Form 5329 2013

What is the Form 5329

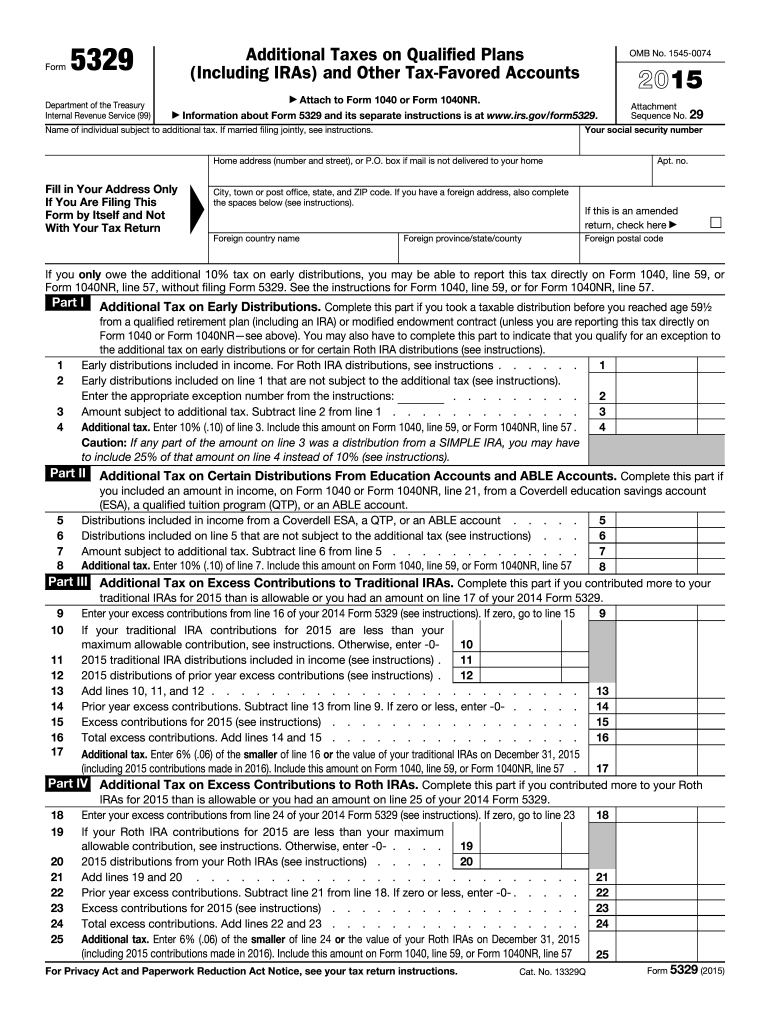

The Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans and other tax-favored accounts. It is primarily utilized to address situations involving early distributions from retirement accounts, excess contributions to IRAs, and other specific tax liabilities associated with these accounts. Understanding this form is essential for ensuring compliance with IRS regulations and avoiding unnecessary penalties.

How to use the Form 5329

Using the Form 5329 involves identifying the specific tax situation that applies to you. The form is divided into several sections, each addressing different scenarios such as early withdrawals or excess contributions. You will need to fill out the relevant sections based on your circumstances, calculate any additional taxes owed, and report this information on your tax return. It is important to ensure accuracy to avoid complications with the IRS.

Steps to complete the Form 5329

Completing the Form 5329 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your tax return and records of any retirement account transactions.

- Identify the specific section of the form that applies to your situation, such as early distributions or excess contributions.

- Fill out the required information accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

- Attach the Form 5329 to your tax return when filing with the IRS.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 5329. Generally, the form must be filed by the tax return due date, which is typically April 15 for most taxpayers. If you are unable to file by this date, you may request an extension. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Penalties for Non-Compliance

Failing to file the Form 5329 when required can result in significant penalties. The IRS may impose a penalty for each month the form is late, up to a maximum amount. Additionally, if you owe taxes related to early distributions or excess contributions and do not report them, you may face further financial consequences. It is essential to ensure compliance to avoid these penalties.

Legal use of the Form 5329

The Form 5329 is legally binding when completed and submitted according to IRS guidelines. It is important to provide accurate information and adhere to the requirements set forth by the IRS. Digital signatures are accepted, provided that the electronic filing complies with the legal standards for eSignatures. Utilizing a reliable digital platform can enhance the security and validity of your submission.

Quick guide on how to complete 2013 form 5329

Complete Form 5329 effortlessly on any device

Digital document management has become increasingly popular with companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form 5329 on any device with the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The simplest method to modify and electronically sign Form 5329 without hassle

- Obtain Form 5329 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of submitting your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or lost documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Form 5329 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 5329

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 5329

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 5329 and why do I need it?

Form 5329 is a tax form used to report additional taxes on qualified retirement plans and IRAs. It is crucial for individuals to file this form if they have excess contributions or if they fail to take required minimum distributions. Using airSlate SignNow, you can easily eSign and submit Form 5329 to ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with Form 5329?

airSlate SignNow simplifies the process of completing and eSigning Form 5329. Our user-friendly platform allows you to fill out the form electronically, gather necessary signatures, and securely send it to the IRS. This streamlines your tax filing process, making it more efficient and less stressful.

-

Is there a cost associated with using airSlate SignNow for Form 5329?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost-effective solutions ensure you can manage your Form 5329 filings without breaking the bank. Check our website for detailed pricing and features.

-

What features does airSlate SignNow offer for managing Form 5329?

airSlate SignNow provides a range of features for managing Form 5329, including customizable templates, real-time tracking of document status, and secure cloud storage. These tools help you efficiently handle your tax documents, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with my accounting software for Form 5329?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, allowing you to streamline your tax filing process for Form 5329. This integration enables you to import and export data easily, reducing manual entry time and minimizing errors.

-

Is airSlate SignNow secure for submitting Form 5329?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive information when submitting Form 5329. You can eSign and send documents with confidence, knowing your data is safe.

-

Can I access Form 5329 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to complete and eSign Form 5329 on-the-go. With our mobile app, you can manage your tax documents from anywhere, making it easier to stay organized and meet deadlines.

Get more for Form 5329

- Information for supplier a supplier is required to have only one certificate of exemption on file properly executed by

- Pdf form r 1 business registration application instructions virginia tax

- 2020 form rdc application for research and development expenses tax credit virginia form rdc 2020 application for research and

- Pdf 2020 form hs 122 vermont department of taxes vermontgov

- Form w ra wisconsin department of revenue wigov

- 2019 schedule 3k 1 partners share of income deductions credits etc form

- Iowa wage report doc templatepdffiller form

- Straight bill of lading 776015639 form

Find out other Form 5329

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT