Form 5329 2016

What is the Form 5329

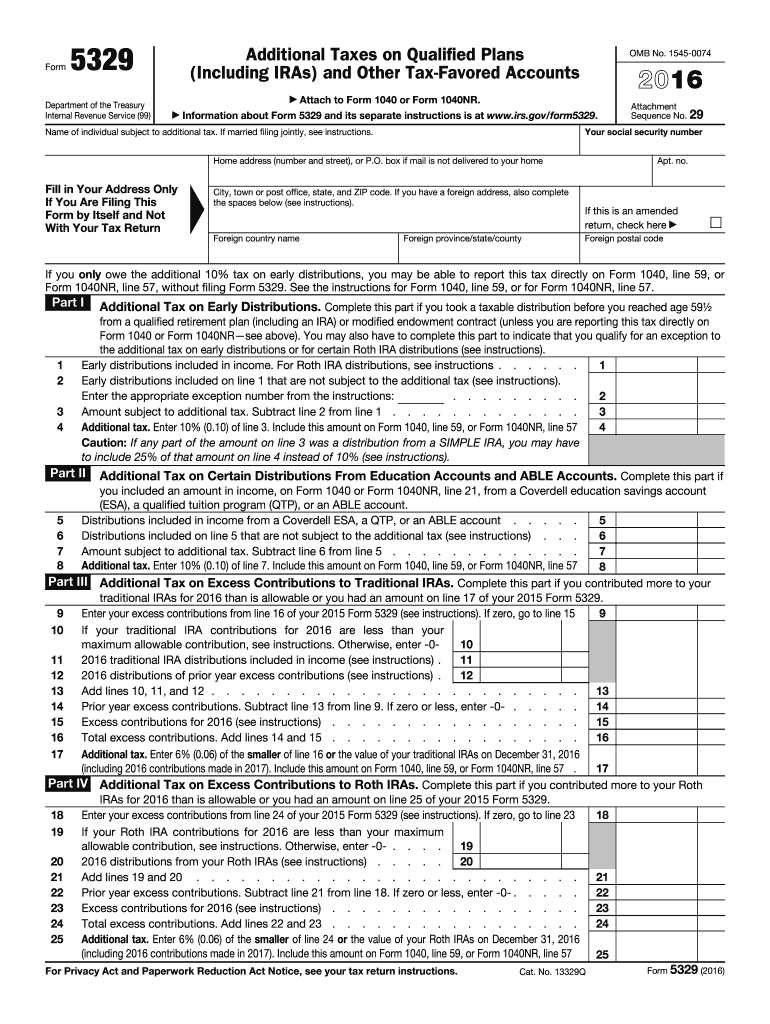

The Form 5329 is an IRS tax form used to report additional taxes on qualified retirement plans and other tax-favored accounts. This form is essential for individuals who have taken early distributions from their retirement accounts or who need to report excess contributions. Understanding the purpose of Form 5329 is crucial for ensuring compliance with tax regulations and avoiding penalties.

How to use the Form 5329

Using Form 5329 involves accurately reporting any additional taxes owed on distributions from retirement accounts. Taxpayers must complete the form if they meet specific criteria, such as withdrawing funds before the age of fifty-nine and a half or exceeding contribution limits. The information provided on this form helps the IRS assess any additional taxes owed, ensuring that taxpayers fulfill their obligations.

Steps to complete the Form 5329

Completing Form 5329 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including details about your retirement accounts and any distributions taken.

- Indicate the reason for any early distributions in the appropriate section of the form.

- Calculate any additional taxes owed based on the IRS guidelines.

- Review the completed form for accuracy before submission.

Legal use of the Form 5329

Form 5329 is legally binding when filled out correctly and submitted to the IRS. It is important to ensure compliance with all relevant tax laws to avoid potential penalties. The form must be signed and dated to validate the information provided. Understanding the legal implications of this form is essential for taxpayers to protect themselves from future audits or disputes with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 5329 align with the annual tax return due date. Generally, taxpayers must submit this form by April fifteenth of the following year, unless an extension has been granted. It is important to be aware of these deadlines to avoid late fees or penalties associated with non-compliance.

Penalties for Non-Compliance

Failure to file Form 5329 when required can result in significant penalties. The IRS may impose additional taxes on early distributions or excess contributions, which can add up quickly. Understanding these penalties helps taxpayers take proactive steps to ensure compliance and avoid unnecessary financial burdens.

Quick guide on how to complete form 5329 2016

Complete Form 5329 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the appropriate form and safely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without hold-ups. Manage Form 5329 on any device using the airSlate SignNow Android or iOS apps and simplify any document-related task today.

The easiest way to modify and electronically sign Form 5329 without hassle

- Locate Form 5329 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 5329 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5329 2016

Create this form in 5 minutes!

How to create an eSignature for the form 5329 2016

How to make an electronic signature for your Form 5329 2016 in the online mode

How to create an electronic signature for your Form 5329 2016 in Chrome

How to generate an eSignature for signing the Form 5329 2016 in Gmail

How to make an eSignature for the Form 5329 2016 right from your mobile device

How to create an eSignature for the Form 5329 2016 on iOS devices

How to make an eSignature for the Form 5329 2016 on Android

People also ask

-

What is Form 5329 and why is it important?

Form 5329 is a tax form used by individuals to report additional taxes on IRAs and other qualified retirement plans. It's essential for ensuring compliance with IRS regulations regarding retirement account distributions and penalties. Understanding how to fill out Form 5329 accurately can help you avoid unnecessary tax liabilities.

-

How can airSlate SignNow help me with Form 5329?

airSlate SignNow provides a seamless solution for eSigning and sending Form 5329 electronically. Our platform allows you to easily upload, edit, and eSign your tax documents, including Form 5329, ensuring a secure and efficient process. This helps you save time and reduces the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for Form 5329?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs, starting with a free trial. This allows you to test our features for eSigning documents like Form 5329 before committing to a subscription. Our cost-effective solution ensures you get the best value for your electronic signature needs.

-

What features does airSlate SignNow offer for managing Form 5329?

With airSlate SignNow, you can easily upload Form 5329, add signature fields, and send it for eSignature to multiple recipients. Our platform also allows you to track the status of your documents, ensuring that you know exactly when Form 5329 has been signed and returned. Additionally, you'll benefit from secure storage and compliance with eSignature laws.

-

Can I integrate airSlate SignNow with other applications for Form 5329?

Absolutely! airSlate SignNow integrates seamlessly with various applications including Google Drive, Salesforce, and Microsoft Office. This means you can easily retrieve Form 5329 from your preferred applications and send it for eSignature without any hassle, enhancing your workflow efficiency.

-

What are the benefits of eSigning Form 5329 with airSlate SignNow?

eSigning Form 5329 with airSlate SignNow provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that all signatures are legally binding and compliant with regulations, giving you peace of mind. Additionally, the intuitive interface makes it easy for anyone to navigate and complete the signing process.

-

How secure is the eSigning process for Form 5329 with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. Our platform employs advanced encryption methods and secure cloud storage to protect your Form 5329 and other sensitive documents. You can rest assured that your information is safe throughout the eSigning process.

Get more for Form 5329

Find out other Form 5329

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement