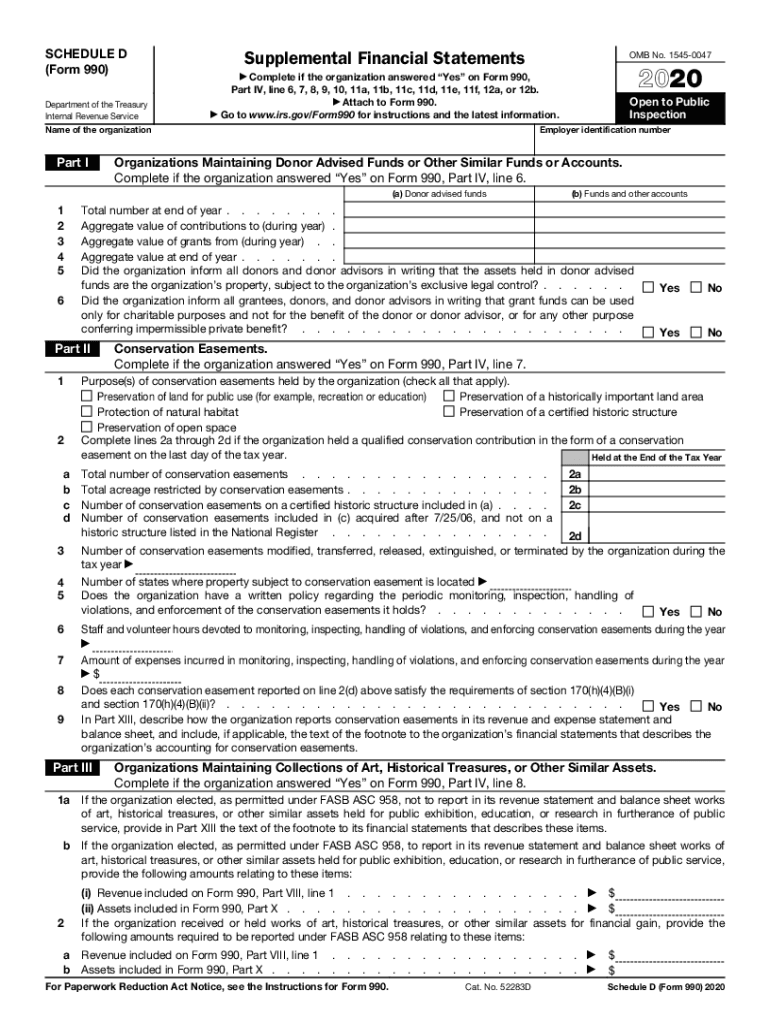

Schedule D Form 990 Supplemental Financial Statements 2020

What is the Schedule D Form 990 Supplemental Financial Statements

The Schedule D Form 990 is a supplemental financial statement used by tax-exempt organizations to provide additional information about their financial activities. This form is crucial for detailing specific financial transactions, including the organization’s assets, liabilities, and net assets. It serves as an extension of the main Form 990, allowing organizations to disclose more complex financial information that may not be fully captured in the primary form. The Schedule D is particularly important for organizations that hold significant investments or have complex financial structures.

How to use the Schedule D Form 990 Supplemental Financial Statements

Using the Schedule D Form 990 involves accurately reporting various financial details that supplement the main Form 990. Organizations should begin by gathering all necessary financial records, including statements of assets and liabilities. Each section of the Schedule D requires specific information, such as descriptions of the organization’s investments and any related financial activities. It's important to ensure that the information provided aligns with the main Form 990 to maintain consistency and compliance with IRS regulations.

Steps to complete the Schedule D Form 990 Supplemental Financial Statements

Completing the Schedule D Form 990 involves several key steps:

- Gather financial records, including balance sheets and investment statements.

- Review the main Form 990 to ensure all information is consistent.

- Fill out each section of the Schedule D, providing detailed descriptions of assets and liabilities.

- Double-check calculations and ensure all required fields are completed.

- Submit the completed Schedule D along with the main Form 990 by the filing deadline.

Key elements of the Schedule D Form 990 Supplemental Financial Statements

The Schedule D Form 990 includes several key elements that organizations must report:

- Assets: Detailed information about the organization’s investments and property.

- Liabilities: Any outstanding debts or obligations the organization has.

- Net Assets: A summary of total assets minus total liabilities, indicating the organization’s financial health.

- Investment Policies: Descriptions of how investments are managed and any relevant policies in place.

Legal use of the Schedule D Form 990 Supplemental Financial Statements

The Schedule D Form 990 is legally required for certain tax-exempt organizations to comply with IRS regulations. Accurate and complete reporting on this form helps ensure transparency and accountability in financial reporting. Failure to properly complete and submit the Schedule D can result in penalties or loss of tax-exempt status. Organizations should keep thorough records and consult with tax professionals to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Schedule D Form 990. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. Extensions may be available, but organizations should be aware of the implications of late submissions, including potential penalties.

Quick guide on how to complete 2020 schedule d form 990 supplemental financial statements

Prepare Schedule D Form 990 Supplemental Financial Statements effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents swiftly without delays. Handle Schedule D Form 990 Supplemental Financial Statements on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Schedule D Form 990 Supplemental Financial Statements with minimal effort

- Locate Schedule D Form 990 Supplemental Financial Statements and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Alter and eSign Schedule D Form 990 Supplemental Financial Statements and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule d form 990 supplemental financial statements

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule d form 990 supplemental financial statements

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What are the 2018 IRS Form 990 schedules?

The 2018 IRS Form 990 schedules are supplemental forms that provide detailed information about specific aspects of an organization's financial activities and governance. These schedules are essential for non-profits and must be submitted with the main Form 990 to ensure compliance with IRS requirements.

-

How can I fill out the 2018 IRS Form 990 schedules using airSlate SignNow?

You can effortlessly complete the 2018 IRS Form 990 schedules using airSlate SignNow's user-friendly interface. Our platform allows you to edit, sign, and share documents securely, ensuring that your forms are filled out accurately and efficiently.

-

What features does airSlate SignNow offer for managing 2018 IRS Form 990 schedules?

airSlate SignNow provides a range of features including document templates, electronic signatures, and real-time collaboration tools. These capabilities help streamline the process of managing the 2018 IRS Form 990 schedules, making it easier for organizations to remain compliant with IRS regulations.

-

Is airSlate SignNow affordable for non-profits needing to file 2018 IRS Form 990 schedules?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for non-profits. This ensures that organizations can easily utilize our solution for preparing and filing the 2018 IRS Form 990 schedules without breaking their budget.

-

Can I integrate airSlate SignNow with other tools to help with 2018 IRS Form 990 schedules?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as accounting and project management tools. This integration allows you to manage your 2018 IRS Form 990 schedules alongside other critical business functions.

-

What benefits does airSlate SignNow provide for filing 2018 IRS Form 990 schedules?

Using airSlate SignNow for filing the 2018 IRS Form 990 schedules offers signNow benefits like increased efficiency, security, and ease of use. The platform simplifies document management, enabling organizations to focus on their mission instead of cumbersome paperwork.

-

Is there support available for questions regarding the 2018 IRS Form 990 schedules?

Yes, airSlate SignNow provides dedicated customer support to help users with any questions related to the 2018 IRS Form 990 schedules. Our knowledgeable team can assist you with navigation and troubleshooting to ensure a smooth filing process.

Get more for Schedule D Form 990 Supplemental Financial Statements

- Electrical contract for contractor wisconsin form

- Sheetrock drywall contract for contractor wisconsin form

- Flooring contract for contractor wisconsin form

- Wi deed form

- Notice of intent to enforce forfeiture provisions of contact for deed wisconsin form

- Final notice of forfeiture and request to vacate property under contract for deed wisconsin form

- Buyers request for accounting from seller under contract for deed wisconsin form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed wisconsin form

Find out other Schedule D Form 990 Supplemental Financial Statements

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself