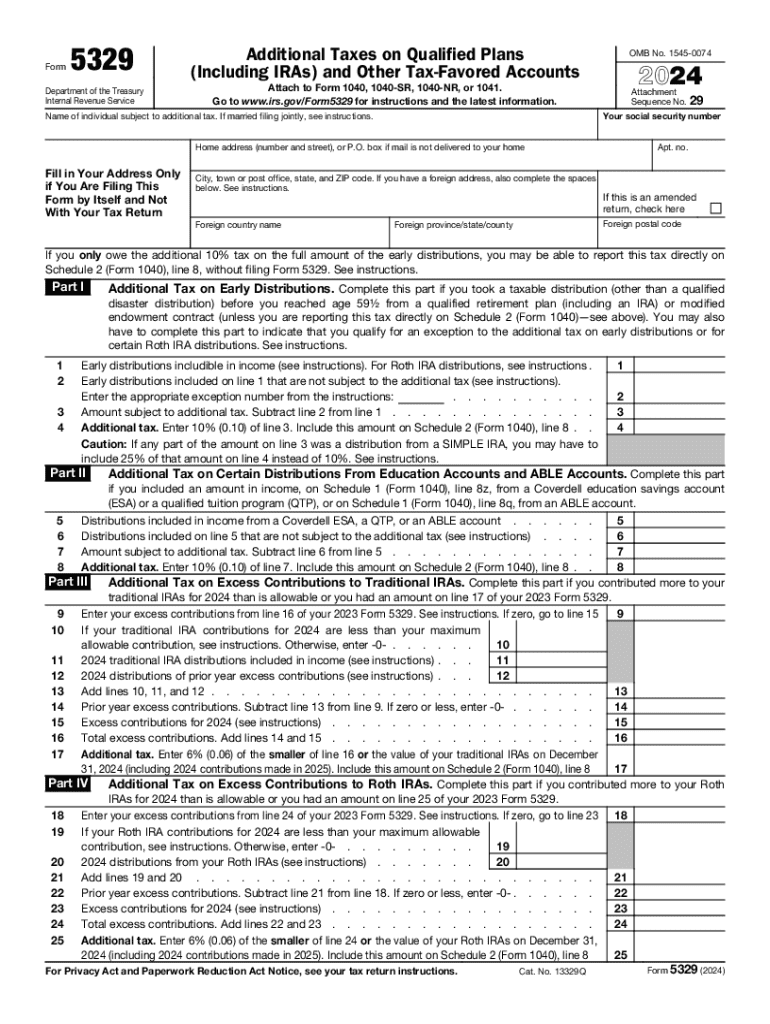

The Form 5329, officially titled "Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts," is a tax form used by individuals in the United States to report additional taxes related to retirement plans and tax-favored accounts. This form is essential for taxpayers who have made early withdrawals from their retirement accounts, such as IRAs or 401(k) plans, or who have failed to take required minimum distributions (RMDs). Understanding the purpose of this form is crucial for compliance with IRS regulations and to avoid potential penalties.

How to use the Form 5329

Using Form 5329 involves several steps to ensure accurate reporting of any additional taxes owed. Taxpayers must first determine if they have any early withdrawal penalties or missed RMDs that need to be reported. The form consists of various sections where taxpayers can indicate the type of tax being reported, such as the ten percent early withdrawal penalty or the additional tax for not taking RMDs. After completing the form, it should be filed along with the taxpayer's annual income tax return to the IRS.

Steps to complete the Form 5329

Completing Form 5329 requires careful attention to detail. Here are the steps involved:

- Gather relevant documents, including retirement account statements and previous tax returns.

- Identify any early withdrawals or missed RMDs that occurred during the tax year.

- Fill out the appropriate sections of the form, providing details about the withdrawals and any exceptions that may apply.

- Calculate any additional taxes owed based on the information provided.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 5329. These guidelines outline eligibility for exceptions to early withdrawal penalties, such as disability or medical expenses. Taxpayers should refer to the IRS instructions for Form 5329 to understand the requirements for reporting and any applicable exceptions. It's important to stay updated on IRS guidelines, as they may change annually.

Filing Deadlines / Important Dates

Form 5329 must be filed by the same deadline as the taxpayer's income tax return, typically April 15 of the following year. If the taxpayer requires additional time, they can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates is essential for compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 5329 when required can result in significant penalties. Taxpayers may face a ten percent penalty on early withdrawals if they do not report them accurately. Additionally, not taking required minimum distributions can lead to a fifty percent penalty on the amount that should have been withdrawn. Understanding these penalties emphasizes the importance of timely and accurate filing of Form 5329.

Handy tips for filling out Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts online

Quick steps to complete and e-sign Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for maximum efficiency. Use signNow to electronically sign and send out Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 5329 additional taxes on qualified plans including iras and other tax favored accounts

Create this form in 5 minutes!

How to create an eSignature for the form 5329 additional taxes on qualified plans including iras and other tax favored accounts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5329 and why is it important?

Form 5329 is a tax form used to report additional taxes on qualified retirement plans. It is essential for individuals who have excess contributions or need to report early distributions. Understanding how to properly fill out form 5329 can help you avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with form 5329?

airSlate SignNow provides a streamlined process for electronically signing and sending form 5329. With our user-friendly interface, you can easily prepare and share this important tax document, ensuring that it is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for form 5329?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to manage form 5329 and other documents efficiently, with options for individual users and teams alike.

-

What features does airSlate SignNow offer for managing form 5329?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing form 5329. These tools help ensure that your documents are completed correctly and efficiently, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other software for form 5329?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate form 5329 into your existing workflows. This flexibility allows you to enhance productivity and streamline your document management processes.

-

What are the benefits of using airSlate SignNow for form 5329?

Using airSlate SignNow for form 5329 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled safely and can be accessed anytime, anywhere, making tax season less stressful.

-

How secure is airSlate SignNow when handling form 5329?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your form 5329 and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

Find out other Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors