About Form 5329, Additional Taxes on Qualified Plans Including IRAs 2022

What is Form 5329?

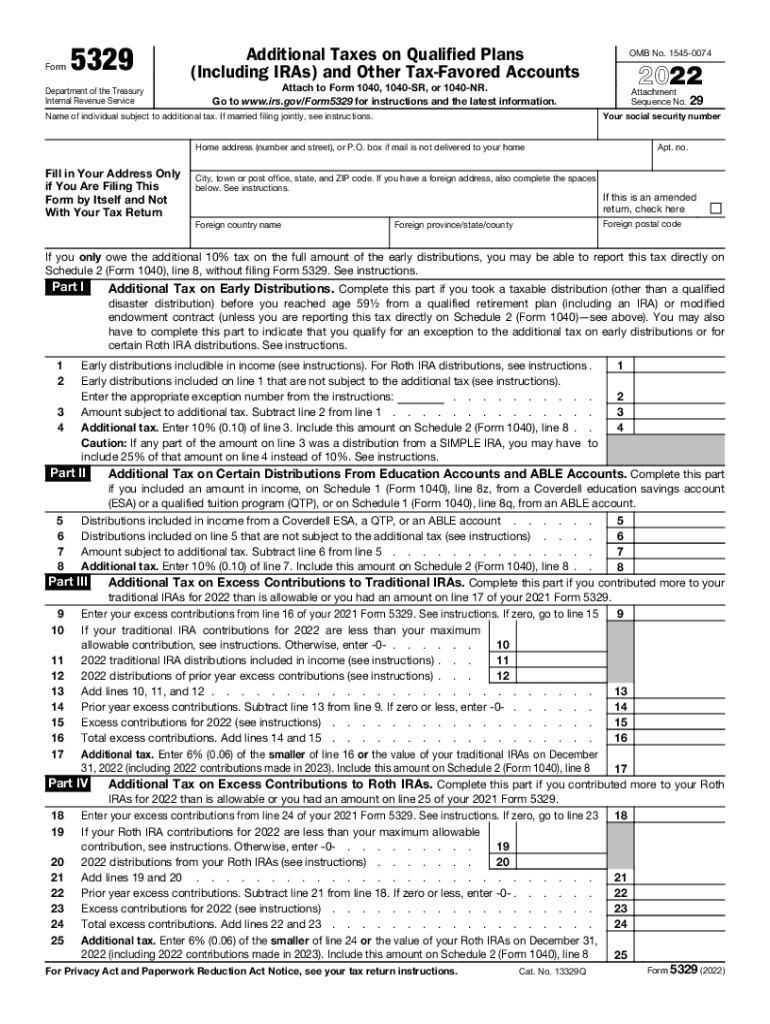

The IRS Form 5329, titled "Additional Taxes on Qualified Plans (Including IRAs)," is used to report additional taxes on distributions from retirement accounts, such as IRAs and 401(k)s. This form is essential for taxpayers who have taken early distributions or failed to meet the required minimum distribution rules. Understanding this form is crucial for ensuring compliance with tax regulations and avoiding unnecessary penalties.

Steps to Complete Form 5329

Completing the IRS Form 5329 involves several key steps:

- Gather necessary documentation, including your tax returns and records of any distributions taken from retirement accounts.

- Identify the specific section of the form that applies to your situation, such as early distributions or excess contributions.

- Carefully fill out the required fields, ensuring that all calculations are accurate to avoid errors.

- Review the completed form for any discrepancies before submission.

Legal Use of Form 5329

Form 5329 is legally binding when completed accurately and submitted within the required timeframe. It is essential to understand the implications of the information reported on this form, as inaccuracies can lead to penalties or additional taxes. Utilizing a reliable electronic signature tool can enhance the legal validity of the submitted form, ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Filing Deadlines for Form 5329

Taxpayers must file Form 5329 by the tax return due date, which is typically April fifteenth for most individuals. If you are filing for an extension, it is important to ensure that Form 5329 is submitted by the extended deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

Examples of Using Form 5329

There are several scenarios in which taxpayers may need to use Form 5329:

- If you took an early withdrawal from your IRA before the age of fifty-nine and a half, you may need to report this on Form 5329.

- Taxpayers who failed to take required minimum distributions (RMDs) from their retirement accounts may also need to complete this form to report the additional tax due.

Key Elements of Form 5329

Form 5329 includes several key sections that taxpayers must be aware of:

- Part I addresses additional taxes on early distributions.

- Part II focuses on excess contributions to IRAs.

- Part III is for reporting failures to take required minimum distributions.

Quick guide on how to complete about form 5329 additional taxes on qualified plans including iras

Complete About Form 5329, Additional Taxes On Qualified Plans including IRAs seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage About Form 5329, Additional Taxes On Qualified Plans including IRAs on any device using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign About Form 5329, Additional Taxes On Qualified Plans including IRAs effortlessly

- Obtain About Form 5329, Additional Taxes On Qualified Plans including IRAs and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and eSign About Form 5329, Additional Taxes On Qualified Plans including IRAs and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5329 additional taxes on qualified plans including iras

Create this form in 5 minutes!

People also ask

-

What is form 5329 pdf and why do I need it?

Form 5329 pdf is used to report additional taxes on qualified plans and other tax-favored accounts. If you have made contributions to these accounts and need to report penalties or additional taxes, this form is necessary. Using airSlate SignNow makes completing and signing your form 5329 pdf simple and efficient.

-

How can I create a fillable form 5329 pdf using airSlate SignNow?

You can easily create a fillable form 5329 pdf by uploading the document to airSlate SignNow and using our intuitive editing tools. Once uploaded, simply add fields for required information and signatures. This process streamlines how you prepare important tax documents.

-

Is there a free trial for using airSlate SignNow to manage form 5329 pdf?

Yes, airSlate SignNow offers a free trial that allows you to explore features for managing your form 5329 pdf. During this trial period, you can test the platform's e-signature capabilities, document management tools, and ease of use. This is a great way to find out how it fits your needs.

-

What integrations does airSlate SignNow offer for working with form 5329 pdf?

airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. This makes it easy to access your form 5329 pdf from multiple platforms. By utilizing integrations, you can streamline document management and improve your workflow.

-

Can I securely send my form 5329 pdf through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes document security, allowing you to securely send your form 5329 pdf to recipients. With features like encryption and audit trails, you can ensure that your sensitive tax information is kept safe during transmission.

-

What are the benefits of using airSlate SignNow for my form 5329 pdf?

Using airSlate SignNow for your form 5329 pdf offers numerous benefits, including quick e-signature collection and secure document storage. Additionally, the user-friendly interface simplifies the signing process for both parties, speeding up your document turnaround time signNowly.

-

How does airSlate SignNow help with filing deadlines for form 5329 pdf?

airSlate SignNow helps you meet filing deadlines for your form 5329 pdf by offering reminders and the ability to track document status. Our platform ensures that you can collect signatures promptly, allowing you to submit your forms on time and avoid penalties.

Get more for About Form 5329, Additional Taxes On Qualified Plans including IRAs

- Nm preliminary form

- Notice subcontractor form

- New mexico termination form

- Original contractors notice to subcontractor or materialman corporation or llc new mexico form

- New mexico subcontractor form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497320041 form

- New mexico notice 497320042 form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for residential property 497320043 form

Find out other About Form 5329, Additional Taxes On Qualified Plans including IRAs

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document