Tax Exempt & Government Entities Edward T Killen 2023

Understanding IRS Form 5329 for 2022

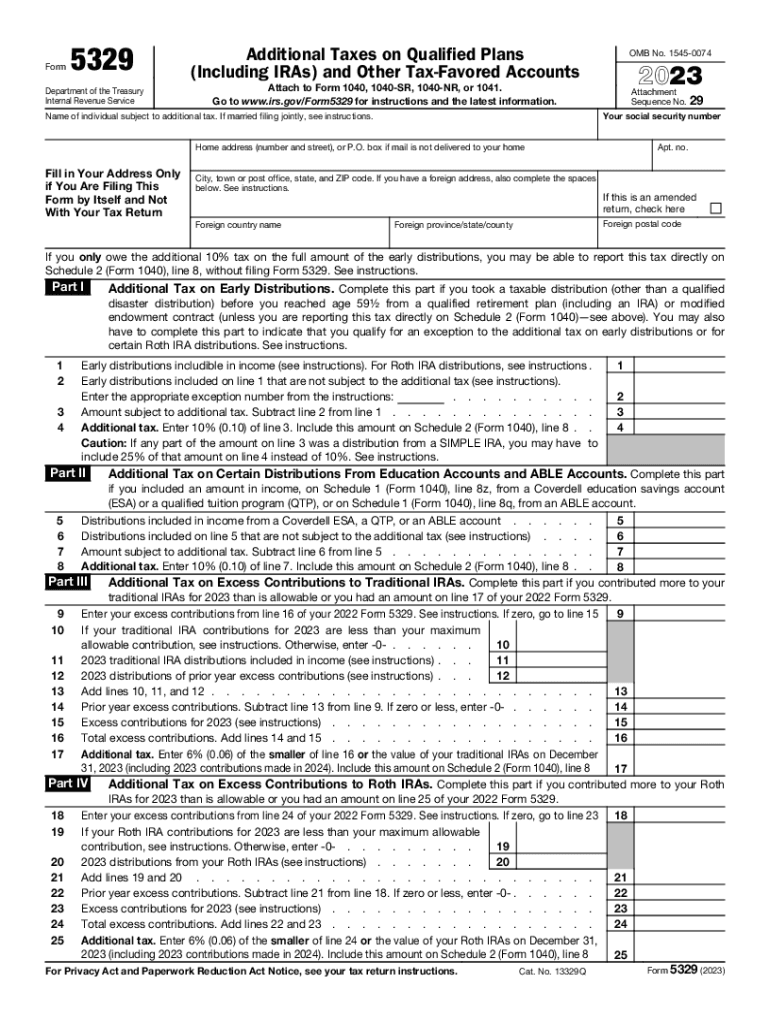

The 2022 Form 5329 is a crucial document for taxpayers who need to report additional taxes on certain distributions from retirement accounts, such as IRAs and 401(k)s. This form is particularly relevant for individuals who have taken early distributions or have not met the required minimum distributions (RMDs). By accurately completing this form, taxpayers can ensure compliance with IRS regulations and avoid unnecessary penalties.

Steps to Complete the 2022 Form 5329

Filling out the 2022 Form 5329 involves several key steps:

- Gather necessary information regarding your retirement accounts, including distribution amounts and dates.

- Determine if you owe any additional taxes due to early distributions or missed RMDs.

- Complete the form by entering your information in the appropriate sections, including any exemptions that may apply.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that you meet all requirements and minimize the risk of errors.

IRS Guidelines for Form 5329

The IRS provides specific guidelines for completing Form 5329. Taxpayers should refer to the official instructions for the form to understand the various sections, including:

- Reporting early distributions from retirement accounts.

- Calculating additional taxes owed.

- Understanding exemptions and special circumstances.

By adhering to these guidelines, taxpayers can navigate the complexities of the form more effectively.

Filing Deadlines for Form 5329

The filing deadline for the 2022 Form 5329 aligns with the standard tax return deadlines. Typically, this means that the form must be submitted by April 15 of the following year, unless an extension has been filed. It is important to be aware of these deadlines to avoid penalties for late submission.

Penalties for Non-Compliance with Form 5329

Failure to file Form 5329 when required can result in significant penalties. Taxpayers may face additional taxes on early distributions or missed RMDs, along with interest on unpaid amounts. Understanding these potential penalties can motivate timely and accurate filing.

Eligibility Criteria for Reporting on Form 5329

Not all taxpayers need to file Form 5329. Eligibility criteria include:

- Individuals who have taken early distributions from retirement accounts.

- Taxpayers who did not meet their RMDs for the year.

- Those who are subject to additional taxes on certain distributions.

Reviewing these criteria can help determine if filing the form is necessary for your tax situation.

Quick guide on how to complete tax exempt ampamp government entities edward t killen

Prepare Tax Exempt & Government Entities Edward T Killen effortlessly on any device

Online document management has gained traction among companies and individuals alike. It offers a remarkable eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Tax Exempt & Government Entities Edward T Killen on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to alter and eSign Tax Exempt & Government Entities Edward T Killen with ease

- Locate Tax Exempt & Government Entities Edward T Killen and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides for this specific reason.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misdirected files, exhausting form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Tax Exempt & Government Entities Edward T Killen and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax exempt ampamp government entities edward t killen

Create this form in 5 minutes!

How to create an eSignature for the tax exempt ampamp government entities edward t killen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 form 5329?

The 2022 form 5329 is a tax form used to report additional taxes on qualified retirement plans, including IRAs. Individuals may need to file this form if they have taken early distributions or if they have excess contributions to their retirement accounts. Understanding the 2022 form 5329 helps ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with filing the 2022 form 5329?

airSlate SignNow offers an efficient way to eSign and send important documents, including the 2022 form 5329. With our platform, you can quickly prepare your documents, making it easier to ensure that your forms are accurate and submitted in a timely manner. This streamlines the process of filing tax forms.

-

Is there a cost associated with using airSlate SignNow for the 2022 form 5329?

airSlate SignNow provides cost-effective solutions for individuals looking to eSign documents like the 2022 form 5329. Our pricing plans are designed to fit various needs and budgets, allowing you to choose the level of service that best meets your demands. Start with a free trial to explore our features before committing.

-

What features does airSlate SignNow offer for efficiently managing the 2022 form 5329?

airSlate SignNow offers features including templates, secure eSigning, and automated workflows that simplify the management of the 2022 form 5329. You can create custom templates for your recurring needs, ensuring that all your tax forms are consistent and ready for signature. Additionally, our platform allows for real-time tracking of documents.

-

Are there integrations available with airSlate SignNow for handling tax forms like the 2022 form 5329?

Yes, airSlate SignNow integrates with numerous applications to facilitate the handling of documents such as the 2022 form 5329. These integrations can connect with your accounting software, making it easier to manage your tax forms alongside your financial data. This means seamless access to your essential tools while ensuring all documents are correctly managed.

-

Can I share my completed 2022 form 5329 securely using airSlate SignNow?

Absolutely! With airSlate SignNow, you can securely share your completed 2022 form 5329 via encrypted email or through a secure link. Our platform ensures that sensitive information is protected, giving you confidence when sharing important tax documents with others, including accountants or tax advisors.

-

Is airSlate SignNow user-friendly for new users needing to fill out the 2022 form 5329?

Yes, airSlate SignNow is designed to be user-friendly, making it simple for new users to fill out essential forms like the 2022 form 5329. Our intuitive interface and guided steps ensure that even those unfamiliar with eSigning procedures can complete their documents quickly and easily. Plus, we offer support resources to assist you along the way.

Get more for Tax Exempt & Government Entities Edward T Killen

- State of texas and being described as follows form

- Utility easement and right of way the state of form

- Form fmha tx 442 8 rev usda rural development

- That referred to below as grantorwhether one or more for good and valuable form

- 031202 draft form

- Res 101017 f city of georgetown texas form

- Right of way easement rev form

- Civil cover sheet js44 aransas county form

Find out other Tax Exempt & Government Entities Edward T Killen

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document