Schedule D Form 990 Rev December Supplemental Financial Statements 2023-2026

Understanding the Schedule D Form 990 Supplemental Financial Statements

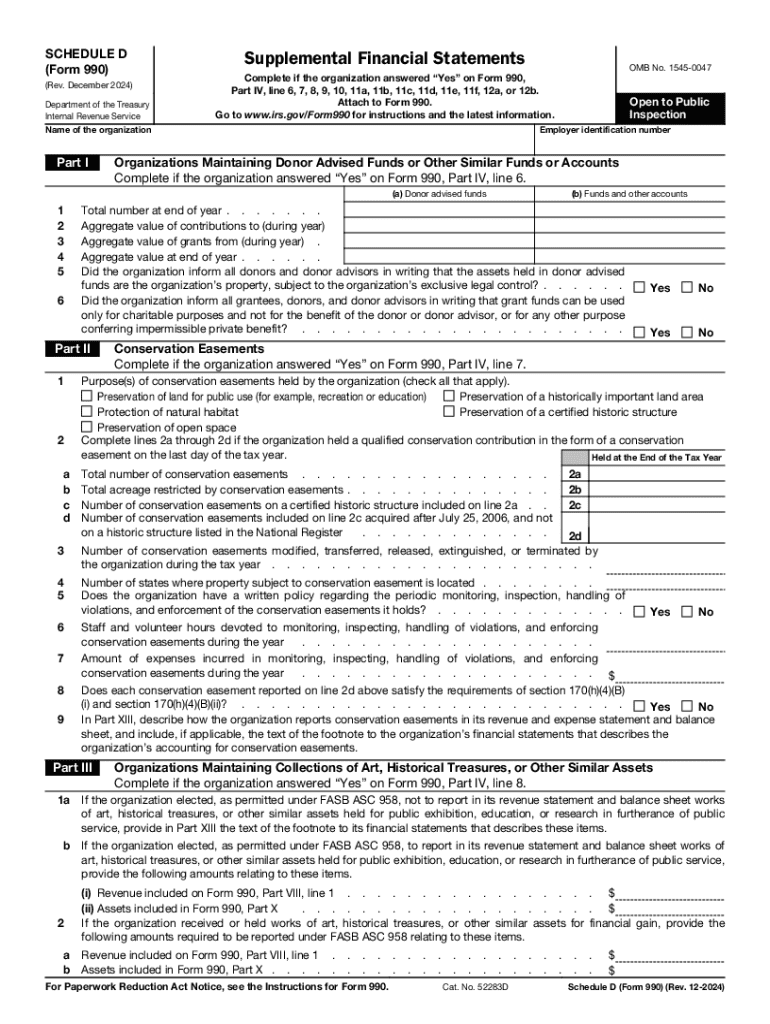

The Schedule D Form 990 is a critical document for non-profit organizations in the United States. It provides supplemental financial information that enhances the transparency and accountability of an organization’s financial activities. This form is essential for organizations that need to disclose specific financial details, such as the types of assets held and any significant changes in their financial status. Understanding this form is crucial for compliance with IRS regulations and for maintaining public trust.

Steps to Complete the Schedule D Form 990

Completing the Schedule D Form 990 involves several key steps:

- Gather Financial Information: Collect all relevant financial data, including balance sheets, income statements, and any additional documentation that supports your financial disclosures.

- Identify Required Sections: Review the specific sections of the Schedule D that apply to your organization. This may include information about investments, endowments, or any significant changes in financial status.

- Fill Out the Form: Input the gathered information into the appropriate sections of the Schedule D. Ensure accuracy and completeness to avoid potential issues with the IRS.

- Review and Verify: Double-check all entries for accuracy. It may be beneficial to have a financial professional review the completed form before submission.

- Submit the Form: Include the completed Schedule D with your Form 990 when filing with the IRS.

Key Elements of the Schedule D Form 990

The Schedule D Form 990 includes several key elements that organizations must address:

- Asset Disclosure: Organizations must disclose all significant assets, including investments and property.

- Financial Changes: Any significant changes in financial status from the previous year must be reported.

- Investment Policies: Organizations should outline their investment policies and any related financial strategies.

- Endowment Information: If applicable, details about endowments must be provided, including their purpose and management.

IRS Guidelines for the Schedule D Form 990

The IRS provides specific guidelines for completing the Schedule D Form 990. These guidelines emphasize the importance of transparency and accuracy in financial reporting. Organizations are encouraged to refer to the IRS instructions for Form 990 and Schedule D to ensure compliance with all reporting requirements. Key points include:

- Adherence to reporting deadlines to avoid penalties.

- Providing complete and truthful information to maintain compliance.

- Understanding the implications of non-compliance, which can result in fines or loss of tax-exempt status.

Filing Deadlines for the Schedule D Form 990

Filing deadlines for the Schedule D Form 990 align with the overall deadlines for Form 990. Generally, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For example, if your fiscal year ends on December 31, the deadline would be May 15 of the following year. It is essential to be aware of these deadlines to ensure timely submission and compliance with IRS regulations.

Eligibility Criteria for Using the Schedule D Form 990

Not all organizations are required to file the Schedule D Form 990. Eligibility typically includes:

- Organizations classified as tax-exempt under Section 501(c) of the Internal Revenue Code.

- Non-profits that meet specific revenue thresholds as defined by the IRS.

- Organizations that hold significant assets or have complex financial structures.

Understanding these criteria can help organizations determine their filing obligations and ensure compliance with IRS regulations.

Create this form in 5 minutes or less

Find and fill out the correct schedule d form 990 rev december supplemental financial statements

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 990 rev december supplemental financial statements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a capital loss carryover worksheet?

A capital loss carryover worksheet is a tool used to track capital losses that can be applied to future tax years. This worksheet helps individuals and businesses calculate how much of their capital losses can be carried over to offset future capital gains, ultimately reducing their tax liability.

-

How can airSlate SignNow assist with capital loss carryover worksheets?

airSlate SignNow provides an easy-to-use platform for creating and managing capital loss carryover worksheets. With our eSigning capabilities, you can quickly send, sign, and store your worksheets securely, ensuring that your financial documents are organized and accessible.

-

Is there a cost associated with using the capital loss carryover worksheet feature?

Yes, airSlate SignNow offers various pricing plans that include access to features like the capital loss carryover worksheet. Our plans are designed to be cost-effective, providing great value for businesses looking to streamline their document management and eSigning processes.

-

What are the benefits of using a capital loss carryover worksheet?

Using a capital loss carryover worksheet helps you maximize your tax benefits by accurately tracking your losses. This can lead to signNow savings on future tax returns, making it a valuable tool for both individuals and businesses looking to optimize their financial strategies.

-

Can I integrate airSlate SignNow with other financial software for my capital loss carryover worksheet?

Absolutely! airSlate SignNow offers integrations with various financial software solutions, allowing you to seamlessly incorporate your capital loss carryover worksheet into your existing workflows. This integration enhances efficiency and ensures that all your financial data is synchronized.

-

How secure is my data when using the capital loss carryover worksheet on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the capital loss carryover worksheet, your data is protected with advanced encryption and secure storage protocols, ensuring that your sensitive financial information remains confidential and safe from unauthorized access.

-

Can I collaborate with others on my capital loss carryover worksheet?

Yes, airSlate SignNow allows for easy collaboration on your capital loss carryover worksheet. You can invite team members or financial advisors to review and sign the document, facilitating a smooth and efficient workflow for managing your capital losses.

Get more for Schedule D Form 990 Rev December Supplemental Financial Statements

- Vertigo lighter warranty 448480369 form

- Confidential morbidity report cmr county of san luis obispo slocounty ca form

- State of texas application continuation sheet form

- Covered california fillable application form

- Stride duluth mn form

- Applications letter form

- Payday loans form

- Introduction agreement template form

Find out other Schedule D Form 990 Rev December Supplemental Financial Statements

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple