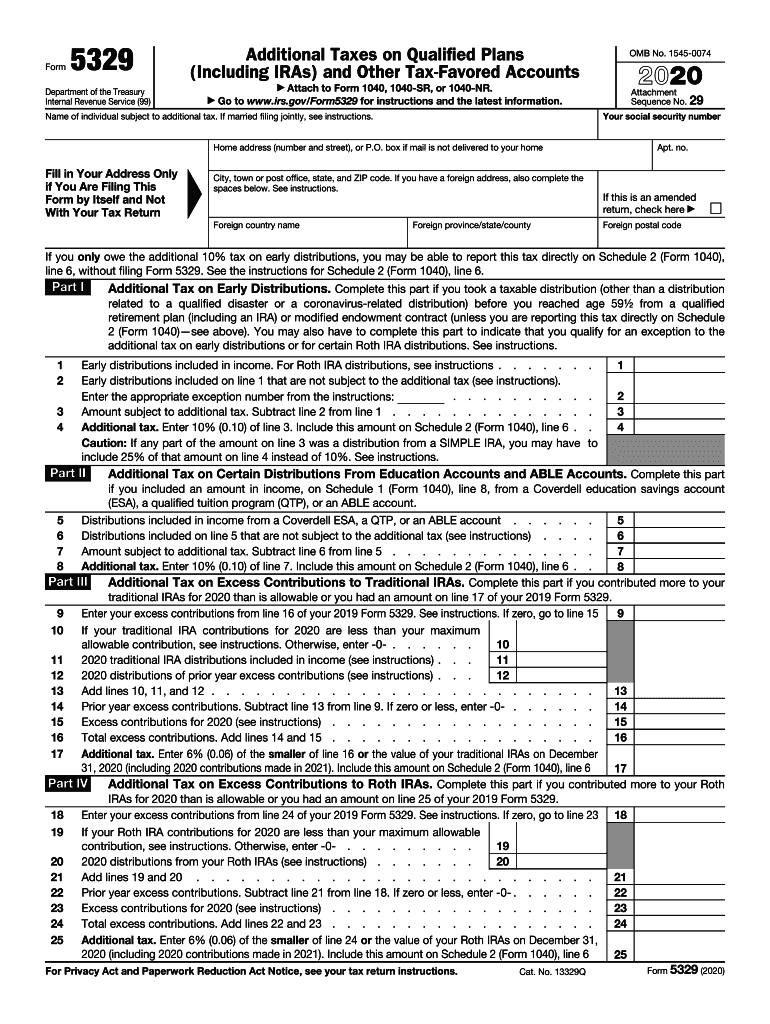

Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts 2020

What is the Form 5329?

The IRS Form 5329 is used to report additional taxes on qualified plans, including Individual Retirement Accounts (IRAs) and other tax-favored accounts. This form is essential for taxpayers who have taken early distributions from their retirement accounts or who have failed to meet required minimum distribution rules. It helps ensure compliance with tax regulations and allows the IRS to assess any additional taxes owed.

Steps to Complete the Form 5329

Completing the Form 5329 involves several key steps:

- Gather necessary information: Collect details about your retirement accounts, including account balances and distribution amounts.

- Determine tax liabilities: Assess whether you owe any additional taxes due to early withdrawals or missed distributions.

- Fill out the form: Enter your information accurately in the designated fields, ensuring all calculations are correct.

- Review and sign: Check the completed form for accuracy before signing it, as errors can lead to penalties.

IRS Guidelines for Form 5329

The IRS provides specific guidelines for completing Form 5329. It is important to follow these guidelines closely to avoid complications. The form must be filed if you owe additional taxes, and it should be submitted along with your tax return. The IRS outlines various scenarios that may trigger the need for this form, such as early withdrawals or failing to take required minimum distributions.

Filing Deadlines for Form 5329

Form 5329 must be filed by the tax return deadline, which is typically April 15 for most taxpayers. If you are unable to file by this date, you may request an extension, but any additional taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is crucial for compliance.

Penalties for Non-Compliance

Failing to file Form 5329 when required can result in significant penalties. The IRS may impose a penalty of 10% on early distributions from retirement accounts if the proper form is not submitted. Additionally, there may be further penalties for failing to take required minimum distributions. Understanding these consequences emphasizes the importance of timely and accurate filing.

Obtaining the Form 5329

Taxpayers can obtain IRS Form 5329 through the IRS website, where it is available for download in PDF format. Additionally, many tax preparation software programs include the form, making it easier to complete and file electronically. Ensure you have the correct version for the tax year you are filing.

Quick guide on how to complete 2020 form 5329 additional taxes on qualified plans including iras and other tax favored accounts

Effortlessly complete Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to edit and eSign Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts with ease

- Find Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 5329 additional taxes on qualified plans including iras and other tax favored accounts

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 5329 additional taxes on qualified plans including iras and other tax favored accounts

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS Form 5329?

IRS Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans, including IRAs. It helps in calculating penalties for excess contributions and failures to take required minimum distributions. Understanding IRS Form 5329 is essential to avoid unnecessary fees.

-

How can airSlate SignNow help me with IRS Form 5329?

With airSlate SignNow, you can easily prepare, sign, and send IRS Form 5329 electronically. Our user-friendly platform streamlines the document management process, ensuring that you meet deadlines without hassle. Plus, you can store and retrieve your form securely whenever needed.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5329?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions ensure you get the best features for preparing IRS Form 5329 without breaking your budget. You can start with a free trial to explore the features before committing.

-

What features does airSlate SignNow offer for IRS Form 5329 management?

airSlate SignNow provides features like customizable templates, electronic signatures, document tracking, and secure cloud storage for IRS Form 5329. These tools help simplify the filing process and enhance collaboration. You can also integrate with other applications for seamless workflow.

-

Can I integrate airSlate SignNow with accounting software for IRS Form 5329?

Absolutely! airSlate SignNow integrates smoothly with various accounting software to streamline the process of preparing IRS Form 5329. This integration not only saves time but also reduces errors when transferring data between platforms. Check our integrations page for more details.

-

How secure is my information when using airSlate SignNow for IRS Form 5329?

Your information is highly secure with airSlate SignNow, as we use advanced encryption protocols to protect your data. When using our platform for IRS Form 5329, you can rest assured that your sensitive financial information is safe from unauthorized access. Compliance with industry standards is a priority for us.

-

Does airSlate SignNow provide customer support for IRS Form 5329 queries?

Yes, airSlate SignNow offers comprehensive customer support for any queries related to IRS Form 5329. Our support team is available via chat, email, and phone to assist you. Whether you have questions about our features or need help with the form, we are here to help.

Get more for Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

Find out other Form 5329 Additional Taxes On Qualified Plans Including IRAs And Other Tax Favored Accounts

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple