Form 5329 2015

What is the Form 5329

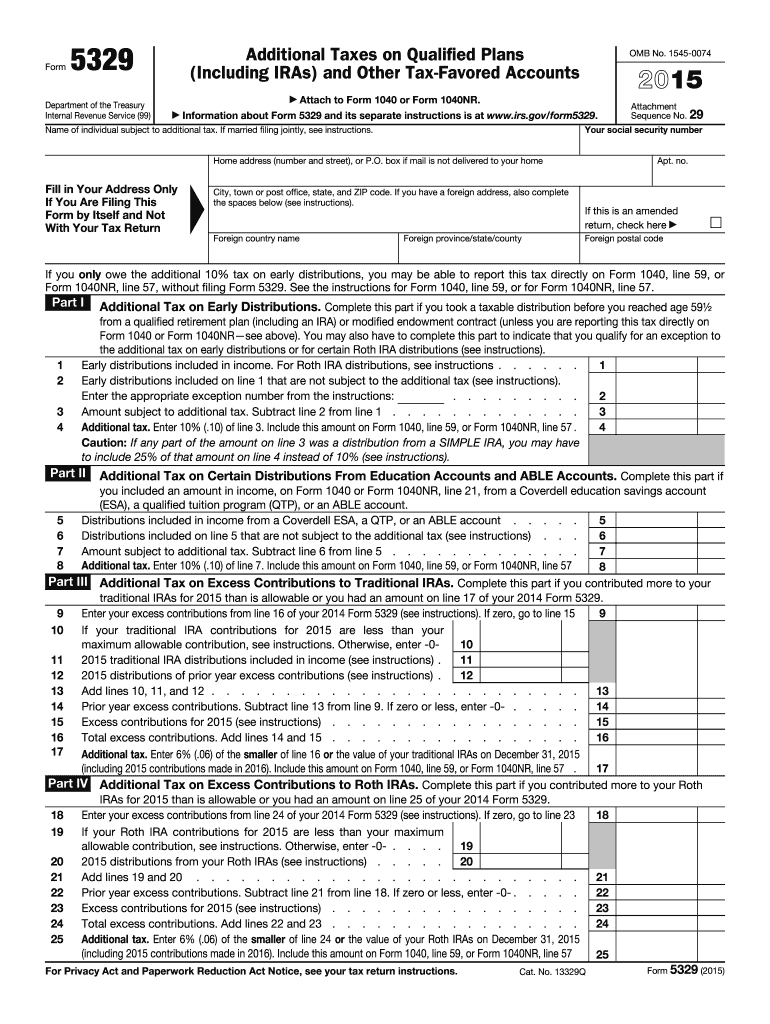

The Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans, including IRAs. This form is particularly important for taxpayers who have made excess contributions to their retirement accounts or who are subject to early withdrawal penalties. Understanding the purpose of this form is crucial for ensuring compliance with IRS regulations and avoiding unnecessary penalties.

How to use the Form 5329

To effectively use the Form 5329, taxpayers must first identify the specific section that applies to their situation. The form includes various parts that address different tax issues, such as excess contributions and early distributions. After determining the applicable sections, individuals should accurately fill out the required information, ensuring that all calculations are correct. Once completed, the form should be submitted alongside the taxpayer's annual return to the IRS.

Steps to complete the Form 5329

Completing the Form 5329 involves several key steps:

- Identify the reason for filing the form, such as excess contributions or early withdrawals.

- Gather necessary documentation, including records of contributions and distributions.

- Fill out the relevant sections of the form, ensuring accuracy in all figures.

- Review the completed form for any errors or omissions.

- Submit the form with your annual tax return or file it separately if required.

Legal use of the Form 5329

The legal use of the Form 5329 is governed by IRS regulations. It is essential for taxpayers to understand that failing to file this form when required can lead to penalties. The form must be filled out truthfully and accurately to maintain compliance with tax laws. Additionally, using electronic signatures through a reliable platform can enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 5329. Generally, the form is due on the same date as the individual’s federal income tax return, typically April 15. If additional time is needed, individuals can file for an extension, but it is crucial to ensure that the Form 5329 is submitted by the extended deadline to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form 5329 can result in significant penalties. For instance, failing to report excess contributions may lead to a 6% excise tax on the excess amount for each year it remains in the account. Additionally, early withdrawals from retirement accounts without proper reporting can incur additional taxes. Understanding these penalties is vital for taxpayers to avoid unexpected financial burdens.

Quick guide on how to complete 2015 form 5329

Complete Form 5329 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage Form 5329 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Form 5329 with ease

- Obtain Form 5329 and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether it be by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 5329 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 5329

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 5329

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 5329 and why is it important?

Form 5329 is an IRS form used to report additional taxes on qualified retirement plans. It is important because it helps taxpayers comply with regulations regarding early withdrawals and excess contributions, ensuring they avoid unnecessary penalties.

-

How can airSlate SignNow help with signing Form 5329?

airSlate SignNow simplifies the eSigning process for Form 5329, making it easy to gather signatures from multiple parties. With our intuitive platform, users can quickly send, sign, and manage this important tax document securely and efficiently.

-

What features does airSlate SignNow offer for managing Form 5329?

airSlate SignNow offers robust features for managing Form 5329, including template creation, real-time tracking, and reminders. These tools enhance productivity and ensure that your tax documents are handled promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 5329?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs. The subscription model ensures that you get access to essential features for managing and signing Form 5329 while remaining cost-effective.

-

Can I integrate airSlate SignNow with other software for managing Form 5329?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing businesses to connect their workflows and enhance efficiency when handling Form 5329. Popular integrations include CRM systems and cloud storage solutions.

-

What benefits do businesses gain by using airSlate SignNow for Form 5329?

By using airSlate SignNow for Form 5329, businesses benefit from increased efficiency, streamlined workflows, and reduced errors. Our easy-to-use platform helps ensure compliance and minimizes the time spent on paper-based processes.

-

How secure is the signing process for Form 5329 with airSlate SignNow?

airSlate SignNow prioritizes security, utilizing advanced encryption and authentication measures for signing Form 5329. Users can feel confident that their sensitive tax documents are protected throughout the signing process.

Get more for Form 5329

Find out other Form 5329

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement