5329 Form 2010

What is the 5329 Form

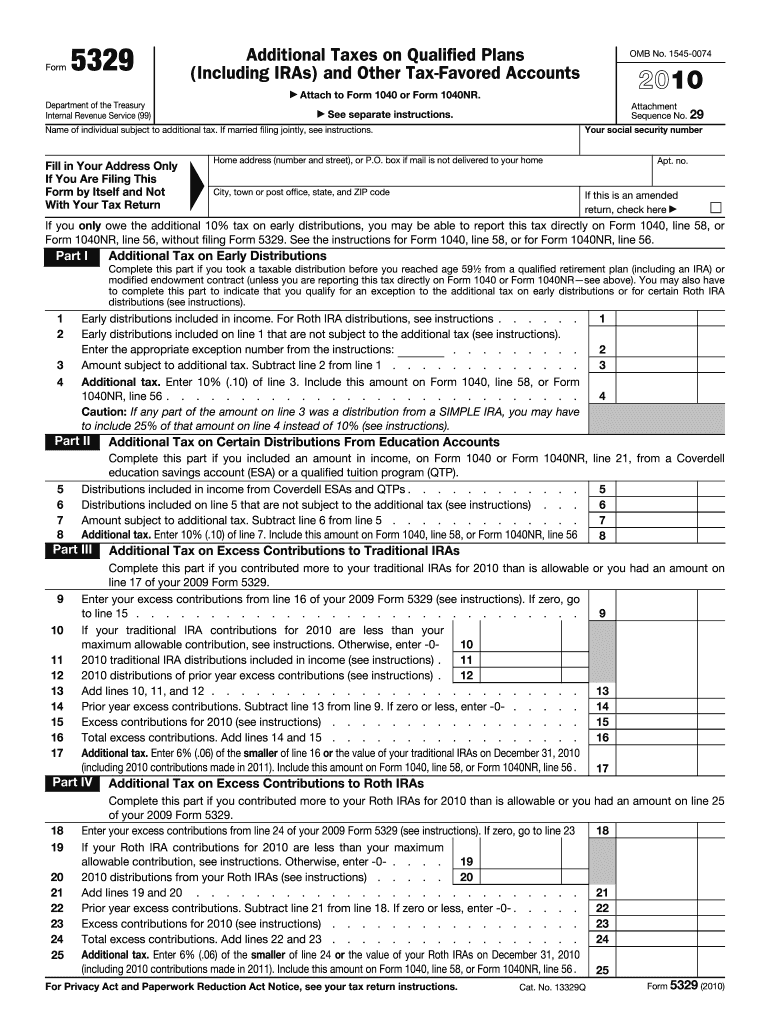

The 5329 Form is a tax document used by individuals to report additional taxes on qualified retirement plans and other tax-favored accounts. It is particularly relevant for taxpayers who have excess contributions to their IRAs or other retirement accounts, as well as those who owe additional taxes due to early distributions. Understanding the purpose of this form is essential for ensuring compliance with IRS regulations and avoiding potential penalties.

How to use the 5329 Form

Using the 5329 Form involves several steps to accurately report additional taxes. Taxpayers should first gather all relevant information regarding their retirement accounts, including contributions, distributions, and any excess amounts. Once the necessary data is compiled, the form must be filled out carefully, ensuring that all sections are completed based on individual circumstances. After completing the form, it should be submitted along with the annual tax return to the IRS.

Steps to complete the 5329 Form

Completing the 5329 Form requires attention to detail. Here are the essential steps:

- Identify the specific section of the form that applies to your situation, such as excess contributions or early distributions.

- Provide accurate figures for the amounts involved, including total contributions and distributions.

- Calculate any additional taxes owed based on the IRS guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Legal use of the 5329 Form

The legal use of the 5329 Form is crucial for compliance with IRS regulations. Filing this form correctly ensures that taxpayers report any additional taxes owed and avoid penalties. It is important to adhere to the guidelines set forth by the IRS, as failure to file or inaccuracies can lead to audits or fines. The form serves as a formal declaration of compliance with tax laws regarding retirement accounts.

Filing Deadlines / Important Dates

Filing deadlines for the 5329 Form align with the annual tax return deadlines. Typically, individual taxpayers must submit their forms by April fifteenth of the following tax year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is essential to be aware of these dates to avoid late fees and ensure timely compliance with tax obligations.

Key elements of the 5329 Form

Key elements of the 5329 Form include various sections that address different tax situations. These sections cover excess contributions, early distributions, and any applicable penalties. Each section requires specific information, such as the type of retirement account involved and the amounts that pertain to the taxpayer's situation. Understanding these elements is vital for accurate completion and compliance.

Quick guide on how to complete 2010 5329 form

Complete 5329 Form effortlessly on any device

Web-based document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 5329 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign 5329 Form with ease

- Obtain 5329 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Revise and eSign 5329 Form and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 5329 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 5329 form

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 5329 Form and who needs it?

The 5329 Form is used by taxpayers to report additional taxes on IRAs and other qualified retirement plans. Individuals who have made excess contributions or need to report early distributions from their retirement accounts must file this form. Understanding the 5329 Form is essential for correct tax reporting and compliance.

-

How can airSlate SignNow help with eSigning the 5329 Form?

AirSlate SignNow offers a streamlined solution for electronically signing the 5329 Form. With our platform, you can easily upload, sign, and send this form securely, ensuring that your tax documents are handled efficiently. Our eSigning capabilities make the process faster, allowing you to focus on your financial planning.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, including monthly and annual subscriptions. Each plan provides access to robust features like eSigning, templates, and secure storage—all essential for managing documents like the 5329 Form. You can choose a plan that fits your budget and operational requirements.

-

What features does airSlate SignNow offer for managing documents?

AirSlate SignNow includes features such as customizable templates, automated workflows, and secure storage for your documents, including the 5329 Form. Additionally, our platform supports bulk sending and real-time tracking of document statuses, allowing you to streamline the entire eSigning process. These features enhance efficiency and organization for businesses.

-

Is airSlate SignNow compliant with tax regulations for the 5329 Form?

Yes, airSlate SignNow complies with industry standards for eSigning and document management, ensuring that your 5329 Form is securely signed and stored. Our platform adheres to the regulations set forth by the IRS for electronic signatures, providing peace of mind that your tax documents are handled correctly. You can trust our service for accurate compliance.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! AirSlate SignNow offers seamless integrations with various tax preparation software, enhancing your workflow when dealing with the 5329 Form. Our integrations streamline the process of gathering and signing tax documents, making it easier to manage your entire tax preparation efficiently. This connectivity ensures your data is synchronized across applications.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the 5329 Form provides numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform eliminates the need for paper documents and in-person signatures, saving time and reducing costs. Additionally, you can access your signed documents anytime, anywhere, ensuring you stay organized.

Get more for 5329 Form

- Troy university talent release form

- Troy university financial aid office 134 adams administration form

- Travel requisition form

- Application for academic fresh start tennessee tech university tntech form

- Prerequisitecorequisite appeal petition form

- Valparaiso university sevis transfer in form valpo

- Academic planning worksheet form

- Instructions for requesting a co1v of vour health record nyu form

Find out other 5329 Form

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy